by Daryl Clements, AllianceBernstein

As the novel coronavirus pandemic wreaked havoc on the markets over the past month, municipal bonds initially benefited from the flight to safety that drove Treasury yields lower. But most recently, markets told a different story, as muni yields rose—and prices fell—more than Treasury yields. Investors are now asking: aren’t many municipal bond issuers vulnerable in this crisis?

Muni issuers’ exposure to the battle against COVID-19 varies. Some sectors, such as hospitals, are on the front line. Others, such as state governments, may experience not only first-order effects as budgets stretch to accommodate virus-related expenditures but also the secondary effects of a crisis-induced local or broad-based recession.

So, what steps can muni investors take to protect themselves and earn income as the crisis rages? The most critical step is to stay active. Passive laddered strategies have no ability to maneuver through the crisis, nor can they efficiently rotate into higher-yielding issues as rates climb. In contrast, active and flexible strategies can help muni investors better respond to the risks—and opportunities—that emerge in challenging environments like this one.

Municipal Yields Sharply Higher

One outcome of recent market activity has been the significantly increased attractiveness of municipal bond yields after taxes, relative to Treasuries.

US Treasury yields saw an unprecedented decline in the past few weeks, with the yield on the 10-year note plunging to a record low of 0.32% at one point on March 9. It’s since made its way back to around 1.0% but remains well below the 1.9% level where it began the quarter.

In contrast, municipal bond yields have risen, with 10-year yields now at 1.7%, compared to 1.4% at the start of the year. The ratio of municipal yields over Treasury yields—a measure of the relative attractiveness of municipals—is now around 400% for one-year securities and nearly 200% for intermediate-maturity and long bonds. A municipal/Treasury ratio above 100% indicates investors should strongly favor municipal bonds over Treasuries.

Investors who had the flexibility to allocate part of their muni portfolios to one- and 10-year US Treasuries, as we suggested in January, should pay heed to that relationship. Now that the after-tax yield relationship between municipals and Treasuries has flipped, we think it’s time to rotate those short-maturity Treasury holdings back into munis.

Tax-Exempt Bond Issuers Show Resilience

Municipal bond issuers tend to be resilient under challenging conditions. Defaults, for example, are extremely rare among tax-exempt bonds. Moody’s Investors Service reports that the average five-year US municipal default rate since 2009 has been just 0.16%.

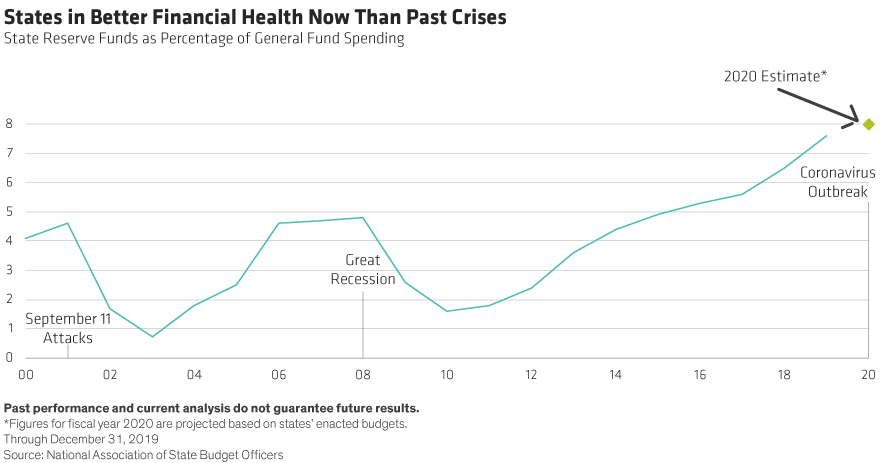

Moreover, municipal issuers are much better equipped to weather a storm than they were in 2001 or 2007 as other crises loomed. Since then, municipal governments have used the longest economic expansion on record to shore up their balance sheets and rainy-day reserve funds with skyrocketing tax receipts. In fact, states began the coronavirus crisis with record-level reserves (Display).

Given states’ and other municipal issuers’ strong financial positioning, we don’t think that the current economic downturn will result in broad bondholder impairment. However, as the crisis continues to unfold, we do anticipate disruptions and downgrades. That makes careful credit research more critical today than ever.

Challenges vary by sector:

State and Local Governments

The situation: As already noted, states have repaired their balance sheets and built cash-funded reserves to historic levels. In the short run, costs associated with fighting the coronavirus will surely rise, but pending aid in the form of a higher federal share of Medicaid costs should help soften the blow.

The challenge: As we saw in 2008, broad-based revenues such as sales and income taxes decline in economic recessions. Today, a drop-off in sales tax revenues is certain, with so many tax-generating businesses—from sports venues to shopping malls—shutting down and tourism halting. As layoffs begin, income tax revenue will suffer too. Ultimately, however, states and municipalities have the authority to raise taxes, tap reserves and cut expenditures, allowing them to ride out a downturn.

Hospitals

The situation: Most major healthcare facilities have enough financial liquidity to weather tighter margins. If additional funds are needed to ensure hospitals’ ability to meet community service needs during the crisis, we believe facilities will receive federal, state or local financial support.

The challenge: Under normal conditions, higher patient volumes would help boost margins. But the significantly higher patient volumes seen in a far-reaching health emergency are likely to squeeze margins instead. Shortages of medical supplies, the potential spread of the virus among healthcare workers, and the suspension of more profitable elective procedures could add to operating pressures.

Senior Living

The situation: The elderly are among the most vulnerable to COVID-19. Elder care facilities in Washington State have been hit particularly hard by infections among residents, visitors and staff.

The challenge: Beyond the human tragedy, facilities may suffer long-term reputational damage, especially as cases rise and potential containment breaches along with them. As they fight the outbreak, they may see fixed costs, such as caregiver salaries and food, increase as supplies grow scarcer or require significant pre-ordering. Costs for increased maintenance are already rising as facilities work around the clock to meet the highest industry standards. In general, though, most senior-living facilities have sufficient cash reserves to weather a decline in occupancy for at least a year.

Utilities

The situation: As essential service providers, water & sewer and electric utilities are generally well-insulated from COVID-19’s thick economic cloud due to their diverse customer base.

The challenge: We expect reduced demand from commercial and industrial users as more people self-isolate and/or work from home. For the same reasons, residential demand is likely to rise.

Airports

The situation: Larger hubs are better positioned to deal with disruptions in service than are smaller, regional airports. Even though the airline industry is under stress, airlines will continue to make payments to airports. These payments represent just 3% of airlines’ budgets, and airports are essential to airlines’ survival.

The challenge: Between airlines voluntarily cutting flights due to lower passenger volume and federally imposed limitations on travel into the US, most airports will see revenue declines in the coming months. The decrease in travelers will also hurt ancillary revenues, such as concession fees from food courts and newsstands.

Higher Education

The situation: Most colleges and universities have physically closed to help prevent community spread of the virus; students will complete the semester online.

The challenge: We expect a modest hit to revenues, as many schools are refunding room and board for the remainder of the school year. Tuition, however, will not be refunded, as courses are being taught remotely. We believe normal operations will resume in the fall, with little drop-off in demand, even if a full-out recession develops. In fact, colleges and universities typically see enrollment in graduate programs rise during economic downturns.

Charter Schools

The situation: Younger people seem to be less affected by COVID-19, but the key concern is community spread into homes. Charter school revenues are based on average daily attendance from the prior year, so schools are in relatively good position for now. The virus also struck very close to the school year’s end, which is leading many states to waive the mandatory 180-day requirement.

The challenge: A shift toward “remote learning” alternatives could spark school closings and teacher layoffs. Schools also may be pressured if states dial down aid to students to make up for budget gaps caused by other aspects of the outbreak. However, that may not impact them until the next school year.

Preparing for the Unexpected

We have good reason to think the broad municipal bond market will hold up under the weight of an economic downturn. Municipal bonds generate more income today than three months ago, and over the long run, municipals act as a buffer against equity volatility.

But rapidly evolving conditions and heightened uncertainty demand thorough fundamental research and continuous monitoring. In our view, that makes an active and flexible strategy municipal investors’ best bet for negotiating the coronavirus crisis.

Daryl Clements is Portfolio Manager of Municipal Bonds at AllianceBernstein.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..