by Erik Ristuben, Russell Investments

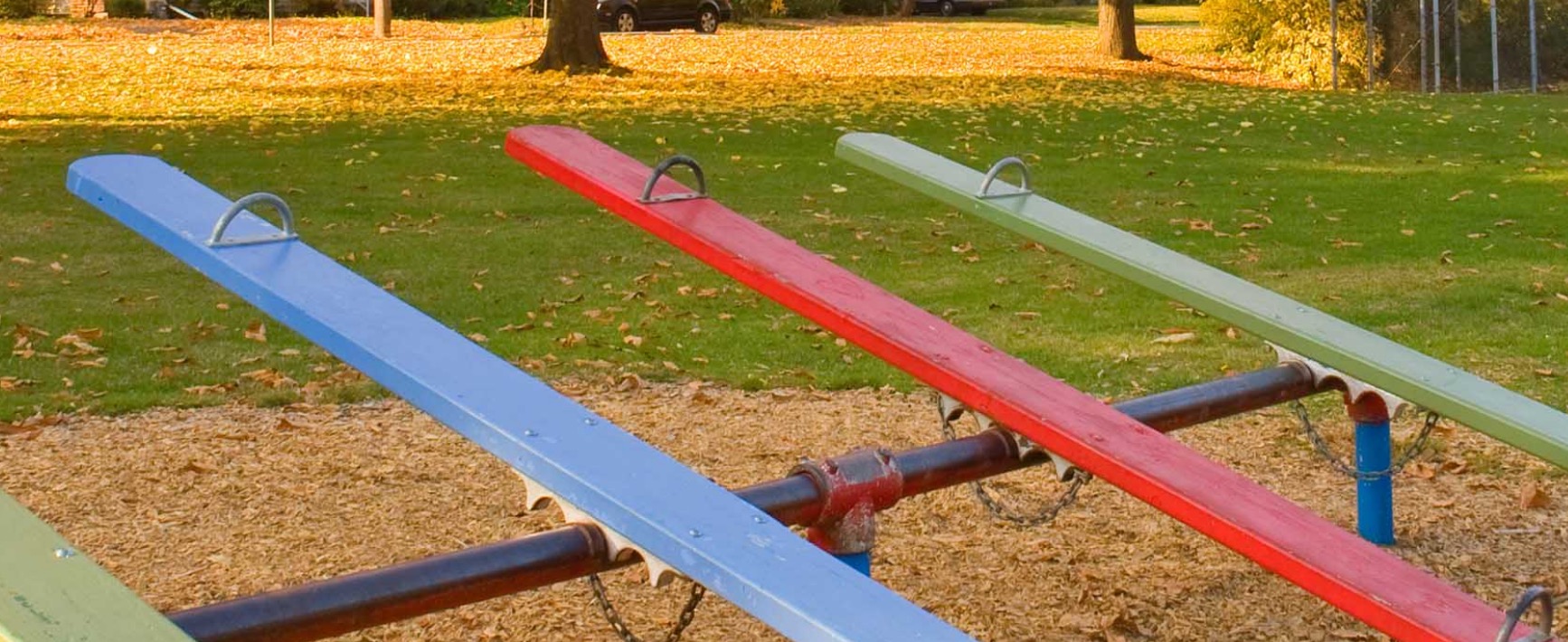

This week, the market has seesawed between optimism and pessimism. Expect that to continue.

The basic market challenge is that the market does not know what the overall impact of the coronavirus will be on the global economy, or when it will end. Neither do we. We do not claim to have any edge or unique ability to forecast the progression of this outbreak. Furthermore, leading medical experts have told us that such an exercise is effectively impossible.

Now that the virus has more than a foothold in both the U.S. and Europe, the market is focused on the potential negative impacts in those economies. That said, given the unknown nature of the economic threat, we believe markets will be heavily sentiment-driven in the short term, creating continued volatility and uncertainty.

Here is what has happened in the last 24 hours:

Equity markets were down in Europe on Wednesday, probably a reflection of Tuesday’s negative U.S. equity market. The U.S. had a good day Wednesday in a bounce back from Tuesday. But Thursday has opened quite negatively in the U.S., with Europe remaining effectively flat. The 10-year Treasury yield fell below 1.00% for the first time ever on Tuesday, then rose above 1.00% yesterday, then fell back below today. Credit spreads narrowed on Wednesday, in sympathy with the positive equity markets. They have widened a little in early trading on Thursday.

We’re paying attention to a comment from former European Central Bank head, Jean-Claude Trichet, that the market might actually view the fully coordinated central bank action as a contributor to market concerns. In essence, if all the central banks act as if the current situation is an economic crisis, their actions may make the market think that things are worse than they actually are at this time. In this context, the U.S. Federal Reserve (the Fed) rate cut earlier this week was positioned as more of a preventative measure than actually attacking a serious and current problem. We believe that is a correct interpretation of the Fed move.

Reminder: Investment plans are for moments like this

Yes, infection rates in Europe and the U.S. ticked up, with more countries and regions now having diagnosed cases. While that may seem like news, it is not unexpected to us, as pandemic experts are saying that in the near-term, the virus will very likely continue to spread. We are told that it will likely get worse before it gets better. But in the end, no one knows all of what happens next.

We diversify our investments because we do not know what will happen. If we knew what was going to happen, we would only own the asset that we know will go up the most. Instead, we acknowledge the reality of uncertainty and build an investment plan to help us navigate that uncertainty. We have that plan so that when we experience periods of tremendous uncertainty, like now, we do not respond emotionally to the news of the day.

If we chose to do so, we could make a very compelling argument that the negative impacts of this crises will be temporary. At the end of that temporary disruption, the economy will likely experience a V-shaped recovery fueled by pent-up demand and cheaper money.

We could also make a compelling argument that this is going to get worse before it gets better—that the steps to control the virus will lead to significantly lower economic growth, perhaps even economic contraction, maybe even a technical recession. If the more pessimistic aspects of this scenario play out, that may mean continued, meaningful, negative equity performance in the near term.

Given the nature of the risk to these markets, nobody knows if either scenario is correct. They could both be right. We believe it is likely that they are not both wrong. In times of such uncertainty, we also believe it is almost always a good idea to stick with the plan. That is why you have it.

Copyright © Russell Investments