by Edward D. Perks, CFA, Franklin Templeton Investments

We begin by re-emphasising the key conclusion of our last commentary on this subject: we believe it is important to maintain diversified portfolios, particularly in times of increasing investment uncertainty. This approach has proven to be beneficial over the last several weeks as volatility has picked up in equity, fixed income and commodity markets.1

We continue to follow a process that resists the temptation to trade around news flow and emotion. Instead, we focus on how the evolving macro-economic backdrop is affecting market fundamentals and adjust our asset allocation views accordingly. Our asset allocation strategy focuses on regions that are more insulated from the growth shock and have enough policy flexibility to respond accordingly. The United States and the United Kingdom both fit this description, whereas the eurozone is in a less favourable position.

More broadly, the range of uncertainties—both medical and market—tempers our enthusiasm to increase holdings of stocks and other riskier investments at this time. However, as we look ahead over the next year, we continue to see attractive return potential from global equities. We continue to believe that navigating the challenges the year ahead presents will require nimble management.

Reviewing Our Initial Premise

Our initial premise was that the coronavirus would impact economic growth with the following characteristics:

- Geographic: Centred around China and Asia

- Duration: A sudden short shock that would be mostly felt in the first quarter of 2020

- Response: The greater the growth impact, the larger the commensurate policy response

We are closely monitoring the situation to validate if these views are supported by updated data. Given recent developments, below are some of our updated views.

Update: Geographic Impact

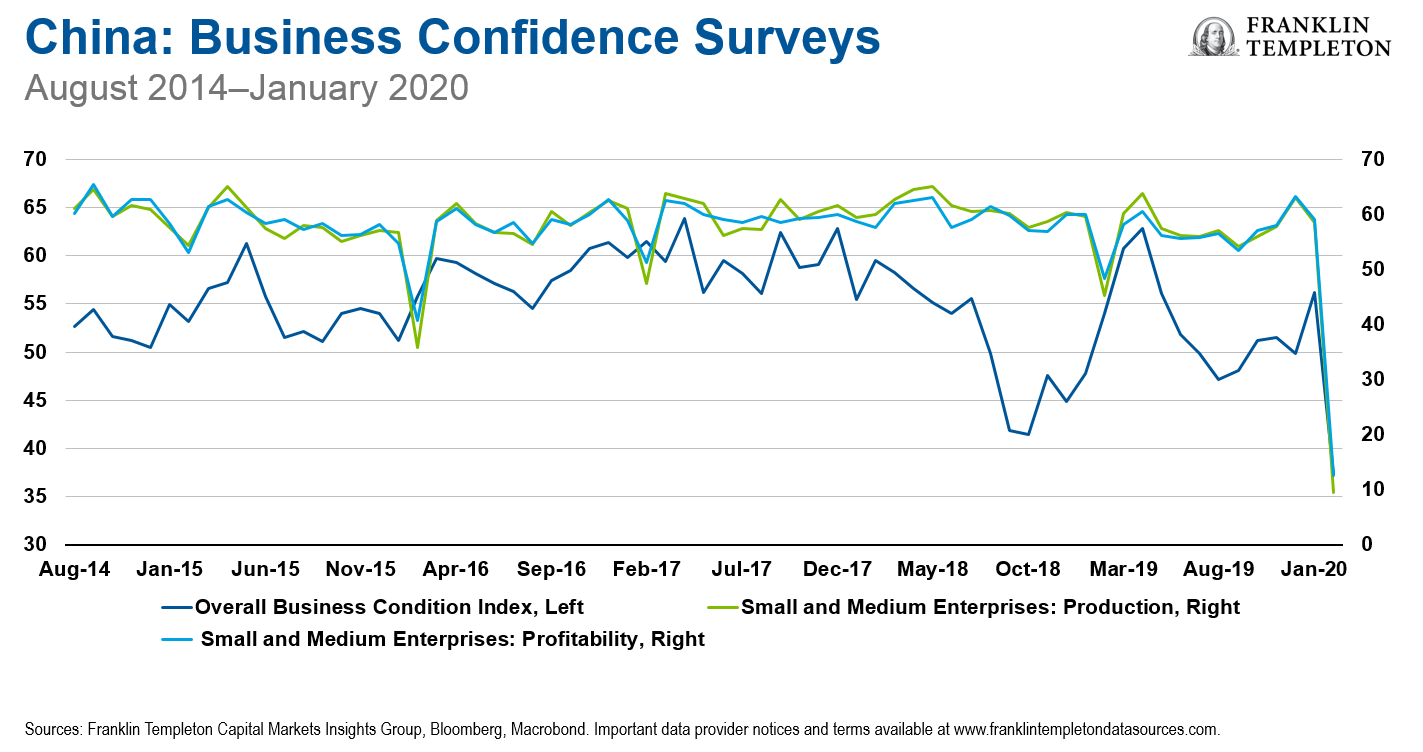

There is little doubt that Chinese economic activity has slowed during the first quarter of 2020; it is more a question of by how much? A variety of daily production indicators, such as passenger traffic or daily power coal consumption, signal very little rebound in activity. Business confidence surveys reflecting February activity also confirm the growth slowdown in China.

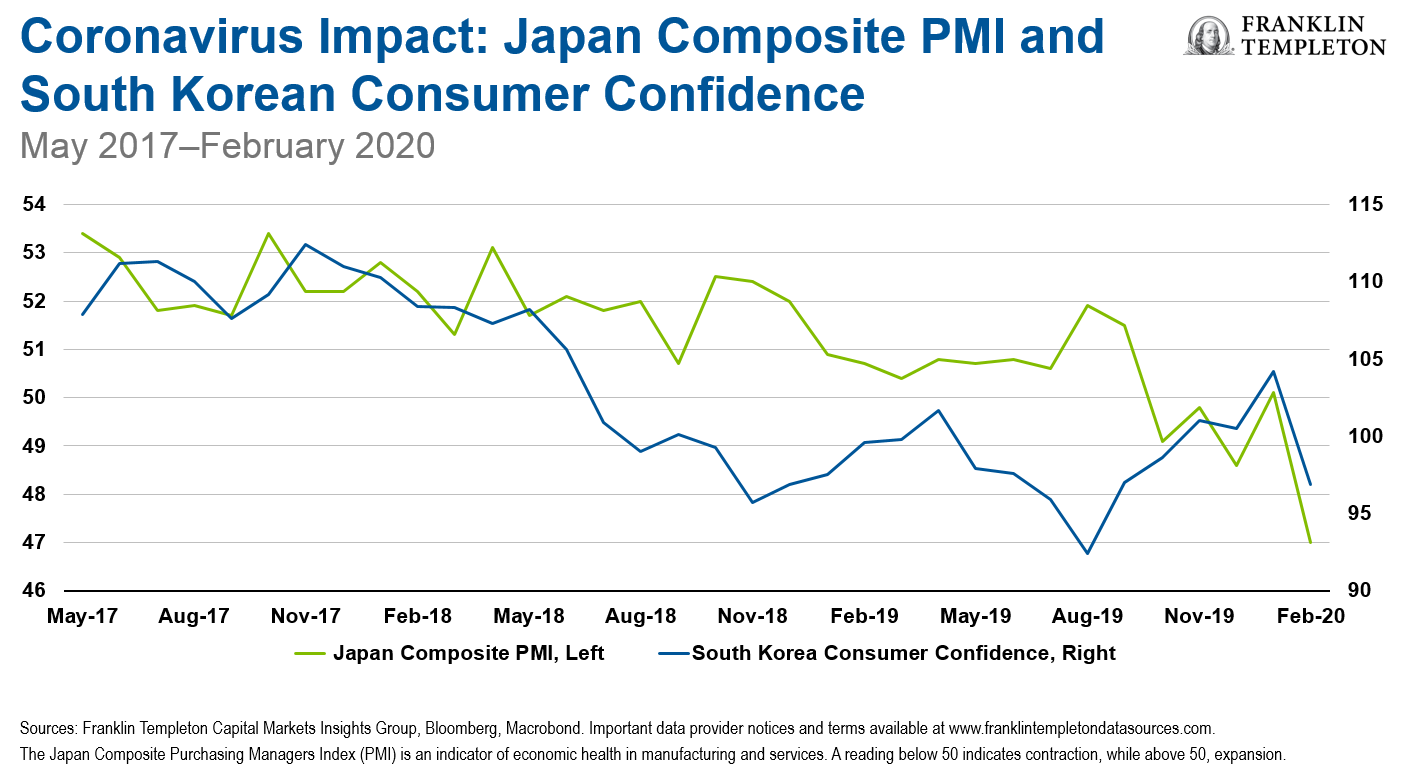

Outside of China, we can observe that the slowdown in activity is having an impact on neighbouring countries in the chart below (most recent datapoint reflects February activity).

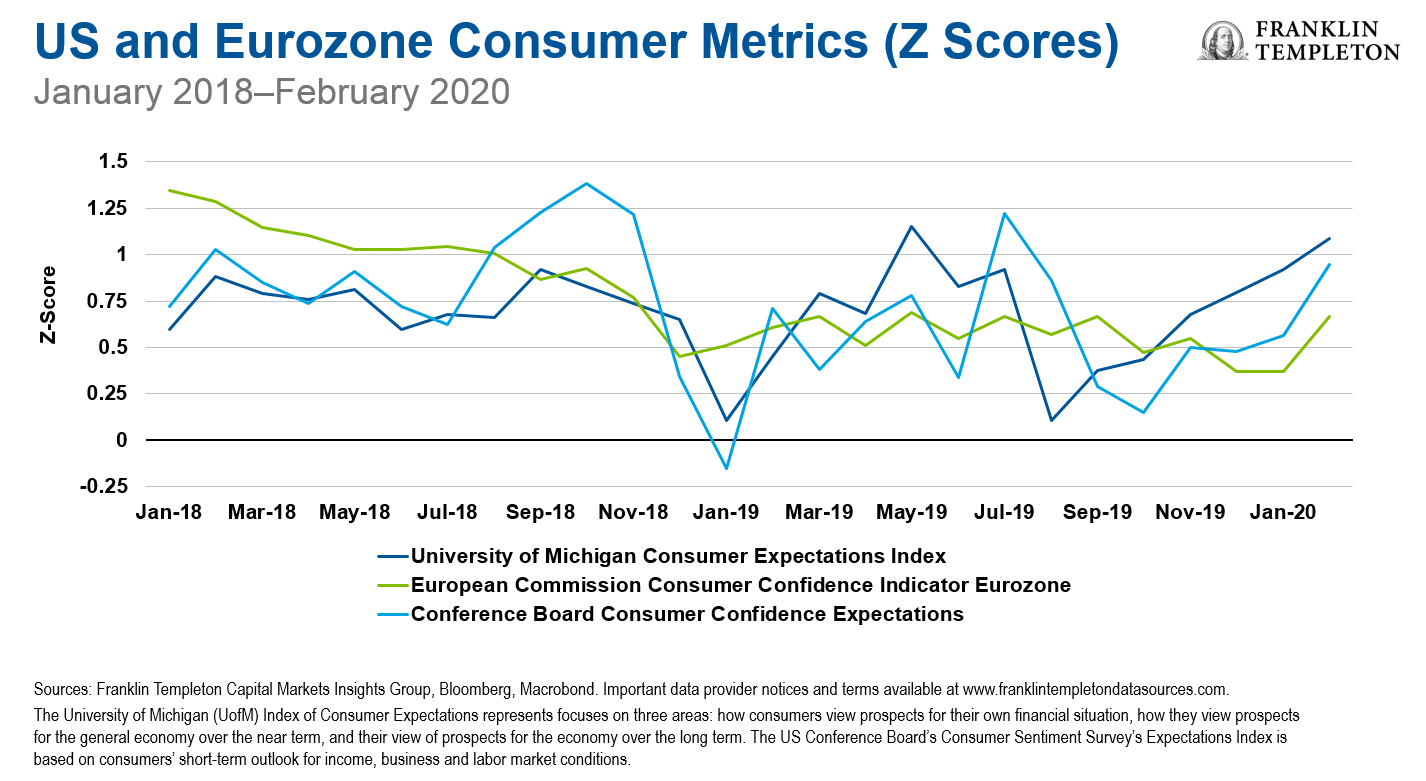

While it makes sense that Asia is the most impacted, there are other sectors that should be more insulated from an Asian growth shock, in our opinion, such as the developed market consumer and labour markets. We track recent sentiment surveys to understand how consumer confidence is evolving amidst the changing global macro backdrop. As at 25 February, we see limited impact to developed market consumer confidence outside of Asia (see chart below).

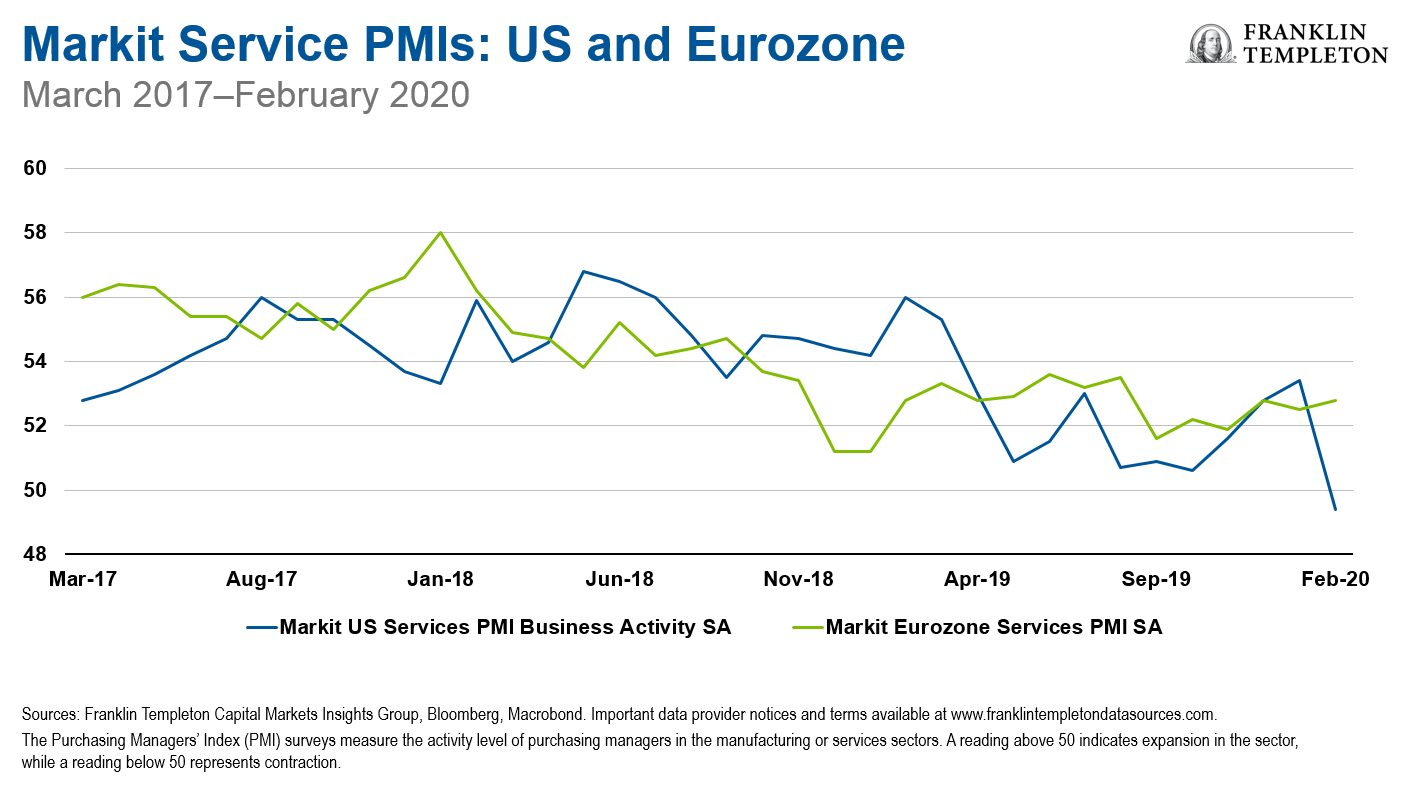

We can also track broader indicators of the US and eurozone service sector. Here, we observe additional evidence of mixed data as the US Markit Purchasing Managers Index (PMI) fell sharply, whereas the eurozone service PMI rose month-over-month (both reflecting February activity).2 See chart below.

While following data flow on a month-over-month basis may be noisy and often unrewarding, the recent divergence between these two economies, led by the US service sector, has caught our attention. The US consumer and service sector would be vulnerable if the virus spreads more widely in the United States. We would expect more resilience in these two sectors unless, or until, this occurs, and we will continue to monitor closely.

Update: Duration Impact

Our initial view on the coronavirus was that the duration of impact would be short-lived as Chinese policymakers were going to great lengths to contain the virus in Hubei. Since then, the number of reported cases in China has slowed, but the coronavirus has spread to many countries across the globe. Clusters of the virus have sprouted up in South Korea, Italy and Iran. As at 26 February, the World Health Organization had reported more new cases outside of China (459) versus inside of China (412).3 The number of countries affected has grown to 37.4

The virus is difficult to contain, as symptoms can be mild and similar to the normal seasonal flu. While there is still a possibility that China sees continued deceleration in cases, this remains an open question as many workers are returning after an extended break and are starting to resume normal activity, which will render containment more difficult. Globally, it seems likely that more clusters will emerge. This ultimately means the duration of the impact will likely be longer than previously envisioned.

Update: Response Impact

Our expectation has always been that the impact to growth would be met with a proportional policy response. So far, we have seen many policy responses across the globe and our initial assessment has held up thus far. These are some of the notable responses (as at 26 February 2020):

- Hong Kong announced stimulus equivalent to approximately 4.3% of current nominal gross domestic product (GDP).5

- Chinese CY2020 local government bond issuance quota now amounts to US$268bn (1.7% of GDP); much of this is front-loaded.6

- The People’s Bank of China cut interest rates on its 7-day and 14-day reverse repurchase agreements by 0.10%.

- On February 9, China’s Ministry of Finance announced that RMB72 billion (US$10.26 billion) has been ear-marked to support the most devastated areas.

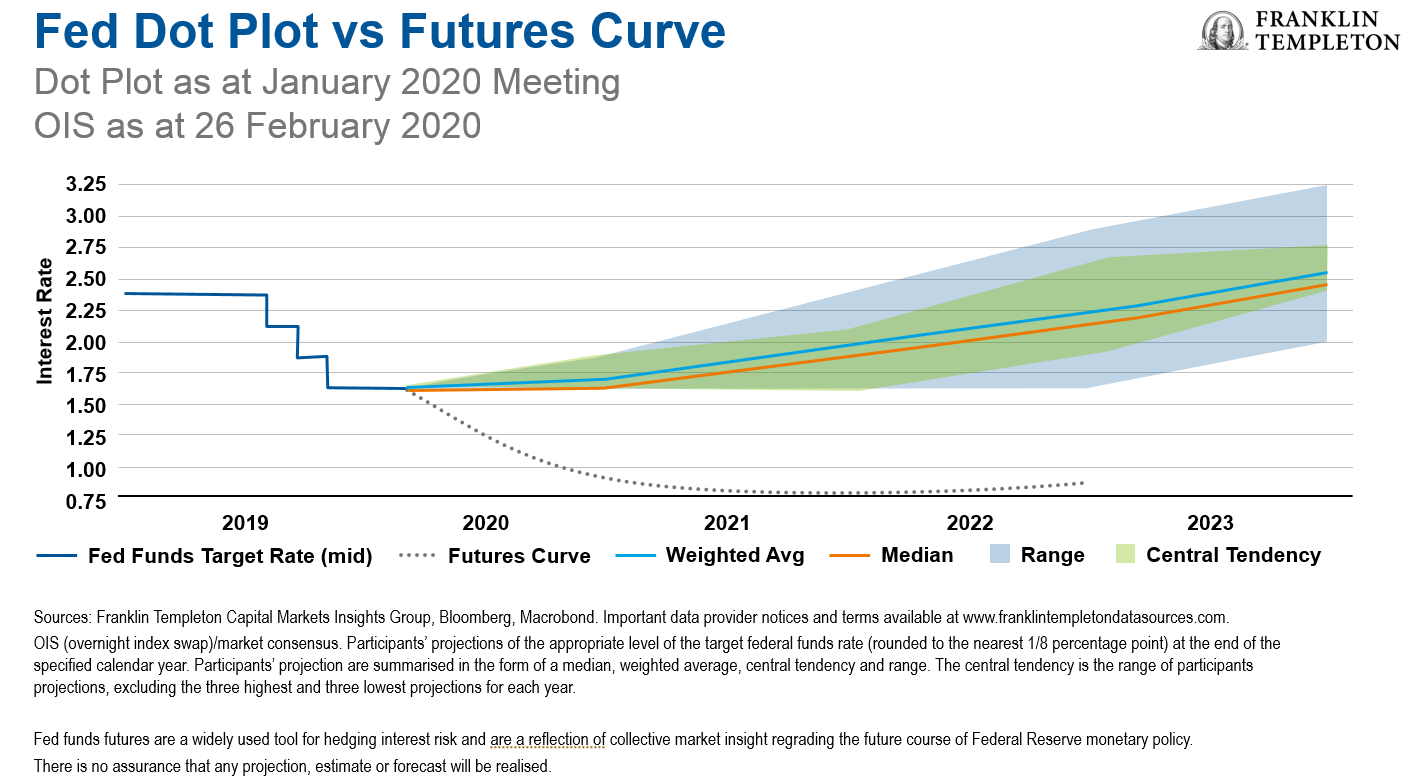

Moving forward, falling oil prices and the low inflation backdrop should allow global central banks to maintain or extend stimulative monetary policy. We are already seeing this being priced into market expectations for official interest rates.

Lastly, we also want to consider how policymakers will respond to the virus itself. The typical response by policymakers has been to quarantine symptomatic individuals in order to prevent further transmission of the virus. Additional measures, such as travel restrictions, are also being imposed, to various degrees. These measures are helpful in containing and preventing the spread of the virus but come with an economic and social cost.

It is interesting to recall that during the early days of the H1N1 influenza outbreak in Mexico, policymakers initially engaged in quarantines, restricted travel, and more. Eventually, these policies were abandoned due to the economic and social cost. H1N1 is an intriguing case study as the mortality rate turned out to be quite low. We are yet to see if equilibrium mortality falls to a similar level for this coronavirus.

Asset Allocation Takeaways

As we update our initial assessment of the coronavirus, a few things have changed. While the growth impact has thus far been centered around China and Asia, the spread of the virus is making it more likely that the growth impact extends to the rest of the world. It will be difficult for the US consumer to remain resilient if the virus becomes more widespread in the United States. The policy responses thus far have been encouraging.

From an asset allocation perspective, we continue to prefer regions that have the policy flexibility to respond to a growth shock, such as the United States and the United Kingdom. Areas like the eurozone, with constrained monetary policy and fiscal challenges, will face a tougher road ahead if the virus spreads further through the region. From a broader portfolio perspective, we continue to believe that navigating the challenges the year ahead presents will require nimble management.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets.

_______________________________________

1. Diversification does not guarantee profit or protect against risk of loss.

2. The Purchasing Managers’ Index (PMI) surveys measure the activity level of purchasing managers in the manufacturing or services sectors. A reading above 50 indicates expansion in the sector, while a reading below 50 represents contraction.

3. Source: World Health Organization, as at 26 February 2020.

4. Ibid.

5. Source: ISI.

6. Source: Morgan Stanley Research, as at 12 February 2020.

This post was first published at the official blog of Franklin Templeton Investments.