The U.S. economy has been resilient in the face of uncertainty, but risks are growing.

by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

One month in, the year 2020 has brought an outsized volume of news. An epidemic scare and a manufacturing slowdown are weighing on our forecast in the near term, while the mix of long-run risks has not lightened.

Fundamentally, the economy continues to grow, with low unemployment and calm inflation. Economic resilience despite uncertainty was a significant theme of 2019, a trend we expect to continue in the year ahead. But challenges to growth are already accumulating, and the heavier balance of risks is weighing on our 2020 outlook.

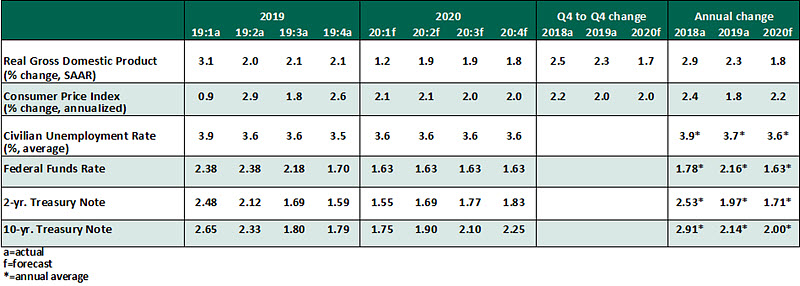

Key Economic Indicators

Influences on the Forecast

- The Coronavirus outbreak is slowing markets around the world. The strongest effects are being felt in China, but all countries are facing economic consequences in proportion to their exposure to China’s economy. Chinese manufacturers are slowing down, and Chinese tourists are cancelling their plans. We believe China is reacting appropriately to contain the virus, and we do not forecast a pandemic.

Nonetheless, slower shipments will weigh on U.S. business investment and inventory accumulation in the first half of the year. Absent a significant escalation of infections, we should recoup a good bit of this lost activity in the second half.

- Boeing’s suspension of 737 MAX production is a further near-term impairment. Billions of dollars of airplane orders are going unfilled, while tens of thousands of Boeing employees and subcontractors are idled. Aviation regulators will be cautious and deliberate in allowing the aircraft to return to service. Though this is not a systemic event, it is large enough to pose a headwind to the broad economy through at least the second quarter.

- The advance estimate of fourth-quarter 2019 gross domestic product (GDP) growth showed continued advancement but with unsteady support. Business investment contracted for the third consecutive quarter, while consumer spending fell from its recent highs to a more steady level of growth. Net exports appeared to boost the economy, but this was due to a decline in imports consistent with slower consumption rather than a material increase in exports. We expect a return to a more typical trade balance will weigh on first quarter GDP.

- Employment remains a source of positive news. In January, the economy added 225,000 jobs, and the unemployment rate of 3.6% remains in very low territory. January’s reading reflects the Bureau of Labor Statistics’ annual benchmark revision to its establishment employment data, which counts the number of jobs created. The downward revision of 514,000 jobs does not change the picture of a strong and growing labor market.

- At its January meeting, the Federal Open Market Committee took no rate action. The Committee’s focus has turned to stabilizing the overnight funding market. Chair Jerome Powell provided a timeline for winding down temporary open market operations in the second quarter and set a floor of $1.5 trillion in bank reserves. In the year ahead, we expect the Fed to hold rates steady; any further cuts will come only in the event of an economic downturn.

- The U.S. and China agreed to a limited “Phase One” trade agreement. China committed to ambitious new purchases of U.S. goods, while the U.S. halted its tariff escalations and reduced one tranche of tariff rates. However, the deal leaves most tariffs in force and does not change the fundamental economic structures that led to the trade tensions. Any relief from lower tensions with China was short-lived, as the U.S. and Europe must work through trade conflicts over aircraft producer subsidies, automotive imports and digital services taxes.

- After five months of contraction, the manufacturing purchasing managers’ index (PMI) returned to a mildly expansionary reading of 50.9 in January. At best, this reflects lower trade tensions from the Phase One deal and portends a recovery in business investment.

- Inflation readings remain benign, continuing a long-term trend. The deflator on core personal consumption expenditures (PCE) grew by 1.6% year-over-year in January, still well below the Federal Reserve’s target of 2%. The consumer price index (CPI) grew by 2.3% on both a headline and core basis, showing that inflation is not absent, just slow. Wages and employment costs have both cooled from their higher rates of growth in 2019, diminishing the risk of a wage spiral causing breakout inflation.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2019 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.

Copyright © Northern Trust