by Larry Adam, Chief Investment Officer, Raymond James

Key Takeaways

- Labor market deserves a ‘round of applause’

- Chair Powell will ‘command the stage’ next week

- Cyclical sector earnings get a ‘standing ovation’

President Trump delivered his third State of the Union address Tuesday night. In accordance with the US Constitution, the president has the responsibility to update Congress on measures deemed “necessary and expedient.” The event is not without tradition, but prior presidents have not hesitated to deliver their message in their own unique way. Thomas Jefferson delivered his speech in writing, Lyndon B. Johnson gave his speech in the evening hours to capture a wider audience, and Ronald Reagan invited guests of honor to capture “the spirit of American heroism.” When it comes to communicating our views, we deliver our message across a number of platforms (webinars, publications, and social media) on a timely basis (daily, weekly, monthly, and quarterly). Today, we provide a ‘State of the Markets’ update on “necessary and expedient” developments impacting the US economy and financial markets.

- The State Of The US Economy | When assessing the ability of the US economy to continue its longest expansion (128 months) in history, the release of several economic data points has provided reassurance that the US expansion remains intact. The ISM Manufacturing Index returned to expansion territory for the first time since July, and the ISM Non-Manufacturing Index has remained above the 50.0 threshold since January 2010. In the labor market, jobless claims fell to near the lowest level in over 50 years and 225,000 jobs were created last month. The resiliency of US economic data allows us to reiterate our expectation of relatively robust 1.8% GDP growth in 2020 with a low probability of recession.

- The State Of Monetary Policy | The Federal Reserve (Fed) has exercised patience and remained calm when short-term volatility inducing events have caused the financial markets to panic. However, the Fed has also displayed its willingness to be proactive, evidenced by the three rate cuts in 2019. While the next FOMC meeting is not until March 17-18, we expect Chair Powell to reiterate the Fed’s balanced stance in his semiannual monetary policy testimony next Tuesday and Wednesday. With little ammunition remaining and with the global impact of the coronavirus yet to be felt, the Fed is likely to exercise patience and not alter rates this year as monetary policy is in a “good place.” Globally, several central banks have cut interest rates in anticipation of slowing growth due to the coronavirus. Brazil, Thailand, and the Philippines all implemented 25 bps cuts this week, bringing the percentage of emerging market central banks that have reduced rates to ~27%.

- The State Of Trade With China | The coronavirus outbreak has called into question whether China will be able to meet the aggressive purchase target (at least $200 billion of US goods and services over the next two years) set forth under the phase one trade deal, especially since the agreement includes a disaster-related clause. However this week, the Chinese government signaled their commitment to upholding the covenants as they halved tariffs on $75 billion of US imports effective next Friday. This will occur in lockstep with the US’s step to reduce tariffs on $120 billion of goods on the same date. We expect that positive trade progress will continue, removing any residual market uncertainty in the process.

- The State Of The Election | Senator Sanders is the leader for the upcoming New Hampshire and Nevada primaries, but the probability of the first brokered convention for the Democratic Party since 1952 is growing (42% according to PredictIt) as he, Buttigieg, Biden, and Warren all remain viable candidates. The true test will be Super Tuesday (March 3), and factors such as proportionate allocation of delegates (vs. winner-take-all), fiscally well-supported candidates and the entrance of Michael Bloomberg increases this probability if the field is not whittled down soon. This uncertainty has benefitted President Trump, who now has the highest approval rating of his presidency (49% according to Gallup) and a heightened probability of winning the election (55% according to PredictIt). A healthy economy gives him an early edge, but we are still 269 days away!

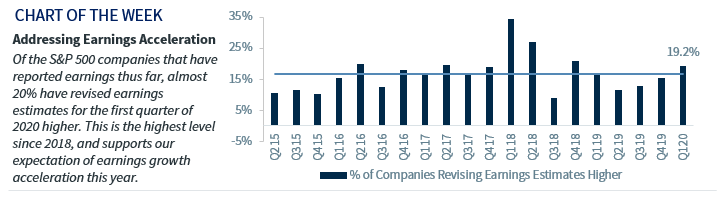

- The State Of Corporate Earnings Growth | Q419 earnings growth should finish closer to ~2%, driven by our favorite cyclical sectors (Communication Services and Information Technology) providing the strongest beats relative to expectations. This cyclical strength is consistent with our 2020 outlook, as aggregate forward consensus earnings growth for cyclical sectors (10.2% YoY) is expected to outpace that of defensive sectors (5.8%). An acceleration of earnings growth in 2020 was further supported this week, as 19.2% of the S&P 500 companies that have reported thus far have revised Q120 earnings estimates higher. This is the highest level since 2018, and is above the 20-quarter average of 16.8%.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James