by Larry Adam, CIO, Raymond James

Domestic stocks had a strong start to the year but soon ran into headwinds related to geopolitical risks in Iran and the Wuhan coronavirus.

Coming off the heels of a strong year, the domestic equity markets took investors on a wild ride in January, starting off relatively strong then running into headwinds in the form of increasing concern about rising geopolitical risks in Iran, as well as the Wuhan coronavirus and its perceived debilitating impact on people as well as global markets, explained Raymond James Chief Investment Officer Larry Adam.

Although it’s unclear how severe the coronavirus will be, it has already disrupted China’s economy as Wuhan is an important link in the electronics and automobile supply chains. This uncertainty likely continues to weigh on markets in the short term until fears subside; but with prior epidemics as a guide, we believe the market impact will eventually prove transitory, according to Joey Madere, senior portfolio strategist, Equity Portfolio & Technical Strategy.

Market observers are also keeping an eye on the primaries and caucus results. Election years often bring increased volatility, and Raymond James Washington Policy Analyst Ed Mills believes this year will be no different. However, with the signing of phase one of the U.S.-China trade deal, we may see some stabilization now that there’s less uncertainty about further tariff increases. The question remains whether both sides can meet their commitments, and what happens if the European Union becomes the next target on the trade agenda.

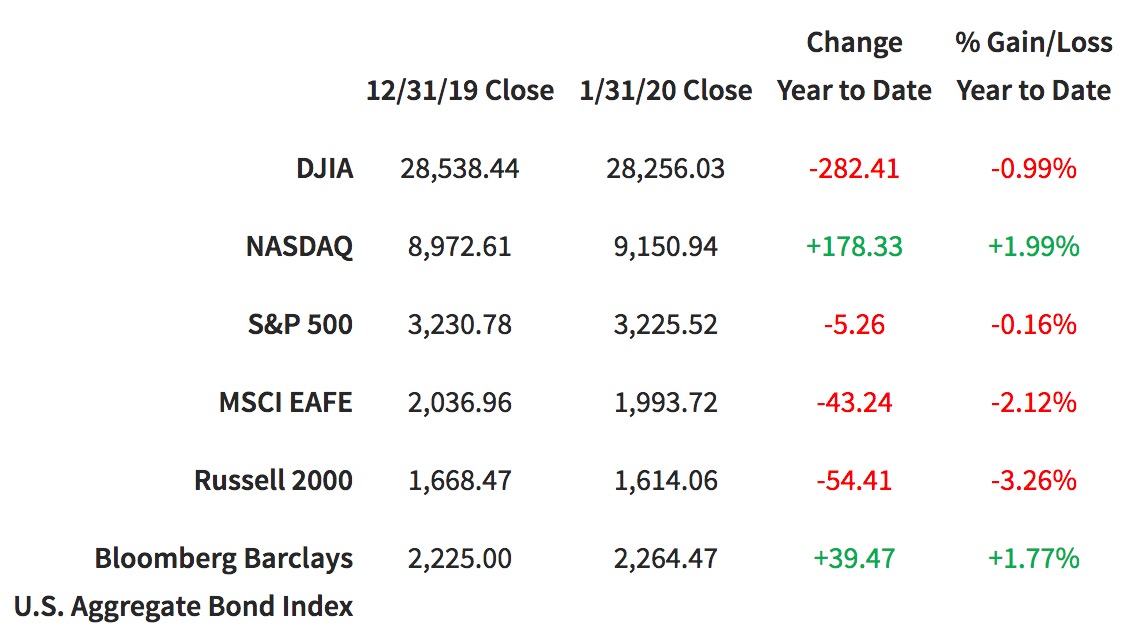

Despite some bumps in the road, January continued some of the momentum from last month and last year, as gross domestic product grew at an estimated 2.1% annual rate in the fourth quarter, and we saw better-than-expected earnings growth. GDP growth is expected to remain mixed, but generally moderate in 2020, according to Chief Economist Scott Brown. The S&P 500 barely slipped into negative territory in January, while the Dow Jones Industrial Average declined 1% and Russell 2000 slid 3.26%. The NASDAQ ended up in positive territory, returning almost 2% for the month.

Performance reflects price returns as of market close on January 31, 2020.

Here is a look at some key factors we are watching, both here and abroad:

Economy

- The Federal Reserve opted to keep the benchmark interest rate at 1.5% to 1.75%, and will continue to purchase $60 billion a month in Treasuries, to support economic growth and boost short-term liquidity.

- Consumer spending growth moderated in the fourth quarter, as expected after two strong quarters, said Chief Economist Scott Brown.

Equities

- After the best year of equity performance since 2013, momentum carried us into 2020 on the back of continued U.S. economic growth, consumer confidence, and better-than-expected earnings growth (both strong 4Q19 earnings results and positive 2020 guidance).

- The pullback in equities on coronavirus concerns comes at a time when investor sentiment had gotten complacent and stocks had reached overbought levels. The market needed a consolidation period to digest its recent gains, Madere noted.

International

- January was a decidedly mixed month for global equity markets, according to European Strategist Chris Bailey. However, the International Monetary Fund’s World Economic Outlook update showed the same or higher growth rates for several global regions through 2021. However, concerns about whether these growth rates can be achieved led to global bond yield declines during the month.

- Unsurprisingly, concerns deepened with the emergence of the coronavirus, however, we also saw the signing of the phase one bilateral U.S.-China trade deal; the formal passage of U.K. parliamentary legislation on Brexit; as well as favorable valuations of international markets compared to their domestic counterparts, Bailey added.

- As mentioned earlier, global banks remain accommodative. The Bank of England monetary policy committee, for example, also kept interest rates at their current level, citing the Brexit deal, as well as the potential for growth over the short term.

Fixed income

- When we opened the new year, the 10-year note yield was just over 1.90% and the first phase of the trade deal agreement was worked out; the expectation was for the Fed to be on hold, the U.S. economy to continue to grow, and inflation to remain well under the 2% threshold. Since then, the 10-year Treasury has traded down to a 1.60% yield; the geopolitical risks have risen; and a SARS-like virus emerged. The point is that financial markets are susceptible to these risks, and the fixed income market and investors can only anticipate so much, according to Chief Fixed Income Strategist Kevin Giddis and Doug Drabik, managing director for fixed income research. As a result, things like the coronavirus outbreak can affect markets quickly, abruptly changing the short-term outlook.

Bottom line

- While volatility is likely to continue to weigh on equities until the virus is contained, overall, we are positive on equities.

- Near-term consolidation can present buying opportunities to add favored stocks or sectors to your portfolio.

Your advisor will continue to watch for movements that may affect your financial plan. In the meantime, please reach out to him or her if you have any questions.

*****