by Kurt Reiman, Blackrock

Kurt lays out why we advocate for a cautious tilt into cyclical assets, such as emerging market and Japanese stocks.

The new year has greeted markets with generally good news: The “Phase 1” trade deal between the U.S. and China has been signed; economic data are looking positive globally; and the corporate earnings reporting season has kicked off with mostly good news. We expect cyclical assets to do well against a backdrop of a modest growth uptick and a pause in U.S.-China trade tensions. In equities, we are overweight emerging market (EM) and Japanese equities. We have also upgraded the value style factor to neutral.

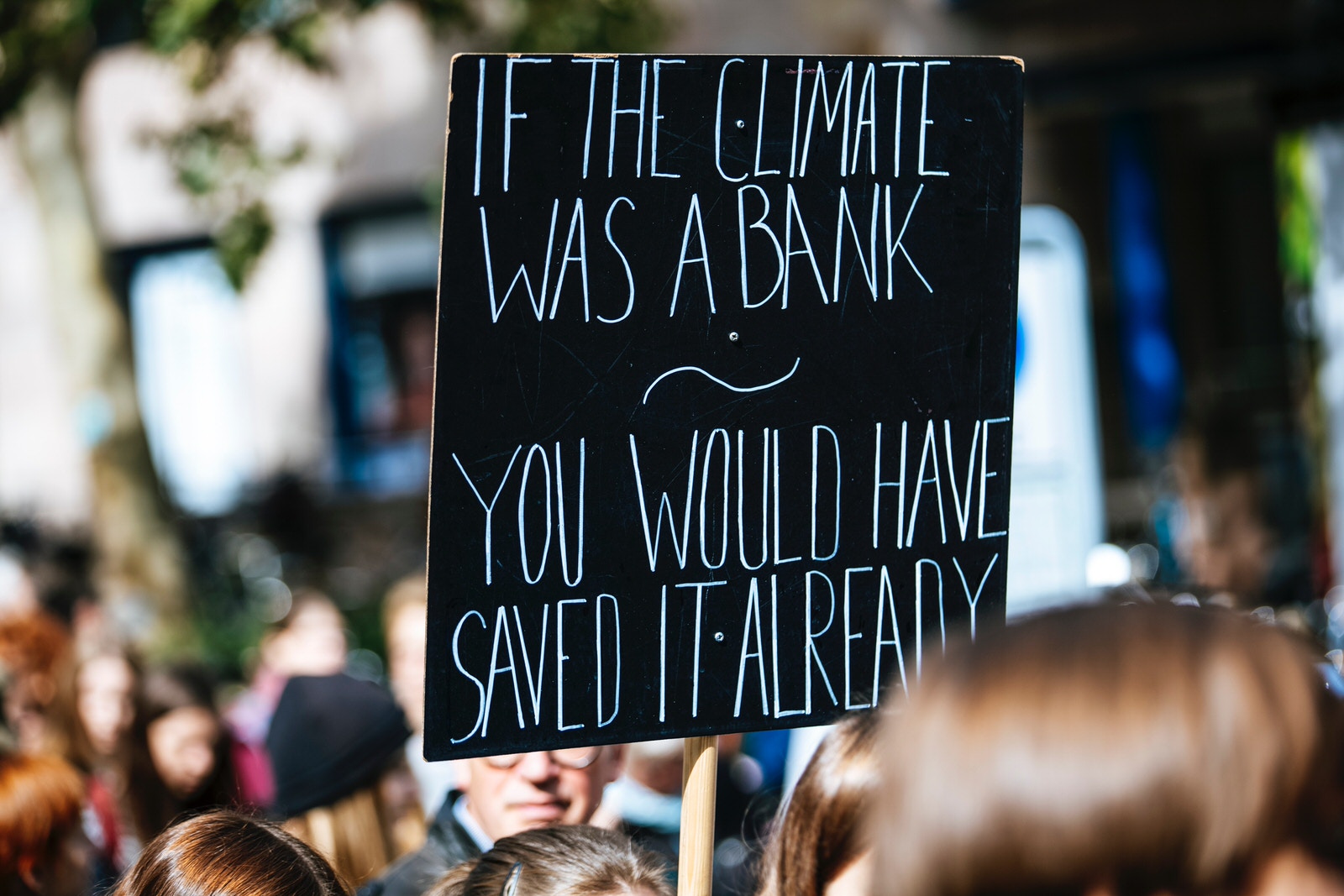

Cyclical assets have severely under performed in recent years, including amid a global growth slowdown. We believe a rebound in global trade and capex should pave the way for stronger performance of cyclical assets over a six-to-12-month horizon, even as we see some long-term trends weighing on these assets, such as the structural downshift in China’s growth. We studied the sensitivity of corporate earnings and equity returns to fluctuations in global manufacturing activity over the past two decades in different regions. See the chart above. The conclusion? Earnings estimates – as well as equity returns – in EM and Japan have historically been the most sensitive. This suggests these markets may have room for out performance during a global growth pickup.

Recent data support our expectation for a pickup in growth this year. World trade volumes appear to have stabilized after sharp declines since 2018. China has reported better-than-expected trade data – alongside rebounding industrial profits and improving manufacturing activity. Financial conditions have eased significantly in developed economies since early 2019, and look poised to filter through to support the real economy in the next six to 12 months. Our BlackRock GPS, which gauges where consensus gross domestic product (GDP) forecasts may stand in three months’ time, indicates global growth should be accelerating slightly through the year. We see this environment as positive for cyclical EM assets.

Japanese equities may benefit from the same dynamics – as well as a pause in U.S.-China trade tensions – due to the export-oriented nature of the Japanese economy. A few other factors work in its favor. A weakened Japanese yen – currently at the lowest level against the dollar since mid-2019 – has historically tended to help lift Japanese stocks. We expect the Bank of Japan to stand pat on its ultra-loose monetary policy and the government to launch sizable fiscal stimulus this year, providing further support for the market. An ongoing improvement in corporate governance is another positive. Share buybacks have surged – up 40% in 2019 to a record high of 7 trillion yen (about $64 billion), according to Morgan Stanley. This should help boost return on equity and share performance. Yet most foreign investors are still underweight the market.

We have also upgraded the value style factor to neutral on a tactical basis amid expectations for a modest cyclical upswing in this late-cycle period. We expect a firming in industrial and trade activity – as well as a steepening yield curve – to underpin the factor. The underperformance in recent years – with the drawdown in value now the third worst and the longest in almost 100 years based on the Fama-French data set – also supports our tactical call. Among other factors, we are moderately overweight quality, which includes many global firms that stand to benefit from easing trade tensions.

Bottom line

We favor a cautious tilt into cyclical assets, including Japanese and EM equities. In bonds, we prefer EM and high yield debt. The risks to our view include profit margin erosion and an unexpected slowdown. For now, we expect revenue growth to boost corporate earnings even as profit margins decline, but higher costs – from wage increases or supply chain disruptions – may eat into profits.

Kurt Reiman is Senior Strategist for North America at the BlackRock Investment Institute. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of January 2020 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2020 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0120U-1067188

This post was first published at the official blog of Blackrock.