by Smead Capital Management

One of our favorite financial writers is Bloomberg’s John Authers. He recently wrote a tongue-in-cheek article about an investment company by the name of Hindsight Capital. In hindsight, or in the company’s case, Hindsight Capital, he talked about what the firm did and what you should have done over the last ten years to produce outstanding returns. It was the ultimate investment version of C.S. Lewis’s book, The Screwtape Letters. Lewis used Satan’s demons to teach a positive message about God and to teach what to do.

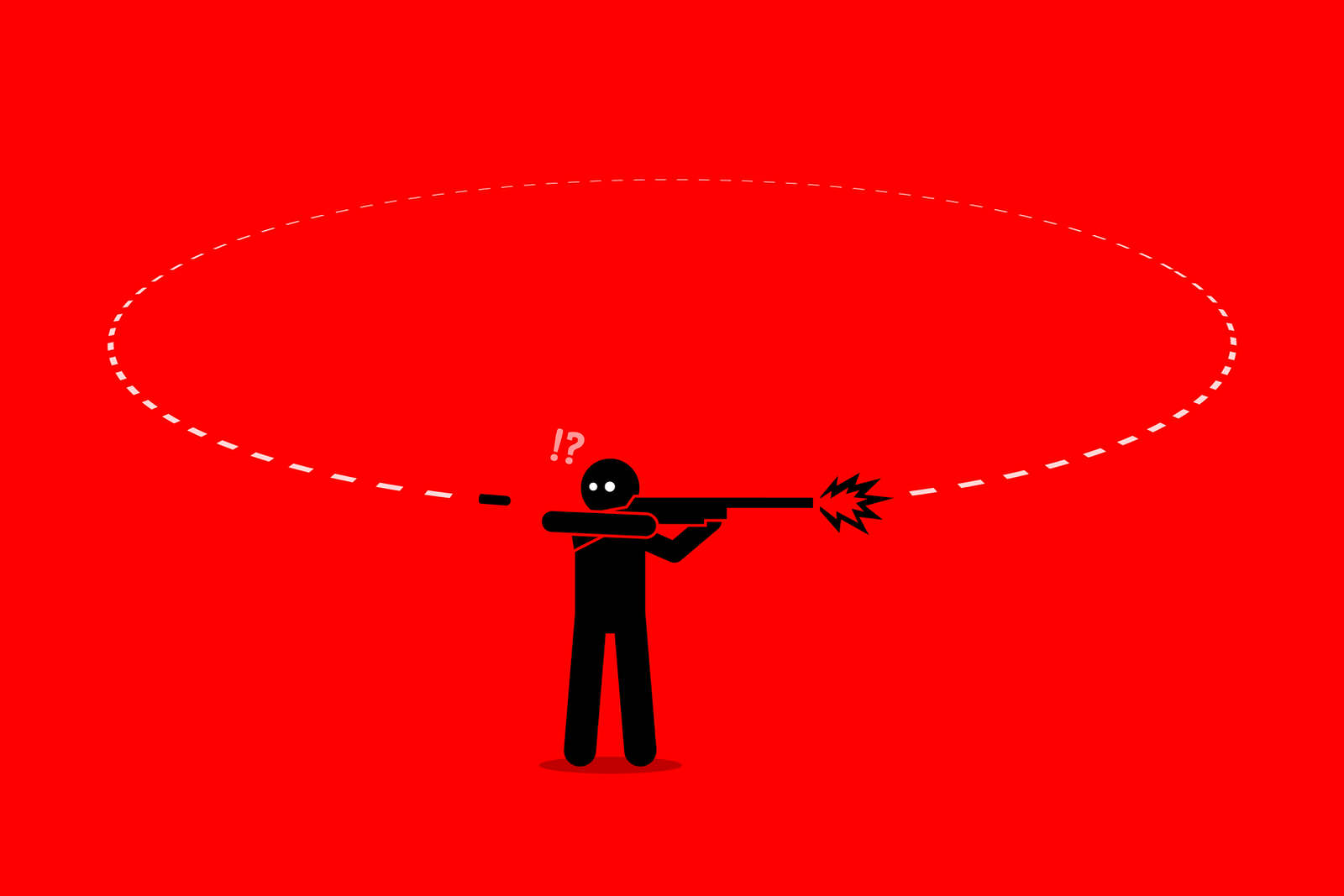

We, on the other hand, are paid to attempt to have foresight. Our foresight is guided by a series of absolutes. Firstly, change is the only guarantee in the investment business. Secondly, at extremes, the crowd is usually spectacularly wrong. Thirdly, in his partnership letters and annual meetings, Warren Buffett tells us to, “Be fearful when others are greedy and greedy when others are fearful.” Lastly, history and psychology provide us an excellent road map for making very contrarian investments.

Looking Back to 1981

Inflation

In 1981, inflation was running at 11% year-over-year and was clearly the most difficult economic problem since the Great Depression of the 1930s. Numerous policies had been tried from 1969 to 1981 by the Republican administration of President Richard Nixon and the Democratic administration of President Jimmy Carter to slow the fever associated with demand-pull and cost-plus inflation. The most popular investments in hindsight in the 1970s were energy stocks, gold, Sunbelt apartments in the Southwestern U.S. and leveraged tax shelters. My career in the investment business started in this scenario.

Why was inflation so high? We would argue that 79 million baby-boomer Americans were getting married, having kids, forming households and replacing 44 million folks in the 30-45-year-old age bracket of the “silent” generation. When 75% more people come to buy things, the price goes way up.

Interest Rates

The appetite for capital and its price in relation to 11% inflation caused interest rates of 15% on Treasury obligations from 30-day to 30-year maturities. In his famous 1999 talk at the Allen and Company summer get together, Buffett explained that the economy grew at 3% per year from 1964 to 1981, despite the high inflation. In other words, the economy was eating capital and capital was the most expensive in my lifetime. Stocks were trading at six-to-eight times earnings, and when you flip that to earnings yield, stocks traded for yields of 12.5 to 16.6%.

U.S. Equity Ownership

In 1981, owning common stocks was mostly for widows with stock certificates in the safe-deposit box and the ultra-wealthy. U.S. households held 11% of their assets in common stocks. The S&P 500 Index funds and other agnostic vehicles were just getting started. My first stock pitch was Coke (KO) at six-times earnings paying a 5% dividend and I would have starved if my career had depended on anyone besides my dad and my cousin buying it from me.

Source: MarketWatch. Data for the time period 1/1/1951 – 3/31/2018.

Equity Valuation

Here is a chart of price-to-earnings (P/E) ratios and dividend yields from 1971 to 1981:

Source: Bloomberg. Data for the time period 1/1/1971 – 12/31/1981.

Source: Bloomberg. Data for the time period 1/1/1971 – 12/31/1981.

The P/E multiples had contracted for 15 years and were among the lowest they had been since the 1930s.

Risk Taking in U.S. Equity

The history of being fearful when others are greedy coincides quite nicely with the peaks in growth stock confidence relative to value stocks as measured by P/E ratios or price-to-book ratios. Value stomped growth in the prior ten years, because the most success in a miserable environment was accrued to asset-heavy and inflation-oriented industries.

Energy as a Percentage of the S&P 500 Index

In 1980, the energy sector peaked at around 29% of the S&P 500 Index:

Source: S&P Index Data. Data for the time period 3/1/1979 – 12/31/2019.

At the end of 1981, 12 of the top 20 market-cap companies in the Fortune 500 were oil companies! The price of oil had risen ten-fold in the prior ten years. Peak oil theories were going wild and Japanese car manufacturers started to sell loads of fuel-efficient smaller cars to an energy price crippled set of Americans.

Source: Fortune. Data as of 12/31/1981.

2020

Inflation

Economists are baffled by the stubbornness of inflation despite being ten years into an economic recovery. The two monetary authorities, the European Central Bank (ECB) in Europe and the Federal Reserve in the U.S., have concluded recently that there is no inflation “anywhere in sight.” Millennials have started households at a much later average age than prior generations and have not yet demanded the goods and services which the Generation X group did the last 15 years.

Interest Rates

The 10-year Treasury Bond closed 2019 at around 1.9%. Below is the chart from late 1981 to today:

Source: Bloomberg. Data for the time period 1/1/1981 – 12/31/2019.

These are the lowest interest rates of our lifetime.

U.S. Equity Ownership

Here is the chart of U.S. equity ownership over the last ten years:

Source: FRED. Data for the time period 1/1/2009 – 12/31/2019.

Not only is the percentage ownership historically high, but it is concentrated in the S&P 500 Index and other low-cost agnostic investment vehicles.

Source: iweblists. Data as of 12/31/2019.

The index is loaded with the five largest market-cap companies. Those five are Apple, Microsoft, Alphabet, Amazon and Facebook. The chart below provides perspective on how much the index is dominated by those five companies:

Source: MarketWatch. As of July 19, 2018.

It takes the smallest 282 companies of the S&P 500 Index to add up to the market capitalization of the largest five tech behemoths.

Risk Taking in U.S. Equity

Here is the P/E chart for the last ten years:

Source: Bloomberg. Data for the time period 12/31/2009 – 12/31/2019.

Thanks to the slowly consistent health of the economy and muted inflation, investors have been willing to pay more and more for each dollar of earnings. As witnessed by growth versus value charts, this has created the widest gap in P/E ratios between styles since the end of 1999 and has gone on a much longer outperformance stretch than growth did back then.

Source: Fama French, Aviance Capital Partners. Data as of 9/3/2019.

Source: Fama French, Aviance Capital Partners. Data for the time period 7/1/1956 – 9/3/2019.

Energy as a Percentage of the S&P 500 Index

At the end of 2019, energy was 4.35% of the S&P 500 Index. Exxon and Chevron amounted to 1.91% of the 4.35%. Therefore, 2.44% of the index is in the other 26 energy companies. Lastly, Middle East tensions leading to supply disruptions appear to be at the beginning in this phase and make U.S. oil production look like a blessing.

Hindsight to 1981

The best thing you could have done in 1981 at the end of the year was the following:

- Bought the longest maturity, non-callable Treasury bonds you could find

- Bought the S&P 500 Index — maximally ramping up equity ownership when nobody had any

- Sold energy stocks, gold and inflation-beneficiary investments

Smead Capital Management Playbook 2020

- Bet that 90 million Millennials will form many more households than 65.8 million Gen Xers did (build houses)

- Avoid bond investments in the U.S.

- Be very selective in stock picking and emphasize inflation beneficiaries in the mix

- Buy energy stocks as opportunities avail themselves

Warren Buffett is being criticized for holding $128 billion in cash at Berkshire Hathaway (BRK). If this is the antithesis of 1981, it is exactly what you would do to be fearful when others are greedy. John Authers might call it foresight.

CEO, Vicki Hollub of Occidental Petroleum (OXY) traded long-term U.S. debt for oil in the Permian Basin, an asset that historically has benefited from inflation, by virtue of acquiring Anadarko Petroleum. We’d like to believe that in ten years, her foresight could become Mr. Authers’ Hindsight.

The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Margin of safety is the difference between the intrinsic value of a stock and its market price. The price-earnings ratio (P/E Ratio or P/E Multiple) measures a company’s current share price relative to its per-share earnings. Alpha is a measure of performance on a risk-adjusted basis. Beta is a measure of the volatility of a security or a portfolio in comparison to the market. FAANG is an acronym for the market’s five most popular and best-performing tech stocks, namely Facebook, Apple, Amazon, Netflix and Alphabet’s Google. Growth investing is focused on the growth of an investor’s capital. Leverage is using borrowed money to increase the potential return of an investment. Momentum is the rate of acceleration of a security’s price or volume. The earnings yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. Profit margin is calculated by dividing net profits by net sales. Quality is assessed based on soft (e.g. management credibility) and hard criteria (e.g. balance sheet stability). Value is an investment tactic where stocks are selected which appear to trade for less than their intrinsic values. The dividend yield is the ratio of a company’s annual dividend compared to its share price.

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Smead Capital Management, Inc.(“SCM”) is an SEC registered investment adviser with its principal place of business in the State of Washington. SCM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which SCM maintains clients. SCM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Registered investment adviser does not imply a certain level of skill or training.

This newsletter contains general information that is not suitable for everyone. Any information contained in this newsletter represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. SCM cannot assess, verify or guarantee the suitability of any particular investment to any particular situation and the reader of this newsletter bears complete responsibility for its own investment research and should seek the advice of a qualified investment professional that provides individualized advice prior to making any investment decisions. All opinions expressed and information and data provided therein are subject to change without notice. SCM, its officers, directors, employees and/or affiliates, may have positions in, and may, from time-to-time make purchases or sales of the securities discussed or mentioned in the publications.

This Newsletter and others are available at smeadcap.com