Santa Claus arrived early this year bringing new all-time highs for some US indices and significant gains overseas, particularly for the UK and Europe.

The combination of a decisive election win by the UK Conservatives finally providing some clarity on Brexit (departure Jan 31, 2020 and new trade deal by Dec 31, 2020) with the US and China agreeing on a Phase I trade deal heading off tariff increases and reducing other tariffs has removed two big clouds that have been overhanging the global economy for years.

With these events not only has fears for the worst-case scenario of trade wars causing a global recession faded, but the pendulum has gone back the other way with investors starting to anticipate an acceleration in economic activity next year boosted by a recovery in global trade. This shift in sentiment can be seen most clearly in commodity price gains reflecting anticipation of increased global demand. Conversely, fear gauges like the VIX and gold continue to soften.

This reduction in fear comes even though the US House of Representatives voted to impeach President Trump last night, sending his case to the Senate for trial. The chorus of yawns from the market indicates that investors see this as political grandstanding and that the Senate is unlikely to remove him from office, leaving that question to 2020 election voters. Meanwhile, the parties have been working together on issues behind the scenes, reaching a budget deal to avert a government shutdown and preparing to ratify the USMCA trade agreement.

Unlike last year, the two holiday-shortened weeks ahead are looking to be relatively quiet. With markets up significantly on the year, the tax-loss and panic selling that provided the final flush last year is unlikely to be repeated. On the contrary, the coming days and weeks could see investors putting capital back into the markets in fear of missing out on a rally.

In this issue of Equity Leaders Weekly, we look at what reduced uncertainty around US-China and UK Europe trade relations has meant for commodities and international equities through a look at wheat and at Chinese stocks.

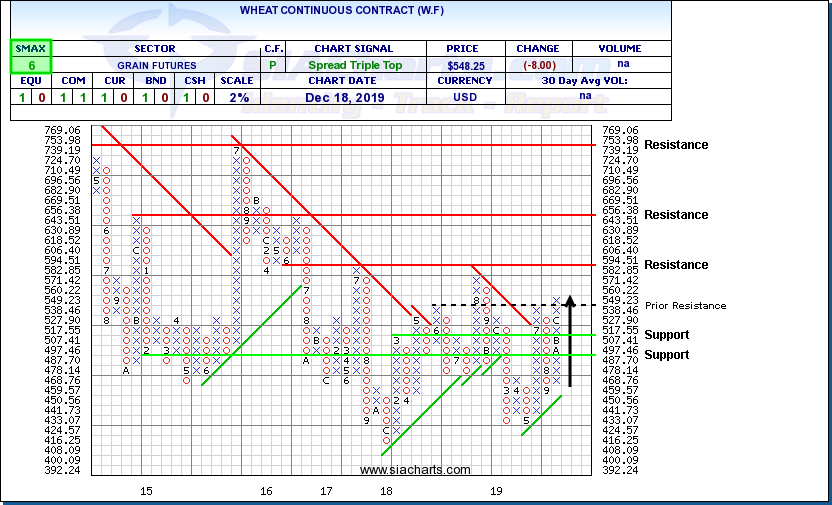

Wheat Continuous Contract (W.F)

Recent progress in trade talks has sparked anticipation of a rebound in overseas economies and increased demand for resources, sparking renewed interest in commodities. Grains in particular have attracted attention with China committing to increasing purchasing US agricultural products as part of the Phase I agreement.

Wheat, for example, has broken out to the upside, clearing $538 to complete a bullish Double top pattern and signal the start of a new upswing. Next potential resistance appears at previous highs and lows near $595, then near $655, where previous highs and a horizontal count converge, and the previous high near $750 on trend. Initial support appears near $505 based on a 3-box reversal.

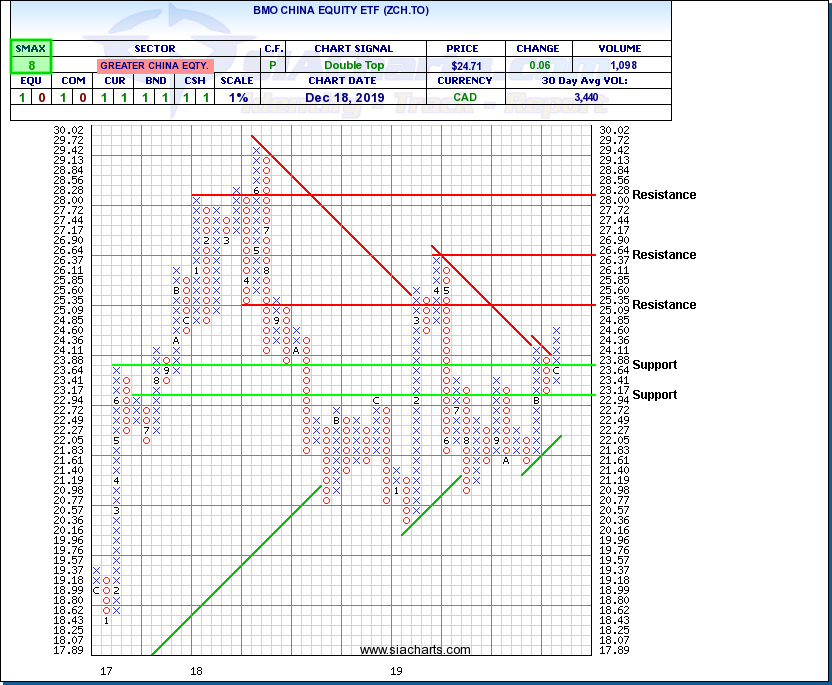

BMO China Equity ETF (ZCH.TO)

With the exception of a brief false start back in the spring, Chinese stocks have been particularly impacted by the US-China tariff/trade war over the last two years, plunging in in the summer of 2018, then base-building between October of 2018 and November of 2019.

In recent weeks, the BMO China Equity ETF has turned decisively upward, first breaking out over $23.65 to complete a bullish Spread Triple Top pattern, then snapping out of a downtrend and completing a bullish Double Top with a breakout over $24.40 to signal the start of a new uptrend.

Recent Chinese retail sales and industrial production reports came in better than expected but Chinese trade numbers have remained weak. As tariffs start to come off, Chinese trade activity could revive and help to improve sentiment toward its stock markets.

The Peoples Bank of China meets this week giving it the opportunity to signal whether it is seeing the economy improving or weakening through its action or inaction. A rate cut would signal concern about the economy while holding steady would signal confidence or hope for recovery The PBOC has been known to take action during December in the past, as it once announced an interest rate change on Christmas Day.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.