by Mohieddine (Dino) Kronfol, Franklin Templeton Investments

Looking towards 2020, we think the global sukuk market has become increasingly relevant as uncertainty in financial markets persists. With unresolved geopolitical issues, ongoing trade tensions and weaker economic performance in developed markets top of mind for investors, we think that investing in the global sukuk market is worth considering.

There are several reasons why the asset class may offer the potential to help reduce risk, diversify portfolios and ultimately help navigate through periods of market tension.

- Firstly, global sukuk market volatility has remained low, at around 2% over the past five years. Not only has volatility been historically low, we expect this trend to persist, given that the market is comprised of a large number of high-quality issuers and home to a dedicated, liquid, investor base. A strong domestic audience of growing Islamic financial institutions has helped anchor the market during stressed scenarios such as the Greek debt crisis, so-called “taper tantrums” in US bonds tied to central bank policy changes, oil price swings or geopolitical escalations.

- Secondly, sukuk have exhibited low correlations to other fixed income sectors.1 This is where we think investors get the potential benefits of diversification,2 which we think becomes increasingly important in an environment where there are growing concerns about For the 3-year period ending 30 June 2019, global sukuk had a correlation of 0.33 to emerging market government debt.3

- And finally, as the global sukuk market has developed and matured, it has gradually exhibited smaller drawdowns during periods of market stress. For all these reasons—lower volatility, lower correlations and smaller drawdowns—we think investors should consider the global sukuk market.

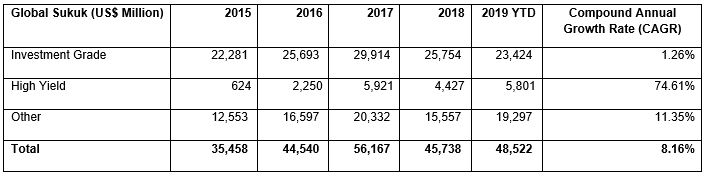

But in our view, these defensive characteristics are not the only reasons to be excited about sukuk in 2020. The market is also continuing to grow and innovate. In 2019, for example, we saw about US$46 billion in total issuance, greater than the 2018 figure. We think the market is on pace to grow by just under 30%, as we continue to see more sovereigns and corporates tap Islamic finance to develop their financial markets or diversify sources of funding.

Challenges Remain

Despite our positive outlook, there are a few areas of concern we are closely monitoring. We have been predicting that the US Federal Reserve (Fed) would turn increasingly dovish, and we expect the US central bank to remain focused on looser monetary policy in the face of softer economic data and increased financial market volatility.

The US-China trade relationship also appears to be further tested, and we believe this will weigh on the Fed as it contemplates the next rate cut of its current easing cycle. In addition, any further negative surprises in US economic data may also weaken the assumptions behind forecasts of relative US economic outperformance compared with other countries and could help to dampen the performance of the US dollar from current, relatively elevated levels. We also believe potential gains from an improvement in outlook are likely to be less than potential losses from a deterioration. And lastly, we are cognisant that sukuk valuations are less attractive now, following double-digit returns in the year-to-date period.

The challenge, which extends beyond the end of the year, is to better understand if economic indicators in the United States and other large economies turn back up again. We think rising risk premia is largely associated with an upswing in global growth metrics. As a result, we have raised cash levels, increased portfolio credit quality and reduced non-US dollar exposure over the past three months, as a precaution against what we see as asymmetric risks.

Ironing Out the Creases

There are also some issues relating to standardisation, innovation and governance that we would still like to see tackled in the global sukuk market. They will be critical to address for the sukuk market to grow its current size of US$444 billion.4 We think the market could potentially reach US$2.7 trillion by 2030, if the market works through some of these concerns. 5

Cost considerations remain an impediment for potential issuers. In addition, the ongoing debate about whether there should be one common Sharia standard for all sukuk issuing markets is a real risk. Our view is that it is difficult to achieve one set of standards. Instead, it is important to continue to innovate to help the market grow.

Governments and financial institutions are the biggest sukuk issuers globally; they make up about 50% of total issuances. We think their role in pushing for market growth will remain vital, and we would like to see them reinvigorate their efforts. In the last four to five years, we’ve seen a lot of new issuers enter the market, including new high yield issuers. That being said, traditional powerhouses like Malaysia have decreased their issuances, a trend we would like to see reverse.

Lastly, we want to see improvement in how environmental, social and governance (ESG) issues are measured and assessed. While there are philosophical overlaps between Islamic finance and ESG, we are not seeing them translated in competitive ESG scores. While we are at advanced stages of deploying a robust ESG model for global sukuk sovereign issuers, we continue to struggle with important data quality and timeliness issues and are yet to see policymakers make headway in mobilising their efforts to address gaps in awareness, data or regulations.

We believe there is a lot to look forward to for the global sukuk asset class. Our team feels confident the defensive characteristics of the market will persist, and this gives us comfort that should any global stresses migrate into sukuk issuing markets, they should be well-positioned to handle potential turbulence. The fact that oil prices have remained supportive of sukuk-issuing economies, and that many corporates have also been on an improving trajectory both in terms of leverage numbers and performance, also makes us optimistic. And, as the global sukuk market continues to develop, we think it will give us much more choice as investment managers, allowing us to better diversify and build healthier portfolios.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

The comments, opinions and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FT affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in developing markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with their relatively small size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Such investments could experience significant price volatility in any given year. Investments in the energy sector involve special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector.

1. Correlation measures the degree to which two investments move in tandem. Correlation will range between 1 (perfect positive correlation where two items have historically moved in the same direction) and -1 (perfect negative correlation, where two items have historically moved in opposite directions).

2. Diversification does not guarantee profit nor protect against risk of loss.

3. Source: Bloomberg, as at 30 June 2019.

4. Source: International Islamic Financial Market Annual Sukuk Report, 2019.

5. There is no assurance that any estimate, forecast or projection will be realised.

This post was first published at the official blog of Franklin Templeton Investments.