by Julie Moret, Franklin Templeton Investments

Listen to our “Talking Markets” podcast for more from Moret.

We’re living in an increasingly changing world. The global population is estimated to hit 10 billion by 2050.1 Around 2.5 billion more people will be living in cities by 2050, with urban areas representing 68% of the world’s population.2

Alongside this, we’re facing rising CO2 emissions, as well as increased air, water and soil pollution.

Against this background, our experience suggests investor preferences are changing too. A recent study we carried out in the United Kingdom echoes the findings from other global research, showing the millennial generation—those born between 1981 and 1997—is actively seeking investment capabilities that deliver a positive environmental and social outcome, alongside producing attractive financial returns.

Demographics shifts and environmental headwinds sit very clearly under the environmental and social banner, but we also consider them to be economic issues. They are potential drivers of change that can impact the operational resiliency of businesses over the medium to long term. We believe this makes demographic and environment considerations relevant for any active investor to understand from a risk-and-return lens.

Megatrends, Sustainability and ESG

Megatrends stemming from these economic drivers are reshaping our world and altering how we operate as consumers and investors.

As a result, companies have to think differently to adapt and sustain their business models. Many businesses are looking to tap into technological advancements to maintain operational efficiencies and continue to generate sustainable growth and earnings.

For example, global population growth and urbanisation are driving up demand for energy, food and water. Estimates suggest global energy usage and food production will grow 50% by 2030, with water usage up 30% over the same time period.3

That expected increased demand presents complex challenges to companies competing on a global scale for finite resources. In response, we’re seeing a growing focus on the efficient use of resources. That includes rethinking waste management, which we believe could benefit companies providing circular economy solutions.

We believe sustainability is at the heart of understanding the consequences and opportunities of this evolution of thinking.

We define sustainability as taking an objective view on how society, consumers and investors are behaving differently and how customers are managing these drivers of change. Considerations of sustainability should focus minds on vulnerabilities and future potential drivers of growth.

In our view, a strong corporate governance foundation sets out how a company is governed and managed. A well-governed company typically also demonstrates strong management of its environmental and social impact, including its human capital.

Environmental, social and governance (ESG) analysis and metrics can offer a measure of sustainability as well as an indication of how companies are approaching longer-term strategic risks.

A Growing Focus on a Wider Stakeholder Base

All of these components highlight the increasing pressure that companies are facing as they manage a wider pool of stakeholders beyond shareholders concerned only with profit maximisation.

Companies need to consider carefully how they handle broader stakeholder relationships, including those with consumers, employees, suppliers and local communities. These relationships ultimately govern a company’s social licence to operate.

In an increasingly global supply chain, there’s more focus on the treatment of suppliers, particularly in emerging economies where weak governance and management can lead to value destruction, either in the form of reputational risk or regulatory fines.

This shifting focus to encompass a wider group of stakeholders is becoming more apparent to us.

The UK Stewardship Code most recently broadened its definition of stewardship to encompass the economy, environment and society.

Its new definition reads: ‘’Stewardship is the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society‘’.

Also, in August of this year, the Business Roundtable, an influential group of 181 CEOs in the United States, announced a new statement redefining the corporate purpose to meet the needs of all stakeholders.

An ESG Toolbox to Better Understand Intangible Assets

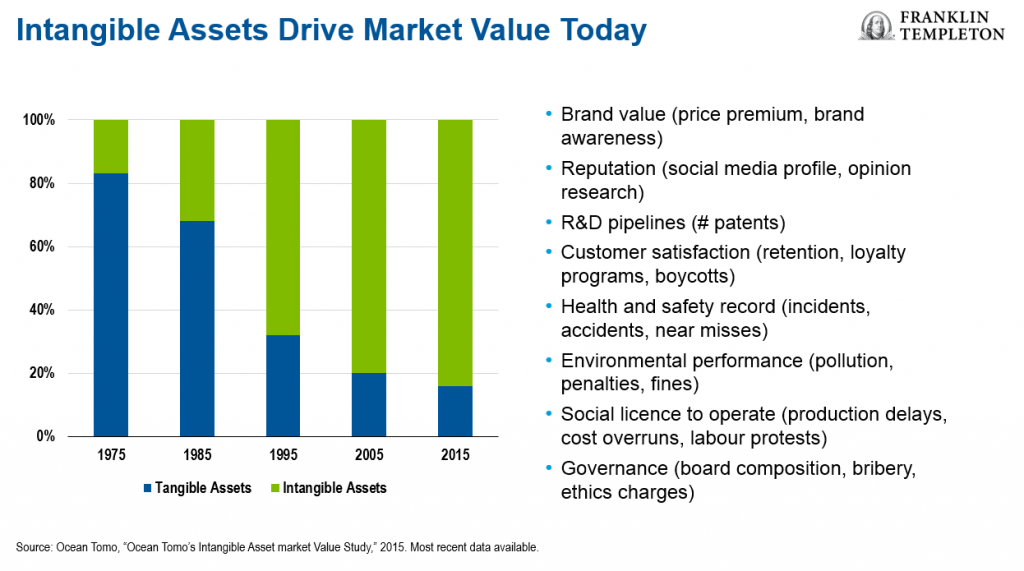

In this evolving environment, our analysis shows that intangible assets, including reputation, brand loyalty and intellectual capital, have formed a larger proportion of companies’ valuations over time.

According to a report from intellectual property valuation firm Ocean Tomo, intangible assets accounted for more than 80% of the market value of the S&P 500 Index in 2015, up from 17% in 1975.4

Intangible assets are drivers of corporate valuations that balance sheets or accounting metrics don’t necessarily capture. However, they are becoming more important in understanding intrinsic value.

We believe financially relevant ESG information can provide better insight into how companies manage many of these issues.

We think there are questions around whether today’s valuation models, which are calibrated for asset-heavy companies, currently capture some of the latent risks around intangibles.

We believe there’s a strong argument that ESG information can be helpful alongside traditional company financial analysis in providing a more holistic view of long-term intrinsic value.

Important Legal Information

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

What Are the Risks?

All investments involve risks, including potential loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

____________________________

1. Source: United Nations, “World Population Prospects 2019,” August 2019.

2. Source: United Nations, “2018 Revision of World Urbanization Prospects,” May 2018.

3. Sources: HM Treasury, Food and Agriculture Organization of the United Nations, International Energy Agency, International Food Policy Research Institute, BofA Merrill Lynch Global Research. There is no assurance that any projection, estimate or forecast will be realised.

4. Source: Ocean Tomo, “Intangible Asset Market Value Study,” 2015. The S&P 500 Index tracks the stocks of 500 large-capitalisation US companies. Indices are unmanaged, and one cannot directly invest in them. They do not include any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance.

This post was first published at the official blog of Franklin Templeton Investments.