“Everybody talks about the weather, but nobody does anything about it.”

by Steve Bonnyman, MBA, CFA®,

Granted, episodes of government infrastructure investment have punctuated recent political and economic history – for instance, in response to the Great Recession – and U.S. President Donald Trump’s promise of a trillion-dollar infrastructure project briefly sparked market enthusiasm in the wake of his 2016 election. So far, that promise has resulted in nothing concrete and the sum total of infrastructure investment in recent years has barely begun to address the perceived need.

Read AGF Investment's full Outlook 2020 – New Year. New Decade.

In short, the world is rapidly approaching a critical tipping point. Aging infrastructure is increasingly failing, and new technologies, such as 5G wireless networks and renewable energy, require a next generation of infrastructural support for their deployment. The need for repair, replacement and innovation in infrastructure seems bound to become only more pressing.

Consulting firm McKinsey & Co. estimated that US$3.3 trillion needs to be invested globally in infrastructure every year to 2030.

The demand for extensive infrastructure development across most of the economies of the world remains undisputed. Estimates of its costs abound; for instance, a 2016 study by the consulting firm McKinsey & Co. estimated that US$3.3 trillion needs to be invested globally in infrastructure every year to 2030 – just to support current economic growth rates.

Evidence of crumbling infrastructure is also mounting. Its impacts range from the deadly to the inconvenient: potable water issues in Walkerton, Ontario (biological contamination in 2000) and in Flint, Michigan (lead contamination); bridge collapses in Italy, India and the United States in more recent years; power outages in California in 2019; and closer to home, the estimated 600,000 and 250,000 potholes crews in Edmonton and Toronto, respectively, patched in 2018.

“Fixing” such problems requires investment, of course, but the primary challenges remain. Not only does infrastructure generally require lots of upfront capital combined with long permitting and construction timelines, projects typically offer long payback periods, and therefore have historically been the domain of government investment.

Meanwhile, public capital markets – a potential source of financing – have been enamoured with “capital-light” businesses, owing to their lower capital requirements and hence higher near-term return on invested capital. And it has helped that governments have been reluctant to give up their control of “public works” even though their revenues are being consumed by more visible, near-term demands like health care, leaving little for long-term, expensive projects.

The political landscape is changing, however, and despite the concerns it raises, populism might well have an upside at least for infrastructure investment. A rising tide of public unrest (driven in part by a politically empowered youth demographic) could be the catalyst for governments to relinquish domination of infrastructure projects and establish the regulatory, subsidy, and return-on-investment characteristics to stimulate private capital to fill the gap.

Infrastructure investment by the private sector is a fairly new industry, being roughly 20-plus years old, and it has long been considered the domain of large private specialty funds. In fact, capital market investors have also had the opportunity to participate, by investing in stocks of “through the chain” (for example, power producers, electrical equipment manufacturers, toll roads and airports) or “bottom of chain” (aggregates, steel, cement, engineering and construction, etc.) companies.

More recently, market evolution has allowed the private investor to participate more directly in infrastructure investment. We see several driving economic forces that could support this trend and create new opportunities. Among them:

E-commerce

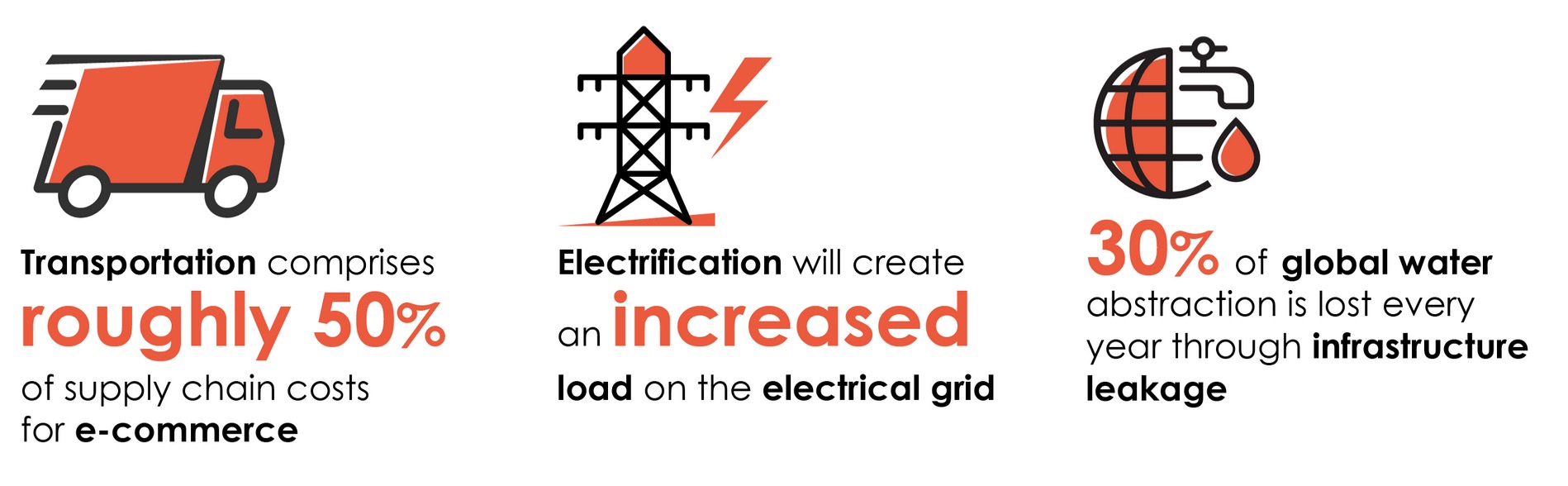

Time is becoming a competitive element in e-commerce, as purchasers expect to order anything, anytime and anywhere and have it delivered tomorrow. This model increases the focus on supply chain logistics and infrastructure support. Transportation comprises roughly 50% of supply chain costs for e-commerce, and failing infrastructure presents a key bottleneck to timely delivery.

Energy transition

With its focus on the use of fossil fuels in transportation and by utilities, energy transition has been the lightning rod of the climate change debate. The two issues are inexorably linked, as the commonly proposed replacement for carbon-based fuel for transportation – electrification – will create an increased load on the electrical grid. Meanwhile, integrating wind and solar power into the existing system will require huge investment in power infrastructure.

Water

According to the United Nations, the gap between demand for water and available water worldwide will approach 40%. Meanwhile, the UN estimates that 30% of global water abstraction is lost every year through infrastructure leakage. New water technologies (purification, desalination) and maintenance/replacement of existing pipes and processing facilities are poised to become a critical need.

Within the public markets, there is already a broad base of global opportunities to invest in the infrastructure chain, from stable, high-cash-flow regulated utilities to public airports, shipping ports and communication towers, as well as the core builders of infrastructure such as engineering and construction firms, cement companies and aggregate producers.

We believe the demand for both renewed infrastructure and growth infrastructure to meet evolving economic needs may be reaching a tipping point. If so, then capital market investors might find infrastructure to be a theme whose time, at long last, has come.

Copyright © AGF Investments