by Marty Flanagan, Invesco Canada

In my recent visit to China, I met with a variety of clients, as well as digital companies. In spite of the overhang of the U.S.-China trade wars, everyone I spoke with remained optimistic about the opportunity for further investment in this important market and broadly bullish in their long-term economic outlook.

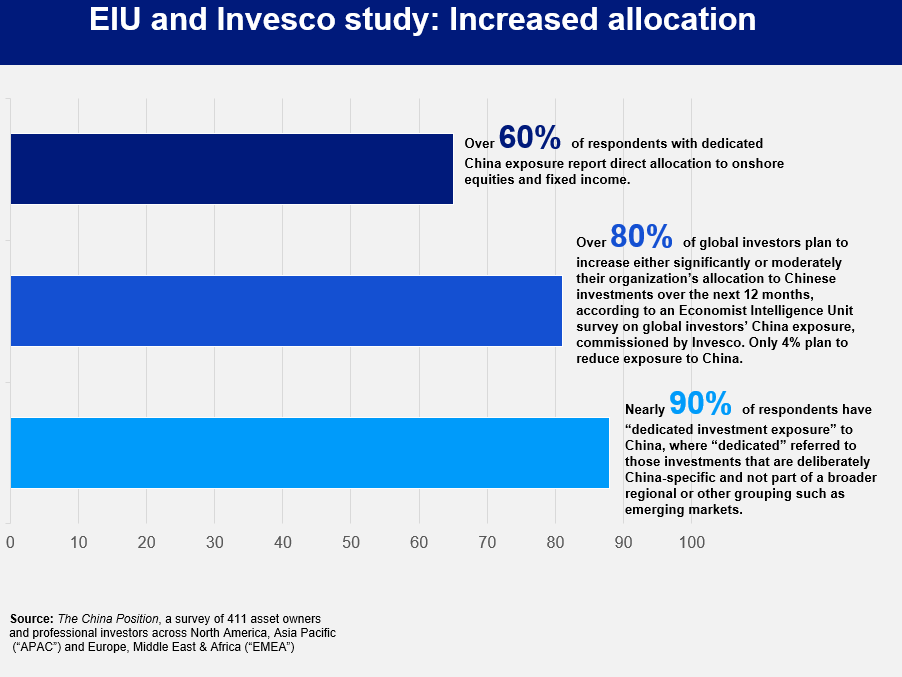

This optimism is consistent with the results of our recent China survey, conducted by the Economist Intelligence Unit (EIU), of more than 400 asset owners and professional investors across North America, Asia Pacific and Europe. In our survey, we found that half of the respondents have increased their investment allocations in China over the past year, and more than 60% said they expect to increase their China exposure over the next 12 months.

As of September 30, 2019.

It’s clear from my discussions that Chinese authorities are committed to supporting investor interests in the country’s capital markets and are taking constructive steps to address investor concerns. For international investors, they have taken steps such as lifting investment quotas in the Qualified Foreign Institutional Investor (QFII) program to allow for easier foreign capital participation.

China’s assets under management continue to grow exponentially on its digital wealth platforms, which are enabling young and technology savvy/growing middle-class investors to participate in the markets efficiently and at scale.2 An early glimpse of this trend several years ago convinced us to launch our own digital wealth platform in the Americas with the acquisition of Jemstep, which we’ve expanded over the years with further acquisitions in Europe and the U.S. Building on the strength of our franchise in China, Invesco is participating in a number of the country’s digital wealth platforms through its joint venture Invesco Great Wall,3 which are making meaningful contributions to our business.

As you would expect, the clients I met with were curious about U.S. sentiment toward China, given the U.S.-China trade wars. As our survey results confirmed, the bullish stance of institutional investors in the U.S. (as well as Europe) is seemingly undeterred by trade tensions. We believe this, coupled with the easing barriers to entry and ongoing regulatory reforms in China’s vast investment market, should further drive interest and investment in one of the world’s most attractive and exciting markets.

This post was first published at the official blog of Invesco Canada.