by Drew O'Neil, Raymond James

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Contrary to popular belief, rising interest rates are not catastrophic to the total returns of fixed income if you own individual bonds. Yes, if you buy a bond today and interest rates shoot higher tomorrow, the market price of the bond will fall. Yet the wonderful thing about owning a bond is that interim price movement does not affect your return if you hold the position until maturity. The obvious but often overlooked reason is that individual bonds have a defined maturity price and date when the investor knows they will be getting their principal returned to them. This is known at the time of purchase. Price movement not having an effect on an investor’s total return goes against most investors’ intuition, as nearly every other asset class’s total returns are heavily dependent on price change over time.

When you analyze the projected total return for an individual bond, the most important point to keep in mind is the timeframe that you plan on holding the security, which for the typical investor (buy-and-hold) is the life of the bond. So for a bond that matures in 10 years, looking forward 10 years to maturity and ignoring mark-to-market pricing is imperative. You don’t purchase a 10-year security for a 2-year time horizon. Over time, the total return on the investment become less about the price movement and more about the cash flow that is produced.

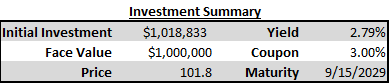

Sources: TradeWeb Direct, Raymond James. Future total returns are estimates based on projected price change, cash flow, and interest-on-interest; and assume that the bond does not default and is held until maturity. Not a guarantee of future results.

The chart above shows the total return for a 10-year bond over time, in two different rising interest rate scenarios. The total return is a combination of price change, cash flow, and interest on reinvested cash flow. As you can see, a move higher in rates will initially hurt the total return, as expected, because the price of the bond has taken a hit and the bond has not paid out much cash flow yet. As more time passes, you can see that the total return quickly turns positive as the fall in price become less of a factor and cash flow “takes over”. By the end of the 10-year holding period, when the bond matures, the interest rate scenario that saw yields rise more (2% higher) actually produced the best returns. This scenario is projected to leave the investor with a ~35% holding period return over the 10-year holding period. This flies in the face of most “rising rates are bad for bonds” commentaries that most investors have come to believe. Just remember, you aren’t buying individual bonds for the short-term prospects, you are buying them to be part of a long-term plan.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Copyright © Raymond James