by Hubert Marleau, Market Economist, Palos Management

The Purchasing Power Parity Rate for the Canadian dollar is around 80 U.S. cents--that means that the price of Canadian dollar is about four cents less than it ought to be. There is a better than even chance that global and domestic conditions could bring that about. The mid-term performance of the loonie has been pretty good, rising from 68.50 US cents in 2016 to 76.60 on thursday morning and showing technical support at the current level.

The outlook for the Canadian dollar for 2020 rests mainly on global economic conditions and three domestic factors. These are the Canadian terms of trade, the Canadian monetary policy and the Canadian attraction for foreign capital. A tide appears to have turned in favour of cyclical segments of the world economy.

Despite the expressed consternation of the likes of the OECD and IMF, the rampant U.S.-China trade optimism of phase one, the optimistic assumption that eventually the correlative global easing push executed over the past nine months and the optimistic belief that an equal global fiscal push is imminent, the aforementioned tide will eventually be reflected in the economic data for Canadian growth and inflation.

Canadian economic trackers which measure real time activity, shows a modest rebound in the pace of growth to 1.6% in Q3. Given the healthy increase in total employment in the past year (2.2%) and the strong wage rate increases of 4.4% year-over-year, prognosis for growth in 2020 is better than 2.0%. A sign of life in the was reported this week for capital expenditures as a result of an improvement in the Canadian business outlook. A pickup in business investment may be near.

Investors should take note that tops in commodity prices like crude oil in particular are always forged in violent, breath-taking periods of volatility and that is not what we were experiencing during the last few weeks with backwardations widening.

After pushing U.S. oil and gas production to record levels, many shale companies are planning to pump less. The move toward voluntary restriction is a new dynamic for the oil industry, reflecting a calculus that is better to spend and produce less while waiting for higher commodity prices. This may prove to be favourable for the Canadian energy sector.

As an aside, the details in the U.S. financial markets and monetary aggregates support the view of a changing environment. Since the end of August, ten-year bond yields have risen 50 basis points of which inflationary and growth expectations each account for 50% of the increase.

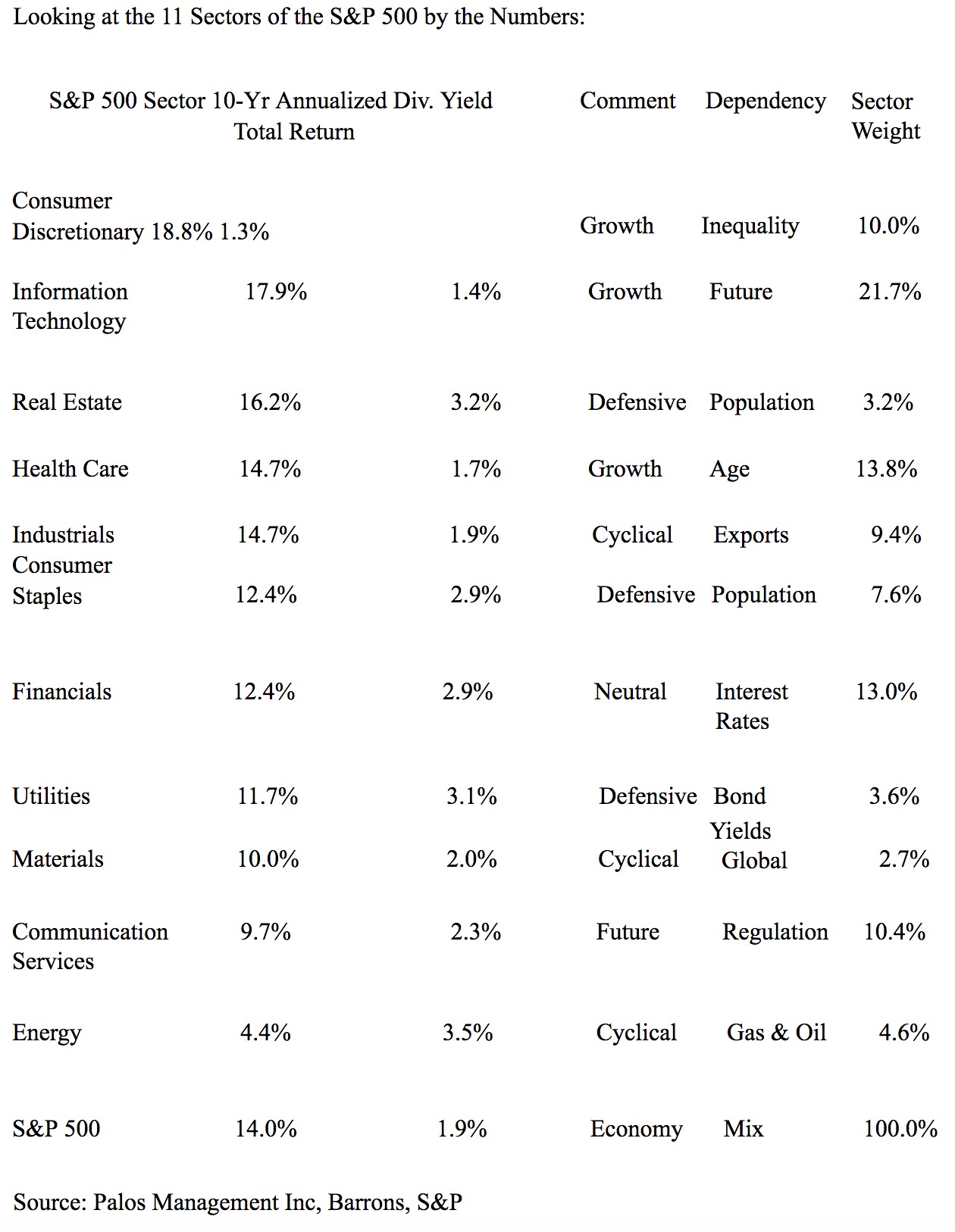

The spread between the neutral and policy rates is positively widening and the yield curve is bullishly steepening. As one would expect in such circumstances, the pace of money supply with zero maturity (MZM) has accelerated and it is now 7.8% higher than it was a year ago. Significantly more than the actual increase in N-GDP. Interestingly, the S&P 500 companies grew CapEx and R&D during Q/3, reducing buybacks.

The future performance of the Loonie looks promising because Canadian terms of trade which are greatly affected by the price of commodities, the Bank of Canada often makes use of the Canadian dollar to minimize the impact of inflationary effects of rising commodity prices and Canada lures foreign capital when cyclical conditions are ripe.

Moreover, the USMCA could surprisingly be closer to a ratification than generally expected. An approval would blunt the criticism that the Democrats are only concerned with the impeachment process at the expense of pressing economic issues. As a matter of fact, the leadership of both parties would like to see implementation by the end of the year.

While the line-up of the usual suspects that typically back the Canadian dollar seem to be improving, it excludes the most worrying scenario of all. That is the popular unrest that is destabilizing the social and political fabric of the country.

While I recognize that, the Canadian elite in Ottawa contend that widespread protest against the current regime and its policies is unlikely to spread, events elsewhere in Canada show that the country is not immune. Of course, an improved global situation for Canadian resources would kick the can down the road.

Copyright © Palos Management