by Larry Adam, Chief Investment Officer, Raymond James

Key Takeaways

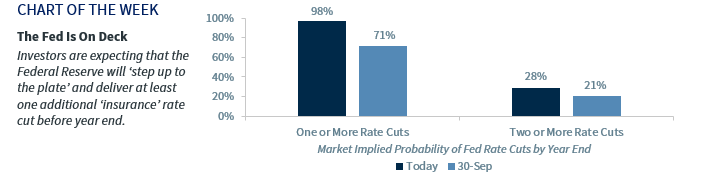

- The Fed Is ‘On Deck’ & Investors ‘Cheer’ For A Rate Cut

- ‘Change-Up’ in US-China Trade Negotiation Tactics

- Next Week Is The ‘Major Leagues’ for Economic Data

The 115th World Series began this week, the culmination of a 162-game regular season. While this season is long relative to other sports, the Investment Strategy season never ends. We are constantly evaluating economic and market data and ensuring that our forecasts, strategies, and outlooks are prepared for ‘primetime.’ From a strategy perspective, we have had several ‘homeruns’ this year such as our call on technology (33.7% Year-To-Date (YTD)), but we have also been thrown some ‘curveballs’ in regards to trade and geopolitical risks. While our role is surely relatable to “America’s pastime,” so too is the current state of the economy and financial markets.

The Fed Is On Deck | Investors are hoping that the Federal Reserve will ‘step up to the plate’ and cut interest rates at the October Federal Open Market Committee (FOMC) Meeting next week. The financial markets are currently pricing in a 96% probability of a cut at the meeting, and a 28% probability of two or more rate cuts before year end. To us, the number of rate cuts is less important than the ultimate result. Our base case is that the Fed has enough ‘firepower’ to implement additional ‘insurance’ rate cuts to extend the current record economic expansion (127 months) for the foreseeable future. Our confidence in the Fed’s ability to ‘swing for the fences’ and extend the economy’s record run is the primary reason we have an optimistic outlook for US equities, which is reflected in our 12-month S&P 500 target of 3,127.

Playing Trade Hardball? | President Trump’s language regarding trade agreement ‘phases’ seemed to come ‘out of left field’ given his traditional ‘all or nothing’ and ‘deal or no deal’ rhetoric. The sudden ‘change-up’ in negotiating tactics is likely due to economic growth concerns and the impeachment inquiry, both of which are negatively impacting his poll numbers and may hamper his reelection prospects. President Xi is facing his own pressures, as China’s 6.0% 3Q GDP growth marked the lowest quarterly economic growth rate since their records began in 1992. Any negotiations that lead to a truce or indefinite postponement of the tariffs could put both countries in the ‘win column,’ with the US consumer proving to be the biggest ‘fan.’ Recent signs of progress from both sides suggest that President Trump and President Xi want to ‘play ball’ and have a formal signing of a Phase One deal at the November 14-15 APEC Summit in Chile—a positive for global equity markets.

Earnings Not Batting A Thousand | Earnings season is far from over, as only 170 companies (~31% of the S&P 500 market cap) have reported. On a positive note, ~78% of companies are beating estimates on the bottom line (relative to the previous 20Q average of 73%), and ~65% of companies are beating estimates on the top line (relative to the previous 20Q average of 60%). However, the average company is ‘beating’ estimates by only 2.6%, which is certainly not a ‘grand slam’ compared to the previous 20Q average of 4.9%. At this time, S&P 500 earnings are projected to decline 4.0% year-over-year (YoY) and need a huge ‘rally’ to avoid the first negative quarter since 2Q16. A comeback is growing less likely, and many of the big ‘sluggers’ reporting next week (Apple, Alphabet, Facebook, Berkshire & Exxon) will need to hit ‘homeruns’ for there to be a chance.

A Whole Different Ball Game | Next week is the ‘major leagues’ of economic data, as we receive reports on 3Q19 GDP, non-farm payrolls, wage growth and the ISM manufacturing index. As for the preliminary reading of 3Q19 GDP, personal consumption will likely remain the ‘Most Valuable Player’ of the US economy. Personal consumption is likely to maintain its ‘streak’ and grow for the thirty-ninth consecutive quarter. Last month, the equity markets reacted quite strongly to the ISM manufacturing Index declining to 47.8, the lowest level since 2009. In fact, the S&P 500 declined 3.0% in the first two days following the manufacturing data point falling deeper into contraction. However, the early signs are that the ISM Manufacturing Index may rebound slightly as several regional manufacturing indices have recently posted improvements. Regardless, while important, this data point is less important than in the past as manufacturing only represents ~11% of the US economy. Turning to the employment report, job growth is expected to understandably slow. Over the last ten years, average job gains per month have been 179,000. However, in order to maintain the 50-year low unemployment rate of 3.5%, our chief economist, Scott Brown, believes the economy needs to add only ~70,000 jobs per month. To be safe, job creation in the 70,000 to 110,000 ‘ballpark’ would be reassuring to keep the unemployment rate at or near 3.5% and wage growth at ~3.0%. Given these supportive trends, we maintain our expectations of relatively robust economic growth with a low probability of recession. Our forecasts for 2019 and 2020 GDP growth are 2.2% and 1.7%, respectively.

Read Larry Adam's Full Outlook as PDF

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James