Can interest rate cuts by central banks restart global growth despite trade tensions?

by Dirk Hofschire, CFA, SVP; Lisa Emsbo-Mattingly, Director; Jake Weinstein, CFA | Senior Analyst; and Ryan Carrigan, CFA l Analyst, Asset Allocation Research, Fidelity Investments

Key takeaways

- The US is firmly in the late phase of the business cycle which is a time when stock market volatility typically increases.

- Interest rate cuts by the Federal Reserve and other central banks have yet to reaccelerate slowing global economic growth.

- Trade tensions between the US and China are continuing to create uncertainty which is slowing business investment.

- Government bond yields are dropping and stocks are turning more volatile, so it’s important to have a diverse mix of investments.

During Q3, the Federal Reserve and other central banks eased monetary policy in an effort to counter flagging global-growth momentum. However, further escalation of the US-China trade conflict continued to weigh on confidence, and it remains unclear whether monetary easing alone is sufficient to catalyze economic acceleration. The mature global business cycle continues to warrant smaller cyclical allocation tilts.

See our interactive presentation for in-depth analysis.

With lackluster global growth and increased policy uncertainty, the continued drop in government bond yields during Q3 spurred gains across less risky bond categories, gold, and interest rate-sensitive equity sectors such as real estate investment trusts (REITs). Year-to-date returns for all major asset categories remained in positive territory, with US stock and bond markets registering strong gains.

Economy/macro backdrop: Mature US and global business cycles

The global business cycle continues to mature, with the US and most major economies in the late-cycle phase. Sagging trade and industrial activity continued to weigh on global growth, with the share of major countries with expanding manufacturing sectors dropping to its lowest level since 2012. This weakness occurred despite an upturn in our diffusion index of China's industrial production. For the first time in the past decade, China's stimulus measures and manufacturing upswing have failed to lift global trade and industrial activity. While China's monetary and fiscal policy easing has helped stabilize industrial activity, we believe high debt levels and US-China trade uncertainty supports our stance that material economic reacceleration remains unlikely.

The US is firmly in the late-cycle phase, but the economy remains supported by consumption, which represents around 70% of GDP. Historically, consumer spending and employment growth stay positive during the late cycle, typically not falling until the onset of recession. Several leading indicators suggest the labor market is nearing peak levels, including consumers’ extremely favorable assessment of the job market, which tends to be most elevated just prior to recession.

Ten-year US Treasury yields dropped due to a decline in both inflation expectations and real interest rates, with both measures decreasing to near multi-year lows. Yields on 10-year Treasurys remained below 3-month Treasurys, keeping the yield curve inverted. Curve inversions have preceded the past 7 recessions and may be interpreted as the market signaling weaker expectations relative to current conditions. The time between inversion and recession has varied considerably, however, and the curve also has flashed 2 "head fakes" in which expansion lasted for at least 2 more years.

Core inflation has been generally stable at about 2% in recent years, but tariff hikes have lately pushed goods prices upward, helping boost core CPI to a multi-year high. Tariffs also have negatively impacted demand—for example, last year's tariffs on washing machines both boosted prices and lowered consumption. The near-term inflation outlook remains balanced amid uncertain trade policy and downside economic risk.

We think global economic momentum has peaked and that trade-policy friction is negatively influencing capital expenditures. Global central banks lowered interest rates during Q3, and the Fed ended its balance-sheet drawdown while the European Central Bank (ECB) reinitiated quantitative easing. However, the global liquidity backdrop is much less favorable than it was in 2016–2017, with US Treasury increases of cash held at the Fed offsetting recent central-bank accommodation. Monetary policy may be showing its limitations, with a number of challenges blunting the effects of easing.

Asset markets: US assets led widespread rally

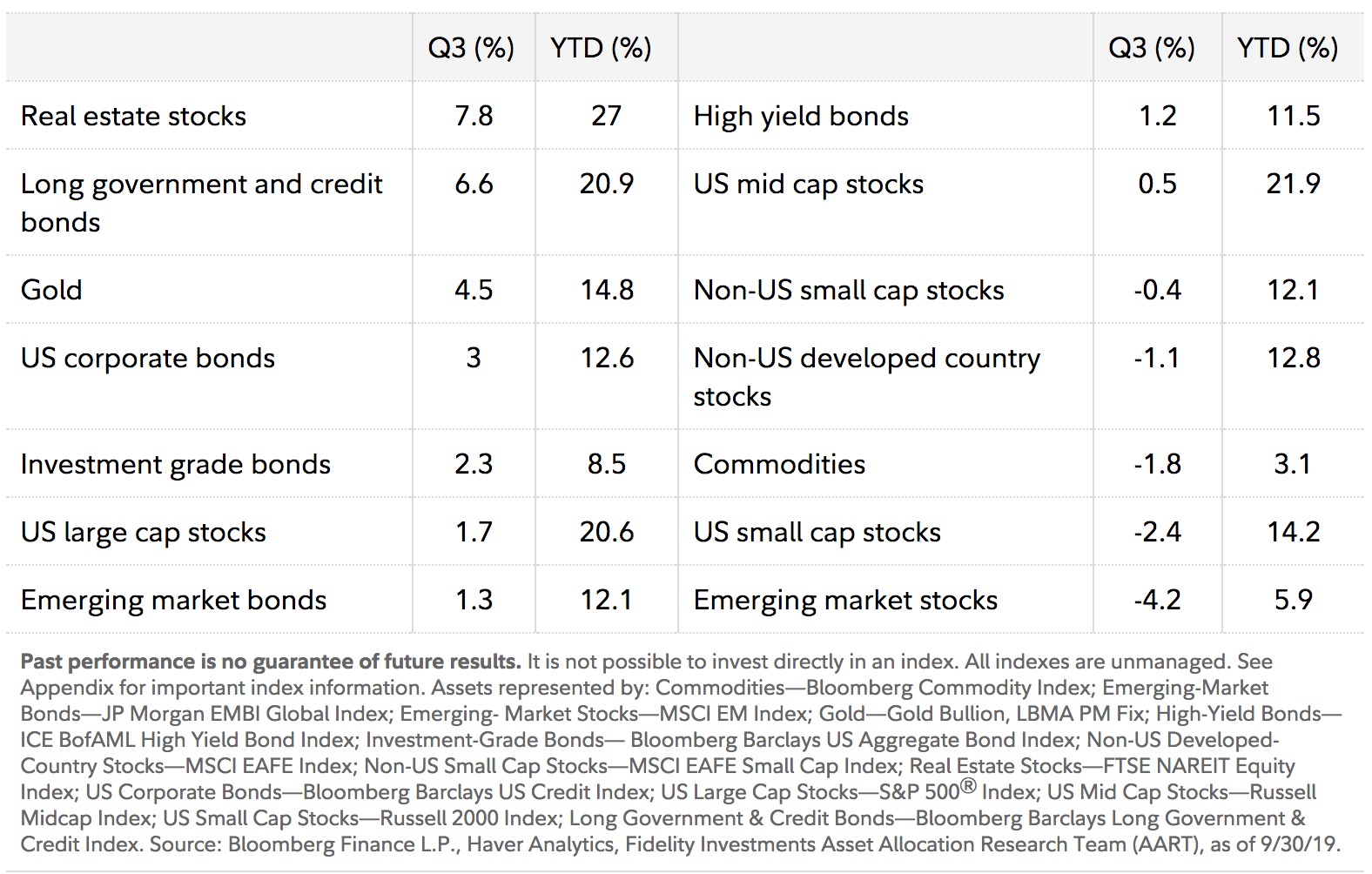

In Q3, equity sectors and factor segments that typically are less cyclical and may benefit from lower interest rates led the equity markets: Utilities, real estate, consumer staples, and minimum-volatility stocks fared best. Treasury bonds and other less risky debt types were the top performers among fixed income sectors. Gold was the best-performing commodity segment. Emerging-market equities struggled.

Returns for categories of assets

US earnings growth continued to decelerate during Q3, after receiving a boost from corporate tax cuts in 2018. Meanwhile, non-US developed-market (DM) and emerging-market (EM) profit growth stayed in negative territory. Forward estimates point to market expectations of a convergence of global profit growth in the mid-single-digit range over the next 12 months.

Continued rising US stock prices pushed equity valuations further above the long-term US historical average this quarter, while trailing price-earnings (P/E) ratios for non-US developed and emerging markets remained below their respective long-term averages. Further, using 5-year peak inflation-adjusted earnings, DM and EM equity P/E ratios remained lower than those for the US, providing a relatively favorable long-term valuation backdrop for non-US stocks. After moving sideways during the first half of 2019, the US dollar appreciated during Q3, resulting in generally expensive valuations versus many of the world's major currencies.

In fixed income, modest inflation, flagging growth expectations, and the Fed's dovish shift pushed bond yields lower for the third quarter in a row. Credit spreads experienced some volatility but ended the quarter roughly unchanged. Many bond categories have dropped to the bottom-yield deciles relative to their own long-term histories. Credit spreads also are generally below their long-term averages.

Historically, the mid-cycle phase has tended to favor riskier asset classes and produce broad-based gains across most asset categories. Meanwhile, late cycle has produced the most mixed performance results of any business cycle phase. Another frequent feature of late cycle has been an overall more limited upside for a diversified portfolio, although returns for most asset categories have, on average, been positive.

Copyright © Fidelity Investments