by Doug Drabik, Raymond James

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

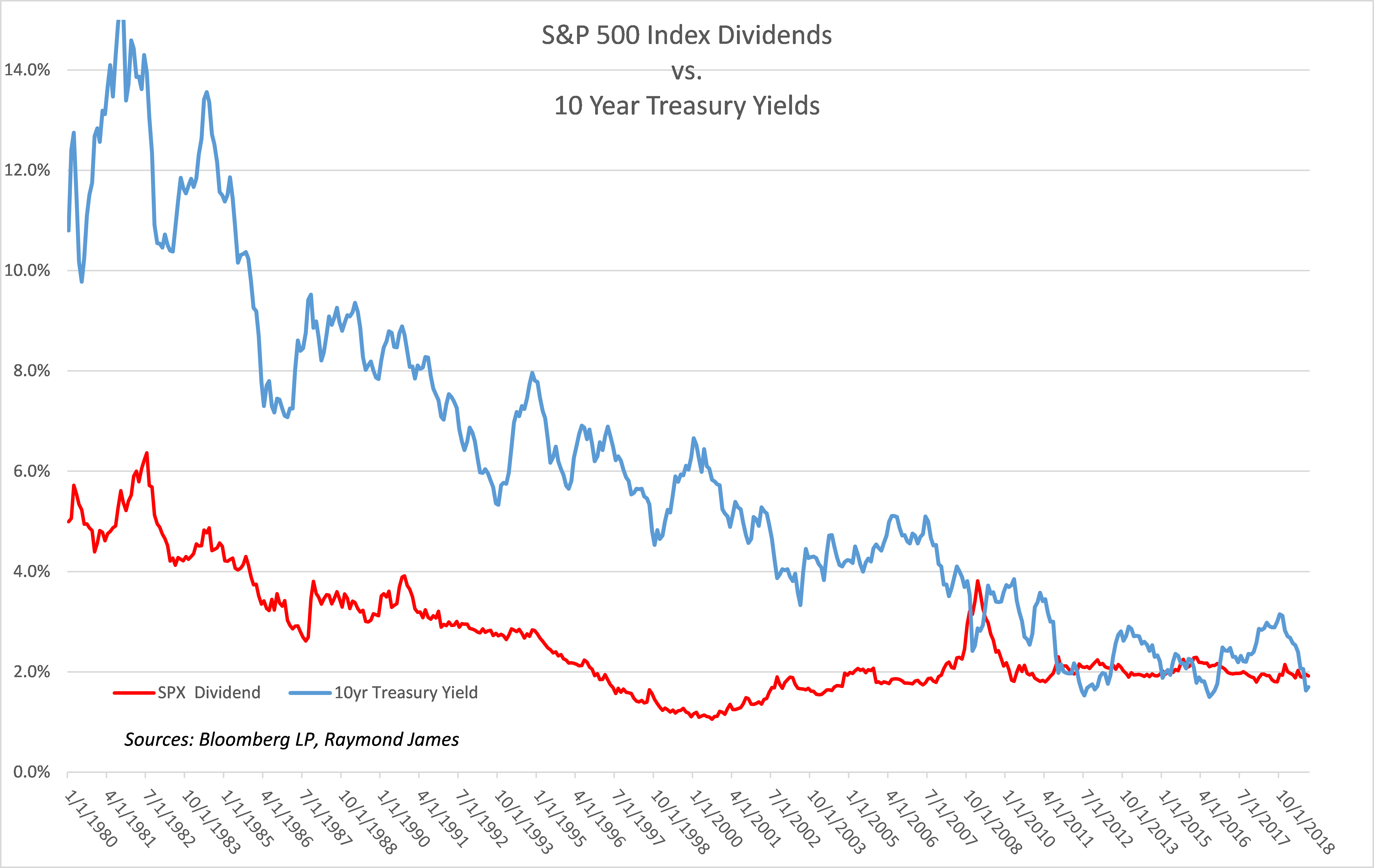

Be careful to embrace dividend paying stocks as part of the portfolio’s fixed income allocation as they are not necessarily good substitutes for that purpose. The graph on the right depicts a comparison of the S&P Dividend Index versus the 10 Year Treasury yield. As they converge, comparisons often emerge. Dividend paying stocks can be valuable holdings as part of the investment portfolio’s growth allocation. Just as with any equity investment, investors anticipate price appreciation, but in addition, can benefit from the dividend income generated. When markets move in the right direction, investors can realize these benefits. However, they do not possess some key characteristics which facilitate the principal protection properties expected of fixed income.

Of great significance, bonds possess a stated maturity. The importance should not be undervalued especially when principal protection is a crucial goal for assets allocated with this intent. A stated maturity allows an investor to hold a bond to its maturity, in essence, negating any interest rate or price moves that occur during the holding period. This powerful bond characteristic, provides purpose for allocating core assets to fixed income.

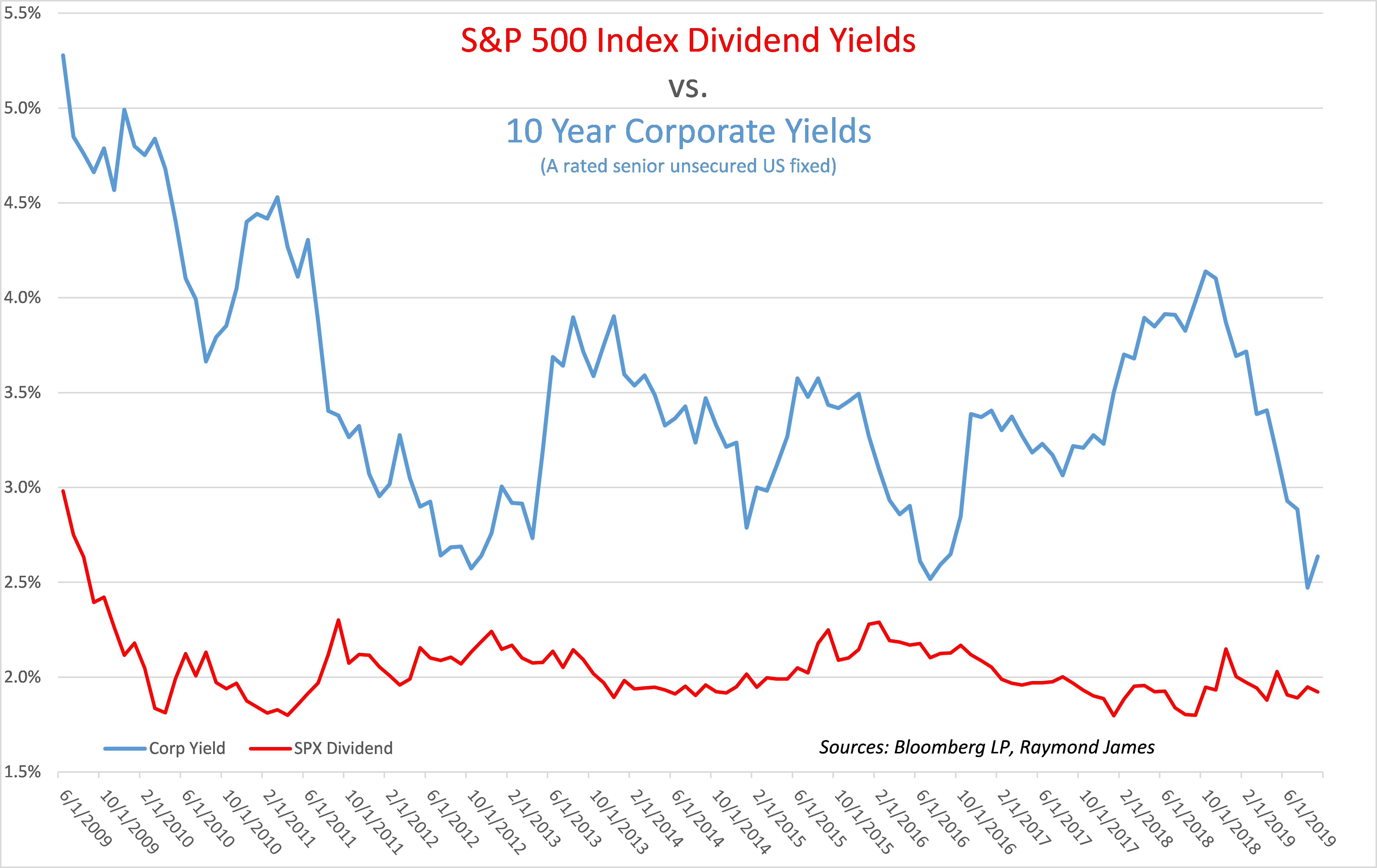

There are additional rationale for avoiding such substitutes. For example, bond coupon payments are not a choice, stock dividends are. Bond payments are mostly fixed, stock dividends can be subjectively adjusted. Also, many fixed income investors hold spread products such as corporate and municipal bonds as opposed to Treasuries. Note the graph to the left which compares corporate bond yields to equity dividend yields. Even if such comparisons must be done (typically for the wrong reasons), contrasting an often employed asset, such as a corporate bond, is undoubtedly more fitting than comparing equities to US Treasuries.

Although dissimilar portfolio purposes should prevent such comparisons, the occurrence of publications, absent distinguishing goals, warrants a reminder that each portfolio allocation is important and serves a very different purpose. Know what you own and why you own it!

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James