by Brian Levitt, Invesco Canada

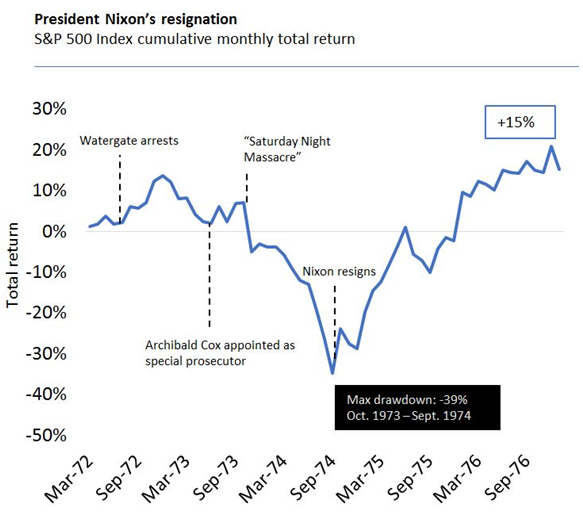

On Saturday evening, Oct. 20, 1973, U.S. President Richard Nixon ordered Attorney General Elliot Richardson, Deputy Attorney General William Ruckelhaus, and Solicitor General Robert Bork to fire independent special prosecutor Archibald Cox, resulting in the resignations of Richardson and Ruckelhaus and the dismissal of Cox. In the month after this so-called “Saturday Night Massacre,” the U.S. equity market, as represented by the S&P 500 Index, fell by more than 10%.1 By the time Nixon resigned almost a year later, U.S. equities had fallen by 26%, and ultimately by 39% at the trough.1

Fast forward to October 2019, when House Democrats have begun to form an impeachment inquiry into President Donald Trump. Investors may read the above paragraph and decide to scale back or eliminate equity positions and sit this one out. After all, markets don’t like uncertainty, and this latest scandal could be with us for some time. The good news, however, is that political surprises and machinations have typically produced short-term market implications that prove to be mere blips in the long-term advance of U.S. stocks.

What’s the real story for investors?

I would implore tactically-minded investors to spend more time getting the bigger macro stories right rather than attempting to adjust their portfolios based on Washington intrigue. The big macro story in the 1970s wasn’t the Nixon impeachment; it was instead high and rising inflation. The growth in the Consumer Price Index rose from 3% to 12% between 1973 and 1974.2 Interest rates spiked and the equity multiple that investors were willing to pay for corporate earnings plunged. It wasn’t Watergate that fell the market, it was runaway inflation. For what it’s worth, the cumulative U.S. equity return from the beginning of Nixon’s second term, through his resignation and pardon, to the day President Gerald Ford left office in January 1977, was +15%.1 Not great, but not a disaster.

Now, juxtapose the big macro stories of the early 1970s to those that were in the background during President Bill Clinton’s impeachment in the 1990s. In this instance, inflation was benign (remember The Great Moderation?), the U.S. Federal Reserve was easing monetary policy, and investors were paying fancy equity multiples for potential future growth. Yes, the market declined peak to trough by 21% in the days following Clinton admitting that he “misled people” and Monica Lewinsky agreeing to cooperate with the independent counsel. Nonetheless, the market had more than recovered by the time the U.S. House of Representatives impeached Clinton. The cumulative market advance during Clinton’s second term was +82%.1

I’d argue that the current environment more closely resembles the mid- to late-1990s than the early 1970s; although I’d note that unlike in the 1990s, investor enthusiasm for stocks is currently not yet irrational, in my view, nor are stocks expensive compared to bonds.

Stocks rebounded after Nixon’s resignation and Clinton’s impeachment

Looking past the headlines

For longer-term investors, I believe it is most important to have a plan and stick with it. If you invested $100,000 in the S&P 500 Index on the Friday before the Saturday Night Massacre, it would have been worth $66,000 by the end of 1974.3 By the time Clinton was impeached, it would have been worth $2.6 million.3 Today, $10.4 million.3

As Bill Clinton famously said, “Follow the trend lines, not the headlines.” The headlines will always be troubling, as long as human beings are attracted to negative news, and I have no doubt that more negative headlines will be coming our way in the days ahead. Fortunately, history shows us that the trend lines tend to get better. Simply consider the vast improvements in the quality of life between 1973 and today for most inhabitants of Planet Earth. In my view, history tells us that equity markets ultimately reflect that improving condition rather than remain mired in the negativity of our headlines.

This post was first published at the official blog of Invesco Canada.