October will be a telling month for Brexit, the eurozone economy and the U.S.-China trade war.

By Carl R. Tannenbaum, Ryan James Boyle. Vaibhav Tandon and Brian Liebovich, Northern Trust

Summary

- Game of Thrones

Gaining power is one thing, but exercising power is another. American President Donald Trump and British Prime Minister Boris Johnson are both dealing with economic and political stress that has dominated recent headlines. How they fare on both fronts in coming months will have important implications for the current expansion.

The rules of engagement in the U.S.-China trade war are continually changing, keeping investors guessing about the future course of global commerce. We expect the U.S. tariffs against China to escalate as threatened, risking a spill-over of tensions to other arenas. October will be a telling month for Brexit, and the eurozone continues to contend with a very sluggish manufacturing sector. Japan has increased its consumption tax, but has taken steps to reduce the risk of a recession.

The ongoing uncertainties will continue to weigh on economic prospects throughout 2020. To respond, major central banks have delivered accommodative policy. Following are our views on the world’s major economic blocks.

United States

- The Federal Open Market Committee lowered the federal funds rate by 0.25% at its September meeting. The dot plot in the quarterly Summary of Economic Projections revealed a board with no interest in a prolonged cutting cycle. In the press conference following the meeting, Fed Chair Jerome Powell gave no indication of the Fed’s next step, reverting to guidance that decisions will be “data dependent.” With valid arguments both to hold and to cut, we expect the Fed to hold rates steady absent any further economic deterioration.

- Sluggish business investment remains the greatest risk to U.S. economic growth. Burdened by trade battles, the manufacturing purchasing managers’ index (PMI) fell to 47.8 in September, indicating contraction. (The PMI for services still shows expansion.) The final estimate of second-quarter gross domestic product (GDP) showed business fixed investment falling by 1% on an annualized basis. At worst, this could signal the start of layoffs and contraction that would impair consumer spending; more optimistically, healthy consumer demand may help heavier industries bounce back.

Eurozone

- Bad news continues to pile up for the region. Incoming data suggests a weak end to the third quarter, with PMIs declining further in September. The eurozone, particularly Germany and Italy, needs a fiscal boost. However, despite growing risks of recession, German politicians are divided over whether to abandon their commitments to balanced budgets.

- European Central Bank President Mario Draghi solidified his legacy by announcing a host of easing measures at his penultimate meeting last month. Though the decision was in line with consensus, the pre- and post-meeting remarks from policymakers revealed a significant internal divide. With monetary policy losing potency, expansionary fiscal policy will be essential for Europe to avoid a regional downturn.

United Kingdom

- Chances of a no-deal Brexit on October 31 have diminished but not vanished. Parliament took control of the process in early September and did its best to take this outcome off the table. With no progress toward a new Brexit deal and elections improbable before October 31, Prime Minister Boris Johnson is expected to begrudgingly seek a Brexit extension to early next year from the European Union.

- The British economy is becoming increasingly fragile, leading to an increased likelihood of a technical recession in the third quarter. Despite the softer momentum, the Bank of England (BoE) stands as the odd one out among major central banks as it looks for a “gradual and limited” path of interest rate increases. A delayed Brexit will likely keep the BoE on the sidelines.

Japan

- After a four-year delay, Japan finally raised its consumption tax from 8% to 10% on most goods and services. The tax increase carries the risk of causing a recession, but in our base case, large mitigating measures by the government will keep recession at bay. Inflation is expected to get a much-needed, but temporary, boost. The central bank left its monetary policy unchanged but hinted at the possibility of easing in October. We expect it to maintain its current stance unless the yen appreciates notably.

- Last week, the U.S. and Japan reached a limited bilateral trade agreement, decreasing the likelihood of the U.S. placing tariffs on Japanese autos. Though a positive development, the deal is not much of a gain to the Japanese economy, but is instead the avoidance of a shock.

China

- After a flurry of tariff escalations, it seemed the U.S. and China are looking for ways to reduce tensions ahead of negotiations this month. As a “goodwill” gesture, the U.S. delayed a tariff rate increase, and China moved to increase purchases of American farm products. But amid these tentative steps toward detente, the U.S. administration is reportedly considering steps to limit financial investments between the nations.

- China’s near-term economic outlook remains challenging amid weak prospects for global and domestic demand. Chinese economic growth continues to slow, dragged down by subdued investment activity and a decline in exports. Policymakers are likely to continue to deploy stimulus measures to stabilize growth. Pressure on the yuan will continue until a trade breakthrough brings economic relief.

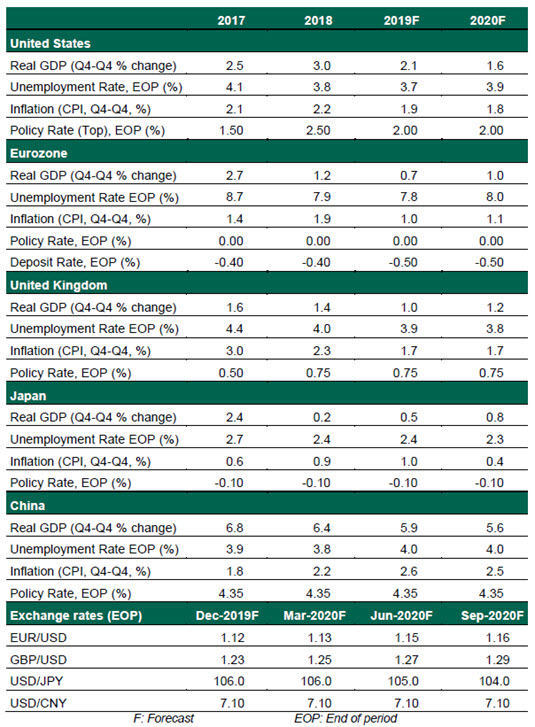

Global Economic Forecast – October 2019