by Monika Carlson, AllianceBernstein

Trade tensions—and the volatility they bring—are forcing investors to think about new ways to generate low-volatility income. We think a mortgage income strategy that balances high-quality securities with historically high-returning ones can help.

When it comes to income-oriented investing, we’ve long advocated a strategy that pairs return-seeking credit assets—high-yield corporate bonds, emerging-market debt and so on—with high-quality government bonds. This approach has historically reduced volatility and limited drawdowns, making it especially valuable late in the credit cycle.

But investors can do even more to reduce volatility sparked by geopolitical risk by adding mortgage strategies to their asset allocation. Why?

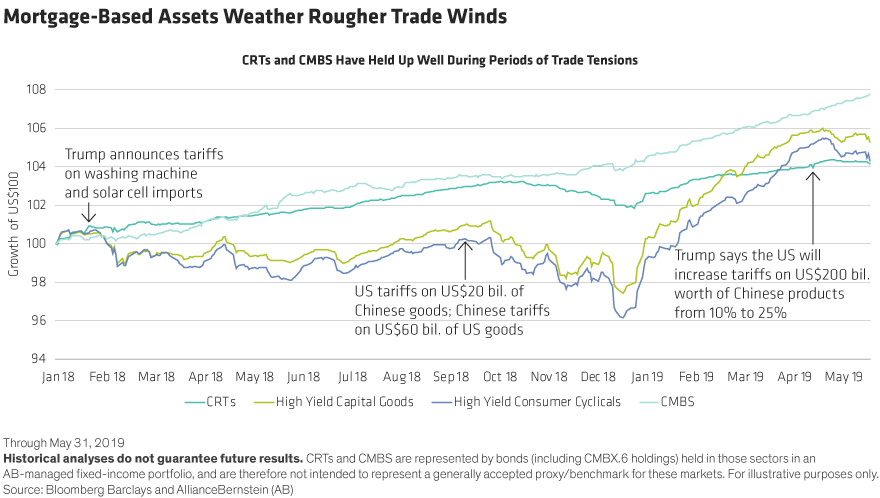

Because mortgage-backed securities are more resilient than high-yield credit to geopolitical risk. Consider the higher-yielding assets on the return-seeking side of the mortgage strategy, such as commercial mortgage-backed securities (CMBS) and credit risk–transfer (CRT) securities—a kind of bundled residential mortgage debt. As Display 1 shows, both have weathered the ups and downs of the US-China trade war better than high-yield credit.

Over the long run, complementary allocations to credit- and mortgage-focused income strategies may help smooth the returns of the overall mix, as the two have tended to outperform at different times.

US Housing Still Strong

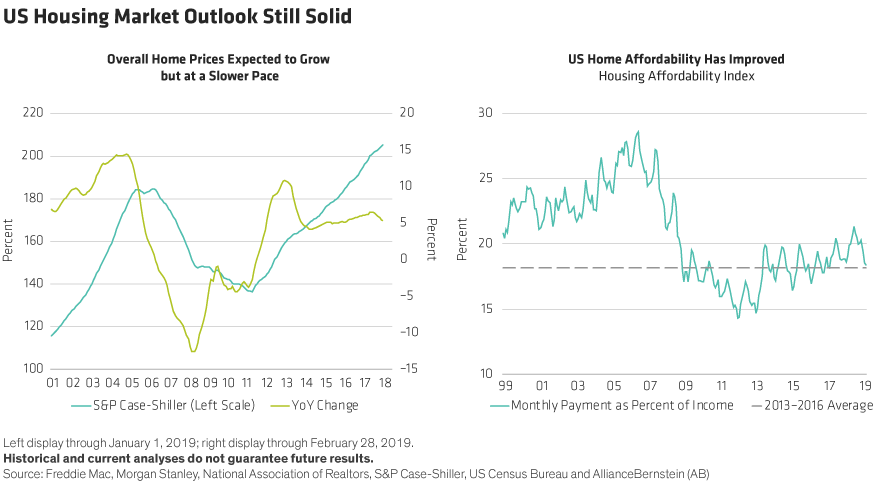

Here’s another reason to consider adding mortgage exposure: US home affordability has improved lately in most US regions and US consumer spending remains healthy. While we expect US economic growth to slow, we’re not forecasting a contraction. And lower interest rates should bring down mortgage rates. We expect US home prices to rise in the coming months, albeit at a slower pace (Display 2).

As a result, we still see opportunity in CRTs, issued by US government-sponsored enterprises Fannie Mae and Freddie Mac. These assets pool thousands of mortgages into single securities that provide investors with regular payments based on the underlying loans’ performance. Unlike typical agency bonds, CRTs don’t carry a government guarantee, so investors may absorb losses if large numbers of loans default. Even so, high borrower credit quality makes CRTs attractive; many have been upgraded to investment-grade status.

CMBS are also attractive and offer a healthy yield pickup over similarly rated corporate bonds. Investor worries about CMBS—particularly those backed by shopping malls—have driven down prices, making many attractive opportunities for investors who can do their homework. But it’s important to be selective because credit fundamentals have deteriorated for securities issued after 2014.

On the higher-quality side of the scale, investors may want to consider higher-quality CMBS, highly-rated collateralized loan obligations, agency mortgage-backed securities from Fannie and Freddie, which carry a government guarantee of principal, and select exposure to consumer-oriented consumer asset-backed securities (auto and consumer loans).

Complementary Income and a Smoother Ride

Much like a traditional credit-based income approach, the manager of a mortgage income strategy can adjust the balance between high-quality assets and higher-yielding ones as valuations and conditions change.

Just as important, securitized assets have exhibited a low correlation with government debt, which plays a key role on the risk-reducing side of the traditional credit income strategy. They’re also relatively uncorrelated to credit and equities, making them a powerful portfolio diversifier.

The way we see it, pairing credit- and mortgage-focused income strategies in a single portfolio can help generate decent income and reduce drawdowns.

The global outlook is increasingly uncertain, and with no end in sight to the US-China trade war, we expect high volatility to persist as we head into 2020. For income-oriented investors, that scenario will require some creative thinking. A “satellite” allocation to mortgages may help investors cushion a more traditional income allocation that leans heavily on high-yield bonds.

Monika Carlson is Product Director—Global Fixed Income Business Development at AllianceBernstein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post was first published at the official blog of AllianceBernstein..