by Jeffrey Saut, Chief Investment Strategist, Saut Strategy

Zebras have the same problem as institutional portfolio managers. First, both seek profits. For portfolio managers, above average performance; for zebras, fresh grass. Secondly, both dislike risk. Portfolio managers can get fired; zebras can get eaten by lions. Third, both move in herds. They look alike, think alike and stick close together. If you are a zebra, and live in a herd, the key decision you must make is where to stand in relation to the rest of the herd. When you think that conditions are safe, the outside of the herd is the best, for there the grass is fresh, while the middle see only grass which is half-eaten or trampled down. The aggressive zebras, on the outside of the herd, eat much better. On the other hand – or other hoof – there comes a time when lions approach. The outside zebras end up as lion lunch, and the skinny zebras in the middle of the pack may eat less well but they are still alive.

. . . Acorn Fund’s founder, and portfolio manager, Ralph Wanger

We recalled Ralph Wagner’s quote (Acorn Fund) while reading this quip from The Hartford Fund’s Dr. Elesa Zehndorfer article titled “Hardwired to Herd.” She writes:

Legendary investor and CEO of The Baupost Group Seth Klarman once reflected on the powerful evolutionary pull of herding when he noted that it is always easiest to run with the herd; at times, it can take a deep reservoir of courage and conviction to stand apart from it. And he was right. In fact, many legendary investors out there – George Soros, Jim Chanos, Carl Icahn – have all made billions of dollars resisting the urge to run with the herd, instead relying on hard data to make exceptional returns. George Soros once made a $1 billion in just 1 day on September 17th, 1992, shorting the British pound. Chanos, as CEO of Kynikos Associates, made $500 million shorting Enron after concluding that the company was operating fraudulently. At the time, Enron couldn’t have been a more lauded or idolized success story, so by shorting Enron stock, Chanos’s move was hugely contrarian.

She goes on to note:

One of the reasons that Seth Klarman talks about the role of courage is because our brains literally register a kind of neural discomfort when we try to stand apart from the herd. That discomfort might not be something that we consciously acknowledge, but it nevertheless represents a powerful driver of our decisions, leading us to unconsciously opt for a herding-based investing decision. A recent study found, for example, that when people did buck the consensus, brain scans found intense firing in the amygdala and that people go along with the herd not because you want to, but because it hurts not to.

We saw many “outside zebras” gorging themselves on stocks in late-2007 as the D-J Industrial Average (DJIA) made a new all-time high and then registered a Dow Theory “sell signal” in November 2007. Subsequently, those outside zebras ended up as “lion lunch” when the senior index shed an eye-popping 48% over the

ensuing 16 months. By March of 2009 many of those outside zebras had moved to the inside of the herd just in time to miss the bottom (we were very bullish). Since those lows more and more zebras ventured back toward the “outside” of the herd driven by performance pressures. I have repeatedly commented that given the immense amount of cash still on the sidelines, as the equity markets continue to rally, the performance pressure, subsequent bonus pressures, and ultimately job pressure become just too great, causing portfolio managers to “pay up” for stocks. And that, ladies and gentlemen, is why the corrections have been relatively short since the November 2012 “lows.” As the Jeremy Grantham writes:

In markets, where investors hand over their money to professionals, the major inefficiency becomes career risk. Everyone’s ultimate job description becomes “keep your job.” Career risk-reduction takes precedence over maximizing the client’s (portfolio) return. Efficient career-risk management means never being wrong on your own; so herding, perhaps for different reasons, also characterizes professional investing. Herding produces momentum in prices, pushing them further away from their fair value as people buy because others are buying.

There were a lot of outside zebras when our short-term proprietary model flashed a “sell signal” in early October 2018. However, after the nearly 20% decline into late-December 2018 most of those zebras had become inside zebras just in time to miss our model’s flip to a “buy signal.” Again, as some of those zebras ventured back out to the “outside” into late-July 2019 our model flashed another “sell signal” and they became lion lunch again punctuated by the nearly 7% decline into what we deemed to be THE LOW of August 5, 2019 at ~2822 basis the S&P 500 (SPX/2978.71). Since then all our models have remained constructive. A discussion of our models would be instructive here.

We have four models: 1) the long-term model; 2) the intermediate model; and 3) the short-term model. Those models tend to tell us the direction of the equity markets for the appropriate time period. The long- term model turned positive in October 2008 and has never turned negative since. Obviously, the other two flip more often than that. Additionally, we have an “internal energy” model that tells us how much energy is built up, or not built up, in the equity markets. It tells us that if there is a lot of internal energy it suggests that if a “move” begins there is enough energy to make it a decent move. It does not, however, tell us in

which direction that energy will be released.

Fast forward. Coming into last week our three directional models were constructive, but the energy model was “looking” for a negative energy blast and we wrote about it. Last Tuesday that looked like a good call

when the Dow Dove over 200-points. However, the next day our energy model did not know the President’s tweets would reverse that “dive” with news of resumed Chinese trade talks. Subsequently, we issued this Trading Flash:

The fact that the equity markets are rallying in the face of this week’s negative “energy blast” is highly bullish. The S&P 500 has traveled above the 2940-2950 overhead resistance level often mentioned in these missives (its 6th attempt) and is probing the next resistance level of 2960 – 2970. Less discomforting world tensions seem to be the driver along with this morning’s better than expected economic reports and renewed Chinese trade talk rumors. Our sense is after the opening “upside pop” stocks will stall awaiting tomorrow’s employment report.

And “park” they did into Friday’s employment report, which was worse that the surface figures suggest. Still, most of the indices managed to extend higher despite the extreme short-term overbought condition of the

equity markets. Surprisingly, last Thursday’s Dow Wow (+373) failed to qualify as a 90% Upside Day with only 77% of the total volume traded coming in on the upside. Still, at least by our pencil, there have been three 90% Downside Days since the “selling climax” low of August 5, 2019 and two 90% Upside Days. Argumentum ad nauseam, that is the way bottoms are made!

In the way of a follow up, we featured Zymeworks (ZYME/$29.08) in the low $20 a few months ago suggesting ZYME may have found one of the “magic bullets” for cancer. We bough more last week around $25.75 after Citi raised its price target to $49 per share. Another featured stock was Inphi (IPHI/$63.10) when it was in the low $40s. We continue to like both names. Another name that was given to us by stock picking genius Amy Zhang, who manages Alger Small Cap Focus Fund (AOFAX/$21.51; we own her fund), at around $30 is Avalara (AVLR/$81.10). Last week Raymond James picked up research coverage with a $100 price target. Here too, we continue to like this name.

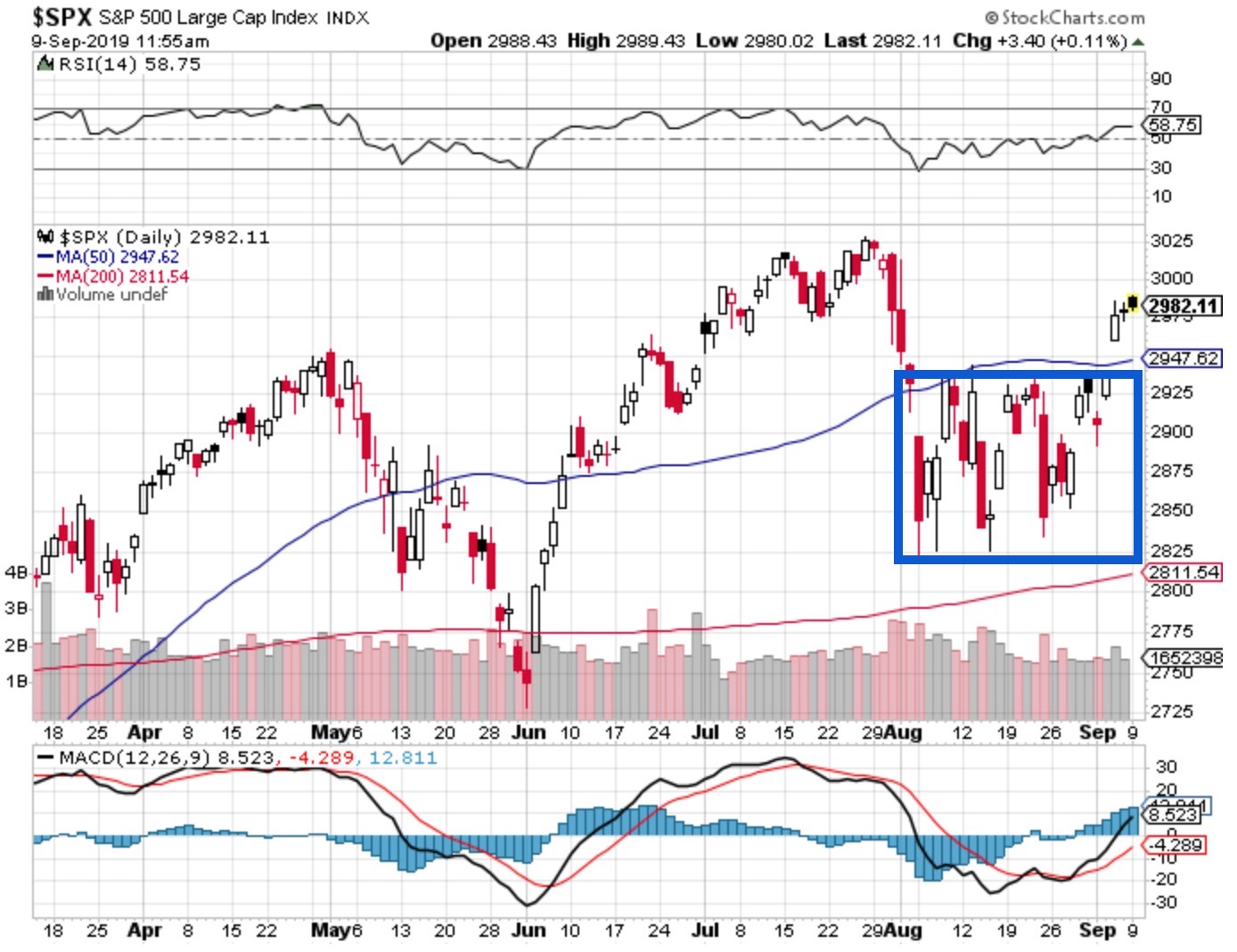

The call for this week: Last week the SPX broke out of the rectangle chart pattern it has been stuck in since August 5, 2019 (see chart). Many pundits averred that rectangle was a topping chart formation that would lead to a stock market crash. We were not one of those negative nabobs. Indeed, such bullish action in the face of last week’s negative energy blast is highly bullish despite the short-term overbought condition of the equity markets. Once this condition is worked off the SPX should see new all-time highs. As our pal Leon Tuey writes:

A question for the bears: Given the well-known "problems" such as the trade dispute, the inverted yield curve, Brexit, Argentina, Hong Kong riots and the widely predicted "recession" and "bear market," why isn't the market crashing? Why are the Advance-Decline Lines hitting record highs?

The S&P 500 Index had an Inside Day in the charts on Friday (The SPX experienced daily price ranges within the previous session’s high-low range). Therefore, short-term trading types will be sensitive to last Friday’s intraday print high of (2985.03) and the low (2972.51). Traders should want to use the Monday upward bias and the hope that Draghi will announce QE and a rate cut on Thursday to push the S&P 500 Index above 3000. This morning we are getting some upside follow through to last week’s breakout with the preopening ESUs better by 14-points.

Chart 1

Source: Stockcharts.com