by Larry Adam, CIO, Raymond James

Key Takeaways

- Info Tech has been the MVP among equity sectors

- U.S. equities outperformed international markets

- Rope-a-Dope Tariff Tiff continues

In two weeks, ESPN will celebrate its fortieth anniversary. Its flagship program, SportsCenter, provides the scores, highlights and important news of the day from the sports world in one concise hour. Rather than watching play-by-play for every game, every sport and every level (e.g., college vs. professional), a sports enthusiast can quickly be brought up to speed.

[backc url='https://sendy.advisoranalyst.com/w/2CbO3sXqwUF8u2dyl69Y5Q/763n6KPErrIdSKvj9ggLLKKQ/3r1wwwm7YluTyJizKIJL763Q']That is exactly what we like to do in our Weekly Headings, provide you with timely market updates—with information that may impact your portfolio—without you having to endure the daily market noise that can be overly frustrating. One of the signature segments of the show is called ‘Top 10 Plays of the Day’ so with Labor Day approaching, below we borrow this theme to articulate what we believe were the ‘Top 10 Plays of the Summer’ for investors. For the ‘Not-So Top 10 Plays of the Summer,’ please follow @LarryAdamRJ on Twitter.

- #10: Gold Medal Moment | Summer heat accompanied heightened volatility, and gold prices benefited as investors sought to diversify in a negative-yielding environment. Since Memorial Day, gold has rallied over 18%, notching its best 3-month return since April 2016.

- #9: Advantage Point - Housing Market | With Treasury yields declining (the 30-year Treasury yield fell below 2% for the first time ever), the 30-year fixed mortgage rate (at 3.9%) fell to its lowest level since November 2016. Low yields should continue to ‘court’ homebuyers as the MBA Mortgage Applications Index rose to its highest level since 2012.

- #8: Budget Deal Avoids Hazards | The bipartisan budget deal was hit down the fairway in July, avoiding a ‘rough’ period for the markets as it sidestepped the threat of debt default, $225 billion of sequestration spending cuts, and a potential government shutdown. The two-year agreement came earlier than expected and should provide a slight boost to the economy given its ~$100 billion of net stimulus over the 2020 and 2021 fiscal years.

- #7: Tech Scores a Touchdown | Since Memorial Day, the Information Technology sector rallied 8.3% and outperformed all other sectors by at least 200 basis points (bps), earning MVP (Most Valuable Player) status from equity investors.

- #6: U.S. Wins the World Cup | Not only did the U.S. Women’s National Soccer Team win the World Cup, U.S. equities ‘won’ the summer as the S&P 500 outpaced international markets by at least 1.9%.

- #5: ‘Ironman’ of Economic Expansions | July marked 121 consecutive months of U.S. economic expansion, the longest streak on record. The strength of the U.S. consumer and the labor market lead us to believe the economy’s marathon run isn’t over just yet and is likely to continue for at least the next twelve months.

- #4: Consumers Run the Court | The U.S. consumer remains the king of court, helping to propel the U.S. economy. From strong retail sales to strong earnings by consumer discretionary companies, it is clear that consumers continue to spend. With job growth remaining solid and elevated consumer confidence, consumer spending should remain a driver of growth.

- #3: Fed Balancing Act | Just like gymnasts on a balance beam, the Federal Reserve (Fed) needs to balance a multitude of factors in determining monetary policy. While the Fed’s performance in July, when they cut the Fed funds rate by 25 bps (the first rate cut since 2008), did not impress the judges (e.g., the markets), we believe the ‘insurance’ cut should support the economy and equity market. Historically, the S&P 500 has rallied ~15% in the 12 months following the initial rate cut.

- #2: Rope-a-Dope Tariff Tiff | The back and forth announcements and counterpunches in the tariff war between the U.S. and China is likely to be ongoing and last a few more ‘rounds.’ While President Trump has promised a ‘knockout’ trade deal that favors U.S. interests, his latest delay of some tariffs targeted toward consumer goods shows a more defensive stance (and helps with holiday shopping!) and is a ‘round won’ for the U.S. consumer.

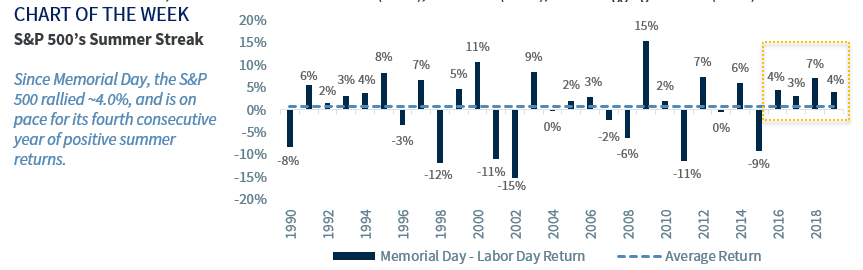

- #1: Summer Months Step Up to the Plate | Since Memorial Day, the S&P 500 has rallied over 4.0% and is on pace to record its fourth consecutive year of positive summer returns, the longest streak over the last 20 years. But the real All-Star has been the fixed income market, where Investment Grade Credit ( 6.7%), Treasuries ( 5.1%), and the Aggregate Index ( 4.7%) all shined.

*****

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James