by Kent Hargis, AllianceBernstein

Rejoice—people around the world are living longer! But pause the festivities—that means they need more retirement money. To ensure they don’t run out of cash, savers need to adjust their investment strategies as their needs change, both before and after retiring.

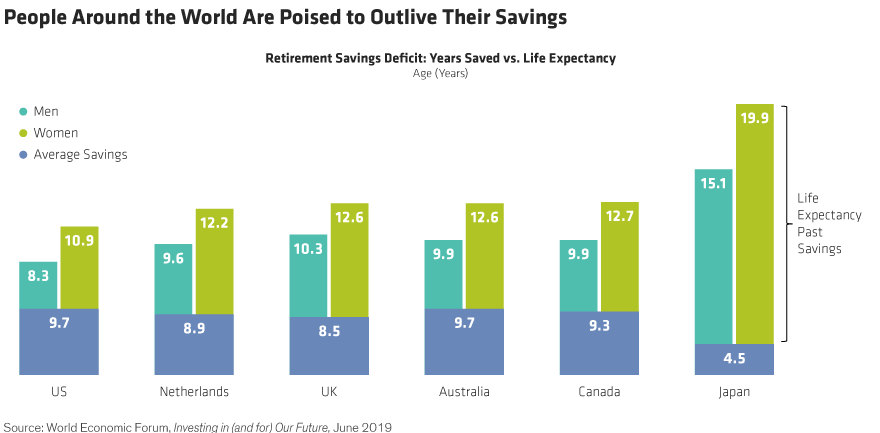

The gap between what people save for retirement and what they need for a longer life is widening. According to a study by the World Economic Forum (WEF), that gap is likely to increase from $70 trillion in 2015 to $400 trillion by 2050 in eight countries—Australia, Canada, China, India, Japan, the Netherlands, the US and the United Kingdom.

In human terms, this means the average Japanese woman will outlive her savings by about 20 years, and the average British woman by nearly 13, the WEF reports. Average American men and women can expect to outlast their retirement funds by eight and 11 years, respectively (Display).

Reducing Risk Too Early

Retirement doctrine dictates that people should invest aggressively when they’re young and more conservatively as they get older. But pumping the brakes too soon is a huge risk. The WEF study, Investing in (and for) Our Future, found that reducing exposure too early to “return-seeking assets,” such as equities, real estate investment trusts (REITs), high-yield debt and emerging-market debt, dramatically reduced retirement savings.

The report modeled outcomes for common default options of defined contribution retirement plans in each country. Those with longer exposure to return-seeking assets built larger nest eggs.

The most extreme example is Japan, where savers invest mostly in defensive assets, including cash, for most of their lives. The top 5% can expect to save only 4.4 times their salary at retirement. In the US, even the bottom 5% of savers can expect to pile up 3.9 times their ending salary by the time they stop working. The difference? The typical US target-date fund invests more than 50% of assets in equities until retirement.

Premature risk aversion needn’t last a lifetime to have consequences. The model portfolios in the US and the Netherlands both start out with about 90% of retirement funds in return-seeking assets. However, typical Dutch retirement plans shift almost entirely into defensive assets between ages 55 and 65, while American plans do not.

Market Volatility Is a Risk to All Preretirement Investors…but for Different Reasons

Unfortunately, human psychology doesn’t make it easy to stay invested in hard times. Research shows that investors fear losing money more than they value making it, which can lead them to flock to defensive assets during market downturns and reallocate to riskier assets only when those assets have become expensive again. The results can be devastating: the annualized returns of the average US stock investor were 50% lower than the average returns of the market over a 25-year period (Display).

Different investors always have different needs. Generally, however, the greatest investment risk faced by investors between the ages of 25 and 45 is that their investments won’t earn an adequate return during their prime working years. Investing heavily in equities and avoiding the temptation to time the market is a key investment priority for most people in this age group. Savers closer to retirement must balance growth risk with the risk of a severe market crash just before retirement, when they may not have time to make up their lost savings—as their focus increasingly shifts from accumulation to decumulation.

Low-volatility equity strategies can smooth returns, helping young savers stay invested during market downturns, and take some market risk off the table for those approaching retirement. Active strategies based on solid fundamental research that choose stable, high-quality companies have a better chance of generating earnings growth even in difficult market environments, in our view. Examples include companies with high barriers to meaningful competition (such as patents or network effects) or pathways to consistent, predictable revenues (such as licensing agreements). We believe combining disciplined quantitative research with fundamental research insights in a stock-picking process can help investors identify quality companies that are reasonably priced.

By investing in companies like these, a low-volatility strategy can aim to participate as much as possible in broad stock market gains while limiting losses when the market falls.

Incorporating Income into the Mix

As retirement approaches and then commences, many investors will need to shift their attention toward generating income and preserving their existing assets. Dynamic multi-asset strategies that balance between equities and income-producing assets are a good way to do that, in our view.

By doing so, an investor can avoid the retirement sin of shunning risk too early, while a strategy that offers a regular distribution replaces some of the lost income retirees face. This is particularly useful at the beginning of retirement, when research shows that spending tends to be heaviest and people’s natural inclination is to live on some of the income produced by their savings rather than to start to diminish their capital value.

We think that multi-asset plans should invest in a wide array of assets, including nontraditional income-producing assets, such as real estate and certain options strategies. Such assets and strategies are less correlated to equity and bond markets, which can lend stability to a portfolio in rocky times.

In the late stages of retirement, preserving capital becomes an investor’s most important objective as there is an increasing tendency to live off not only the income earned from savings but also the invested capital. At that point, allocating almost exclusively to bonds—with special attention to inflation protection—can help savers ensure they don’t run out of funds, in our view.

Stages, Not Ages

Although age is a helpful way of figuring out what strategy might suit an investor best, the choice must ultimately be based on individual needs. For example, someone who inherits a sizable pile of money might shift his or her focus from growing assets to preserving them much earlier than most prior to retirement. But this saver also enjoys the luxury of being able to pursue a more aggressive strategy for longer in retirement because the need to access capital is diminished.

Generally speaking, however, the key to investing effectively for retirement is to stay nimble. This means maintaining an exposure to growth assets for as long as possible, which will involve incorporating strategies that smooth volatility—and calm nervous trigger fingers. At some point, it likely will be important to incorporate income-producing strategies, and later shift focus almost exclusively to asset preservation. Standing still with one strategy may be easier, but actively engaging in retirement savings is increasingly essential to help people meet their spending needs for much longer lives and a prolonged retirement.

Kent Hargis is Co-Chief Investment Officer—Strategic Core Equities at AllianceBernstein (AB)

Sammy Suzuki is Co-Chief Investment Officer—Strategic Core Equities at AllianceBernstein (AB)

Adi Monappa is Managing Director—Multi Asset Solutions at AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

This post was first published at the official blog of AllianceBernstein..