by Harry G. Katica, CFA, Saut Strategy

“No Country For Old Traders”

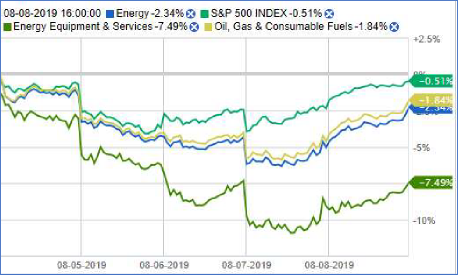

S&P 500 8-8

Source: Finviz

“No Country for Old Men”

In the 2007 thriller set in the West Texas desert, a brutal killer stalks a man who discovered a suitcase filled with cash. With a sinister looking grin, the criminal mows down one character after another, until finally getting the money. Leaving town at the end of the story, his car is hit broadside in a random car accident. The killer limps away.

The image came to me Monday, when the DJIA was down almost 1,000 points. Sellers felt like cold-blooded killers, gashing stocks across the board. It was a brutal sell-off from last Wednesday to Monday, slicing 1,700 points of the Industrials in four days. By the end of the free fall, investors were shell-shocked, and the experts were speechless. Those that did go on TV were not willing to take any chances. It was No Market for Old Men.

My trading account took a beating. Even though I had ample cash and contained the damage to a few positions, there were still a few big losses. Most of my mistakes are still emotionally based. I get down on a stock and get angry at myself. Then I press. Most of my gains come when I am in sync with the market, and as Jeff knows, that can come and go every few weeks. I managed to stay

afloat during the carnage and lived to take some new positions.

Once again, the key was to stay engaged while the poop was hitting the fan. I felt some serious dry heaves while assessing the damage Monday afternoon. It made me sick to my stomach to think of the losses piling up. The fear was thick as a knife, and even Cramer had frayed nerves. Not knowing if the market was headed up or down, I did buy some stocks. If I was too scared to buy stocks with the DJIA down almost 1,000 points, how could I call myself a Contrarian investor?

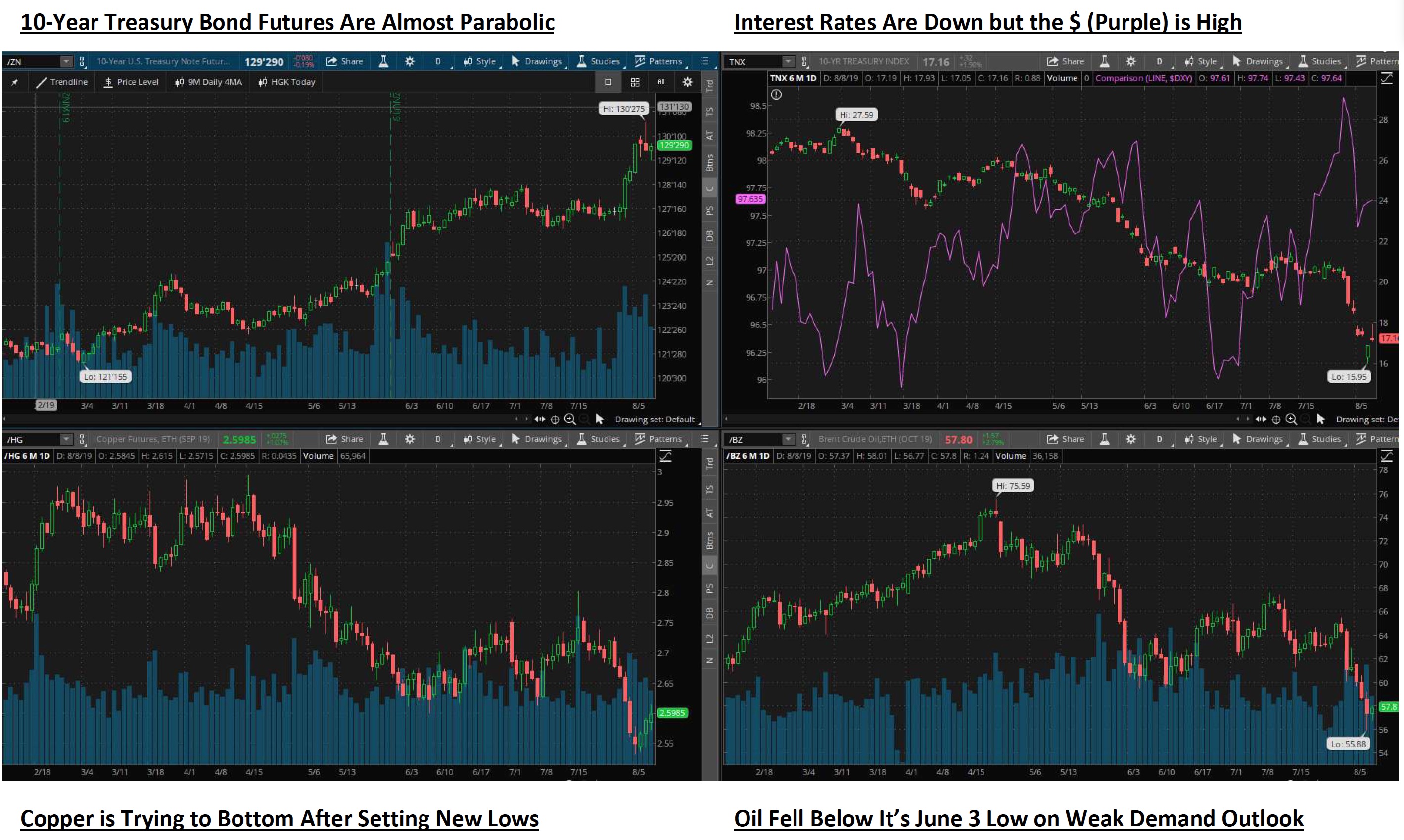

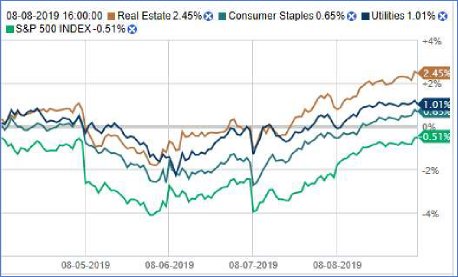

My case rested on the high correlations among the major indexes in the last five days. For most of the prior weeks, there were significant variations in performance from Large Caps to Small Caps, Tech to Staples, Transportation and Utilities. This can be seen in the chart below. But when Fed Chair Powell got the ball rolling last Wednesday, everything went down pretty much in unison. It felt like capitulation, at least in the short-term. Those are the times someone in power whispers to the market. I’ve got your back. I don’t know who said what to whom this week, but the stock market breathed another sigh of relief.

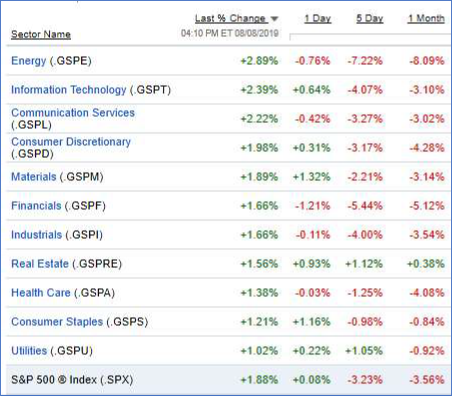

Sector Spotlight

Sector Rotation also experienced another full swing during the past week. Exception for Real Estate, every sector was down for the last month and week. This condition reflected a quick buildup of intense sell pressure and an absence of real buying. No surprise for the first week of August. Add in an off-balance Fed, a few tweets, and a currency devaluation to scare investors.

By Thursday, all sectors participated to the upside. It’s a good sign that investors now believe a synchronized coordination is one the way, regardless of the tariff situation. That confidence should restore investor’s risk appetite going forward. Stocks can continue that early cycle consumer recovery that was getting started. I wouldn’t expect a huge turn in global economy, however. Modest growth, with a monetary tailwind should be enough to sail markets into fall.

Utilities always mark the start of my weekly sector analysis. The sector is a barometer for interest rates, and an uptrend in the stocks usually signals favorable monetary conditions. What we don’t want is for the group to vacillate from best one day to worst the next. It shows a lack of direction to investors, and it can create false technical breakouts. The Utility ETF (XLU) bounced between $59 and $61 since early June. It still has not confirmed the dramatic fall in interest rates reflected in the bond market. Maybe that means that yields are lower than they should be in the US. Keep that in mind if global demand ever does stabilize.

Consumer Staples joined the other defensive sectors at the bottom of the rankings for Thursday. While the group did manage a 4% bounce off the Monday low, it did lag other sectors, just like it’s supposed to. For too many weeks, the defensives were up when cyclicals were down, and vice versa. Stocks have a better chance of sustaining new highs when all are participating.

Real Estate may need a little rest after rallying 4.5% since Monday and making new 52-week highs. Like Utilities, the sector has been trading in a wide range since early June, zigging when economic numbers are weak, and zagging when they are strong. When paired with Financials, Real Estate offers an attractive hedge against rates, since the two are normally negatively correlated. This is almost an essential strategy to take. Otherwise investors could be frustrated by volatile interest rates.

Source: Fidelity

Financials are fighting through the gravitational pull of low interest rates and an inverted yield curve. While it may be inevitable for the Fed to lower short-term rates and participate in the global stimulus, the Banks have yet to receive anything more than temporary relief. It’s too early to tell if the recent 10-20 basis point uptick in the last two days is going to be sustained.

My guess is that rates will continue to fluctuate. While no bold prediction, it’s hard to see how global growth picks up much until after Brexit. I prefer to invest in this sector paired up with a REIT or Utility. It is a sound way to build a portfolio, and reduce the volatility associated with moves in interest rates.

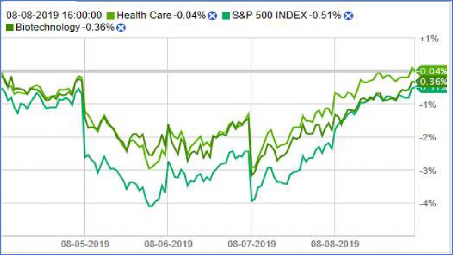

Health Care has struggled in recent weeks, as the administration contemplates new regulations, and the presidential candidates fight over who can give away the most free stuff. While it’s hard to imagine much of a change in rhetoric until after the election, many Biotech, Pharmaceutical, Medical Equipment, and Life Sciences stocks are trading at attractive valuations. For the first time in a while, AMGN and BIIB have come to life. These stocks must participate in order to drive the Biotech group. Some of my favorites are VAR, A, PKI, and LLY.

- Biotech was a mixed bag (SRPT, AGIO, REGN, ABBV, JNJ, NKTR, ALXN, TECH). BIIB and AMGN acting much better.

-

Life Sciences (TECH, PKI, ILMN, WAT, A, QGEN, )

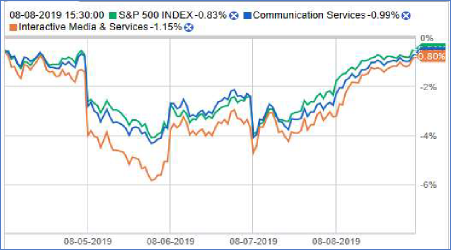

Communication Services got a lift this week as several of its beleaguered leaders struggled after earnings. Both GOOG and FB continue to face a regulatory challenge that could slow growth. NFLX and DIS still face costly investments and significant competition in the entertainment space. Some new names came across my screen this week – SBGI, SPOT, and WWE. They represent domestic growth plays.

Helping out the Sector are the misplaced wireless providers, VZ and T, that might be able to benefit from lower rates and less competition. If you maintain a large cap income portfolio and don’t have a full weighting, this is a good time to top off. I also like TDS, another wireless operator.

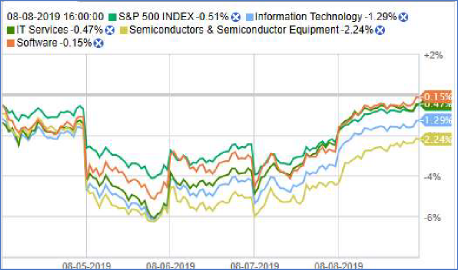

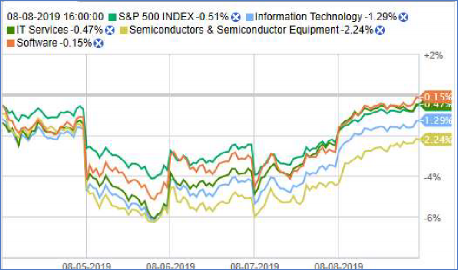

Information Technology was down an astonishing 9%+ from last Thursday to late Monday. Since then, it rallied 5%. This performance is an example of how quickly markets can adjust to new information. Slowing global growth and less trade equates to lower earnings and stock prices one week. The next, coordinated stimulus benefits all cyclical stocks. When market was controlled by humans, it would be unthinkable that information could travel so fast and stocks could adjust instantly in changes to the global macro. I guess its just a sign of the times.

For the first time in a while, I like some hardware names. CSCO is an innocent bystander to the Huawei saga, but it reminds me how important communications infrastructure will be to the world and internet of the future with 5G. DELL stands to benefit from a rebound in computer sales. It is still well off its May highs. CTXS may be ready for a turnaround.

Consumer Discretionary stocks recovered this week from a 10% correction that started in early July. The sector received an extra shot of adrenaline in early July, when expectations for a 50-basis point rate cut got the best of investors. AMZN, which represents almost 25% of the sector weighting, fell by about the same amount as the group. Q2 results were mild disappointing to the street. However, with the rate cut train picking up steam again, investors can return to the early cycle consumer playbook. Valuations can rise in advance of a visible pickup in sales. That story could get us through the next few months, when Q3 results start in mid-October.

Homebuilders have been one of the more interesting industry groups for the last 18 months. While business performance is lackluster, the stocks are very sensitive to interest rates, mortgage applications, and re-financing activity. As result, its key stocks (LEN, TOL, DHI) have almost acted like Utilities. It is a good sign for them to be rallying though. It means the other consumer- oriented sectors can become more optimistic as well. That should be good for Retailers and Apparel stocks. While managements are already complaining about the impact on retail sales, me thinks there could be a silver lining. Currency fluctuations give astute retail buyers extra room to play with their margins, especially if Chinese suppliers help on costs.

Transportation stocks (the 12th sector) had choppier going this week than other cyclical sectors. At first, FDX took the group down on trade war fears, and its discontinuation of business with AMZN. The performance improved Wednesday and Thursday when it became more apparent that there is going to be another easing cycle. Air Freight, Rails, and Truckers will be able to ride the stimulus up, without having to show improved results for a while. R has been a laggard in the group. It gained momentum on Thursday. CSX and KSU have pulled back considerably from recent highs. With railroad shipment still lackluster, these stocks could see a change in psychology if the economy looks to improve.

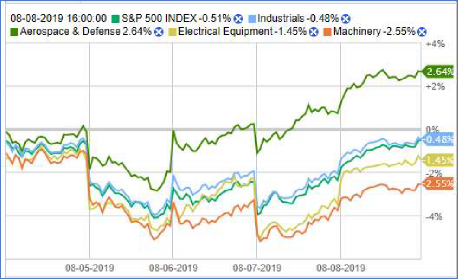

Industrials finally got a lift from BA whose low valuation must have caught investor’s attention. 737 problems be damned, stocks don’t need earnings anymore. BA looks like it could drag the sector higher tomorrow. The recent federal budget keeps the gravy train going for defense stocks. TXT is one way to play.

Machinery stocks were among those hit the worst last week, as the trade war truly upsets their opportunities in China. CAT was the biggest hot potato. It looks ready to follow BA higher.

Materials has showed improved performance on the strength of DD & DOW. Both fell on Q2 results, yet they have surged on the expectation of global easing. If there is a stiffening of trade concerns, it’s hard to see one in this sector. Interesting names in the Chemical sector are a plus (LYB, ESI, IFF).

Energy went from worst to first again this week, topping the performance ranking Thursday with a 2.9% gain. The gain came after higher than expected crude inventories hit the group Wednesday and a 10% in the swoon since last Thursday.

Crude prices are extremely sensitive to growth expectations going forward. Investors are concerned about sluggish demand due to the trade war. Excess production, particularly in West Texas, has also rattled investors. At some point, these two forces could join up and result in a much more stable outlook. Another big acquisition or two in the Permian might further smooth out production. For that reason, HES and OXY still makes sense right here.

Source: Fidelity Online