by Jeffrey Saut, Chief Investment Strategist, Saut Strategy

So, readers of these missives probably know that we have been out of the country for a while. First was a week in Montreal seeing portfolio managers (PMs) and presenting at a lunch. Then off to Berlin for a few days to do the same before driving to Warnemunde, Germany to board the Crystal Cruise ship “Serenity” and speak at Steve Forbes’ “Cruise for Investors.”

Now we don’t know what the economists in NYC are looking at, but the restaurants in Berlin and the subsequent ports were full of people as were the streets. So, Germany may be in economic trouble, but it sure didn’t look that way to us. As a sidebar, it was hotter in Europe than it was in Florida, but I digress.

In one of the Forbes’ sessions I was on a panel along with such notables as Gary Shilling Ph.D., John Buckingham (captain of The Prudent Speculator founded by our deceased friend Al Frank), Marilyn Cohen (Envision Capital Management), well you get the idea. In that panel discussion John Buckingham made many of the points we have lived by over the decades. First, the successful investor needs to have patience.

As we have opined, “The rarest commodity on Wall Street is PATIENCE.” In today’s world there seems to be a need “to do something” because the markets are doing something. In reality, you do not need to do something. As Warren Buffett said, “I made most of my money by just sitting.” Indeed, sometimes me sits and thinks and sometimes me just sits!

John’s second point was about dividends. Dividends are a huge contributor to the total return for portfolios. Since 1926 the S&P 500 (SPX/2932.05) has returned roughly 10.4% per year. Five percent of that return came from earnings growth.

Nine tenths of it came from Price Earnings multiple expansion (PE), but a large part of that return (4.5%) came from the compounding of dividends. His third point was about managing risk. For me this is the single most important tenet for the successful investor. In Benjamin Graham’s seminal book, The Intelligent Investor, Graham tells us:

The essence of portfolio management is the management of RISKS not the management of RETURNS. All good portfolio management begins and ends with this premise.

Or as my father use to say, “If you manage the downside in a portfolio and avoid the big loss, the upside takes care of itself!”

We got off the ship last Monday and spent a few days in Amsterdam because we had not been there in 7 years. On Wednesday we taxied to Schiphol Airport for the flight back to the U.S. The flight was uneventful, the best kind, but as we approached Boston’s Logan Airport our captain told us the airport was closed due to high winds and we would have to “circle” for 1.5 to 2 hours.

We finally got into the terminal and went to the Delta Sky Club only to find our 7:06 p.m. flight to Tampa had been delayed to 8:30 p.m. Subsequently, it was delayed to 9:30, 10:30, 11:30, and then 12:30 a.m.

That would have put us back at our Saint Petersburg house around 4:30 a.m. just in time for me to go to the studio to appear on CNBC. That just wasn’t going to work, so I canceled CNBC, called my friends the Regency Grand Hyatt and booked two nights . . . verily, “trapped” in one of my favorite cities.

Last week many traders, not investors, became “trapped” in the equity markets as most of the major averages had their worst week of the year. I wish we could say we called the downturn, but all we thought would happen was a mild pullback. As written in our report dated 7-29-19: We have used the target price of 3200 pretty much all this year and have not had to raise said target price, at least not yet.

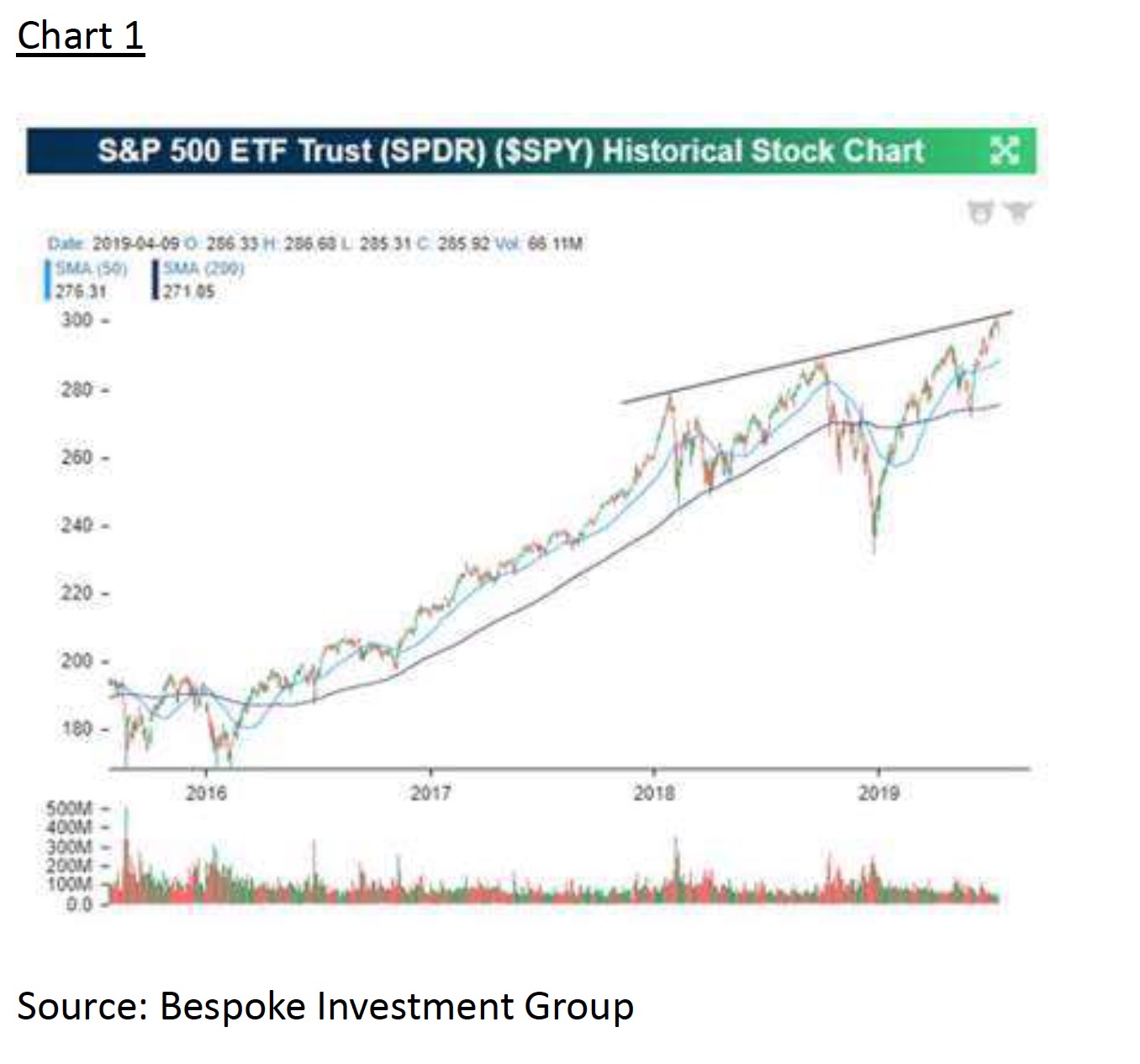

While it is true the SPX has run into another potential overhead resistance zone (see chart 1), as Leon Tuey notes, “Buy the dips.” As a reminder, our firm, Capital Wealth Planning’s CEO (Kevin Simpson) and I are doing a system wide conference call on August 1, 2019 at 4:15 p.m.

That call was well attended and emphasized many of the investment points John Buckingham made on the cruise (patience, dividends, and managing risk), all of which are the investment tenets of Capital Wealth Planning.

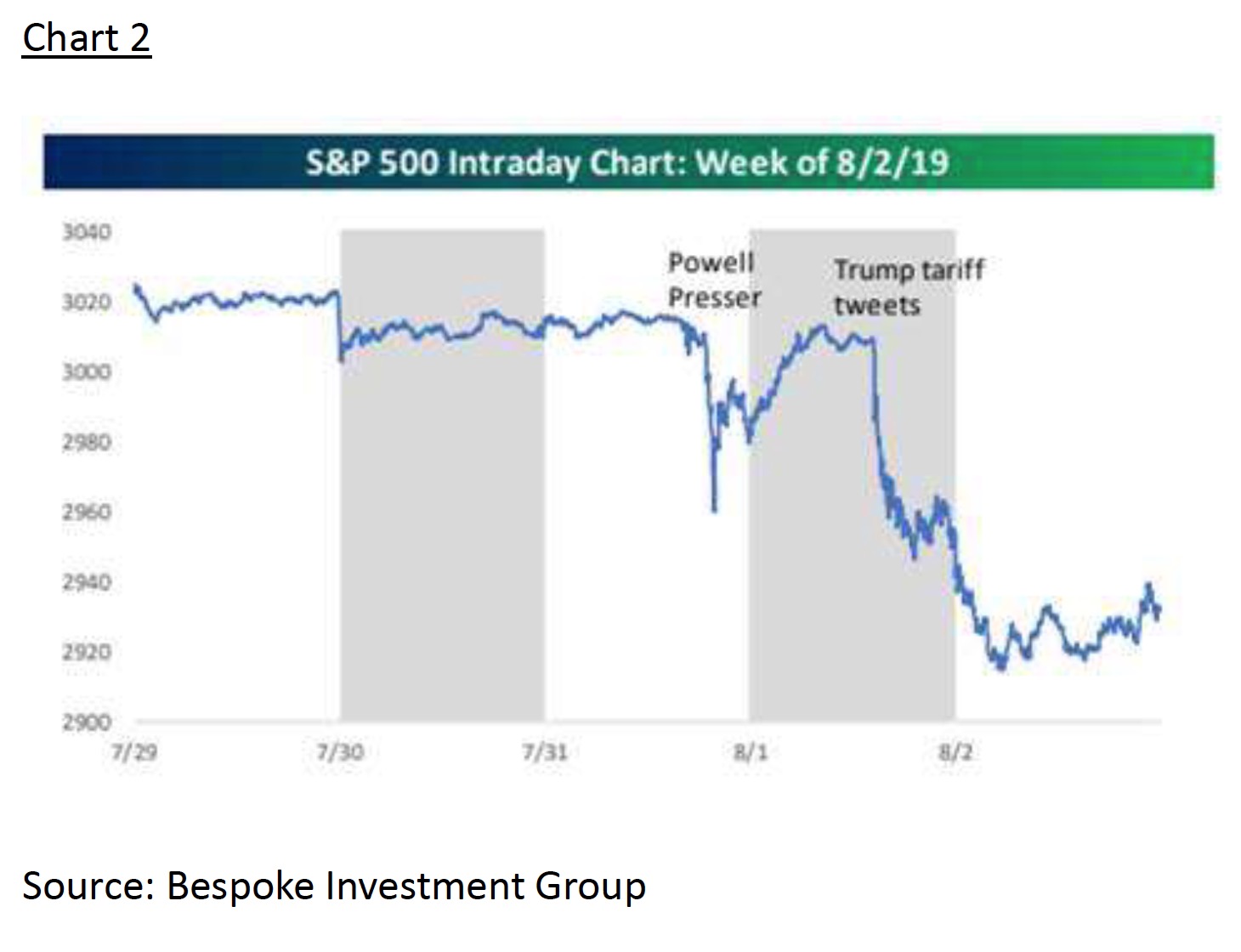

Obviously, we did not anticipate Jay Powell’s hint that it was one rate hike and done, although he seemed to walk that back after the Dow fell over 300-points. Nor did we anticipate the tariff hike on more Chinese goods with a threat that tariffs could be raised to more than 25% (chart 2).

For whatever reason the SPX fell from last Monday’s intraday high of ~3025 into Friday’s intraday low of ~2914 for a 3.7% loss. In last Thursday’s 4:15 p.m. conference call I mentioned that news typically only has a short-term impact on markets and Friday’s late comeback may just prove that.

But, as often stated “never on a Friday;” meaning when stocks are into a downside skein they typically do not bottom on a Friday. The result of the Weekly Wilt is that the SPX knifed below our envisioned 2940 – 2960 support level to close last Friday at ~2932. The next support level is at 2870 – 2900 with a point and figure short-term trading target of 2870.

Quite frankly we do not think that target will be touched, but if last Friday’s intraday low is violated (~2914) that target zone becomes a real possibility. That said, our energy models are still positively configured, as are our intermediate/long-term timing models. However, the short-term model has become “squirrelly.”

Speaking to what many Wall Street pundits have termed a “punk” earnings season, as of Friday 64.8% of reporting companies have beaten the bottom-line earnings estimates, while 57.8% have bettered revenues estimates. The Healthcare Sector has shown the best “beat rate” followed by Technology and Financials (chart 3). The recent economic reports have not been as fortunate.

Last week 20 of the economic release came in weaker than the estimates and 11 were reported as stronger than the estimates. The biggest economic shocker of the week was the Chicago PMI of manufacturing that came in at 44.4 for a big miss and the weakest reading since December 2015.

Meanwhile, despite all the talk about a weaker U.S. Dollar, the Dollar Index (DXY/97.85) traded out to an all-time high (chart 4). Sticking with the best perform sector (Healthcare), some stocks for your potential “buy lists” include: Tandem Diabetes (TNDM/$65.26), HMS Holding (HMSY/$39.13), Amerisource Bergen (ABC/$90.44), and Humana (HUM/$293.93).

The call for this week: When the markets can gyrate wildly on Fed Foils and Presidential tweets the near-term market wiggles are tough to figure. While we attempt to forecast such wiggles, we are much better on the intermediate/long-term direction of the markets. Remember, “Long-term planning is not about making long-term decisions, it is about understanding the future consequences of today’s decisions.”

We were bearish on the Dow Theory “sell signal” of September 23, 1999, bullish on the DT “buy signal” of June 2003, and bearish on the DT “sell signal” of 11-21-2007. Moreover, we “called” the bottom on March 6, 2009. Actually, we turned bullish on October 10, 2008 when 92.6% of stocks traded made new annual lows.

In 55 years of observing markets, we have NEVER seen such a downside capitulation as October 2008; and, we have believed we are in the biggest secular bull market of my lifetime! This morning Chinese Foreign Ministry spokeswoman Hau Chunving said, “China will not accept any kind of extreme exertion of pressure, intimidation or blackmail. Neither will China give in an inch on major issues of principle.

Now it's time for Washington to show sincerity and demonstrate to the world that the US is still a reliable partner that can carry out negotiations.” And with that the renminbi is at decade lows versus most currencies. Such action has the preopening S&P 500 futures off some 40-points . . . Good Grief!

Investing/trading involves substantial risk. The author and Saut Strategy do not guarantee or otherwise promise as to any results that may be obtained from using this report. Past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence, including carefully reviewing any prospectus and other public filings of the issuer. These commentaries, analyses, opinions, and recommendations represent the personal and subjective views of the author, and are subject to change at any time without notice. The information provided in this report is obtained from sources which the author believes to be reliable.