by Noelle Corum, Invesco Canada

The U.S. Federal Reserve (Fed) cut rates by 0.25% for the first time in over a decade,1 a move largely expected by the market. Heading into the July Federal Open Market Committee (FOMC) meeting, much of the debate was around whether or not the Fed would deliver 25 or 50 basis points. However, we were focused on the statement and Fed Chairman Jerome Powell’s press conference for further insight on future policy. Future policy, or the Fed’s reaction function, is particularly important as we navigate in an environment where we believe market pricing indicates more cuts than our economic outlook would imply.2

Below, we lay out a framework for thinking about possible outcomes for rate cuts and markets. The Fed appears to be following a new reaction function centered on average inflation targeting. This framework would allow the Fed to move inflation toward its mandated target of 2%, and even allow it to fluctuate above 2%, as long as inflation averages 2% over a given business cycle. The market has already tested the Fed; as inflation headed lower in early 2019, bond markets began pricing rate cuts.3

What happened at the July meeting?

Wednesday’s Fed statement was balanced, noting solid job gains and consumption but soft business investment and lackluster inflation. It further reiterated the FOMC is monitoring the economic outlook and will act as appropriate to extend the current expansion.

In his press conference, Powell called this rate cut a mid-cycle adjustment to combat current risks to the economic outlook, rather than the start of a cutting cycle. He stated three main threats to the outlook that the Fed has been monitoring since the start of the year and now justify a rate cut: weakening global growth, trade policy developments and inflation running below target.

What can we expect in the months that follow?

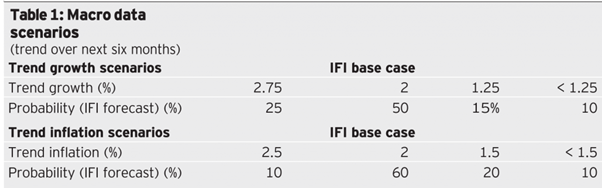

In our view, the outcome from this meeting further ratifies our expectation that the Fed is moving toward a framework which monitors inflation more closely, despite a solid labor market. Further, Powell made it clear that risks to U.S. growth via the manufacturing sector and trade developments are being monitored as well. So what now? What should we expect in the ensuing months? How might the macro data evolve, and what would different macroeconomic outcomes mean for Fed policy and markets? Below, we lay out four scenarios for trend growth and inflation over a six-month horizon and their projected probabilities. We also provide a framework for projecting the Fed’s reaction based on its framework, and implications for risk asset performance.

Macro scenarios and Fed reaction function

Table 1 highlights our base case: 2% trend growth and 2% trend inflation over the next six months.

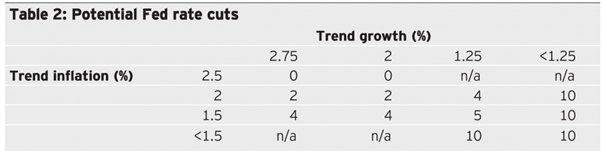

Our base case scenario implies two Fed rate cuts in total, or one more in 2019, as shown in Table 2. This compares to the market’s current pricing of four cuts in total, or three more over the next year. According to our model, annual trend growth below 1.25% or inflation below 1.5% would imply a much larger number (10) of cuts. Boxes marked n/a represent rare scenarios that we believe are unlikely to occur in the near term.

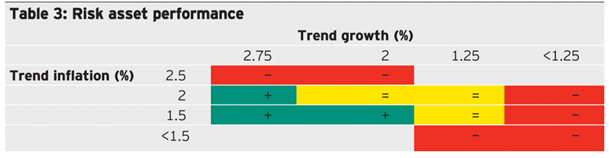

What do these scenarios imply for asset performance? In Table 3, we forecast asset performance using our macro factor analysis framework. In the top left of Table 3, tighter financial conditions may cause risk assets to underperform. In the bottom right, low growth would likely cause risk assets to underperform. Our base case scenario (2% trend growth and inflation), suggests neutral performance of risk assets in the near term. However, if growth falls sharply (below 1.25%), or if inflation rises sharply (2.5%), we would expect risk assets to perform poorly.

Conclusion

In our base case of 2% trend growth and inflation, we believe credit investors can expect to collect coupons but price returns will likely be limited. In other words, if growth and inflation do not “break out” higher or lower, the Fed should remain responsive for the majority of 2019, but not cut aggressively. The red boxes in Table 3 represent scenarios in which the market perceives the Fed to be behind in its policy action. This would likely add volatility to markets as the probability of a policy error begins to increase. We do not see evidence in the underlying data to make a strong case for these scenarios, but we continue to monitor these risks closely.

This post was first published at the official blog of Invesco Canada.