by Jeffrey Saut, Saut Strategy

"Ich bin ein Berliner" (German pronunciation: [...ç .b.n .a.n b....li.n.], "I am a Berliner") is a well-known quote from a speech by United States President John F. Kennedy given on June 26, 1963, in West Berlin. It is widely regarded as the best-known speech of the Cold War and the most famous anti-communist speech. . . . Wikipedia

I have been to Berlin before but have never seen “The Wall” until last week. I remember President Kennedy’s speech on June 26, 1963 and had a hard time grasping “Man’s inhumanity to man!” Having now seen it, I am even more remorseful of that era. At dinner that night I broke bread with some portfolio managers from Vienna where somehow the conversation turned to Austrian-born Peter Drucker.

Peter Drucker was a writer, consultant, and teacher who was deemed the father of modern management theory. His groundbreaking work turned management theory into a serious discipline, and he influenced or created nearly every facet of its application. He coined such terms as the “knowledge worker,” which plays to the intangible capital theme often discussed in these missives. A bòn mót he once related was:

“The most enduring lesson I’ve ever learned came from an old janitor at New York University, which had completed a new magnificent graduate-school building that had no windows on the first nine stories. We moved in; and, you know there’s always a short, brutal heat wave in New York at the end of April. The temperature went from 80 to 90 to 100; and everybody, the women included, stripped down to the barest essentials. It continued to get hotter and my patience wore out! I went down to hunt-up the janitor and scream at him. Way down in the third basement I found an old toothless man and yelled at him, ‘Can’t you read a thermometer?’ He looked back at me and said, ‘Mister, if I could read a thermometer what would I be doing as a janitor?!’”

Indeed, the janitor’s job was to watch the calendar because in New York you heated the building until May 15 and then you turned on the air conditioner. The janitor merely followed the orders he had been given – no questions asked! In the stock market many mavens also follow the calendar . . . you simply play the summer rally long; then around Labor Day, you sell because of the “look out for October” history-haunts. They read the calendar, not the temperature, of the markets. Unfortunately, many investors failed to participate in this summer’s rally. Indeed, the late-October to the late-December of 2018 decline, and the May to June swoon of 2019, left many investors too timid to buy. We identified those trading tops, and subsequent trading bottoms, albeit those were just tactical wiggles in an ongoing secular bull market that has years left to run.

For example, many professional investors did not believe the June 3 low was the daily, and intermediate, term cycle-low, which launched this year’s summer rally (we issued a Trading Flash that morning stating that this is a bottom on June 3}. Now the pros are faced with performance anxiety as the end of the third quarter looms. Yet investors are still skeptical, voicing concerns about Euroquake, a slowing China, our dysfunctional government, etc. I have addressed most of these concerns in prior missives. Nevertheless, the single most reoccurring “knock” I have heard since the bull market began is that the volume has been extremely low by historical standards. In theory that “knock” makes sense, but followers of said theory have missed out on one of the strongest Bull Run in the history of the S&P 500. We think the rally extends.

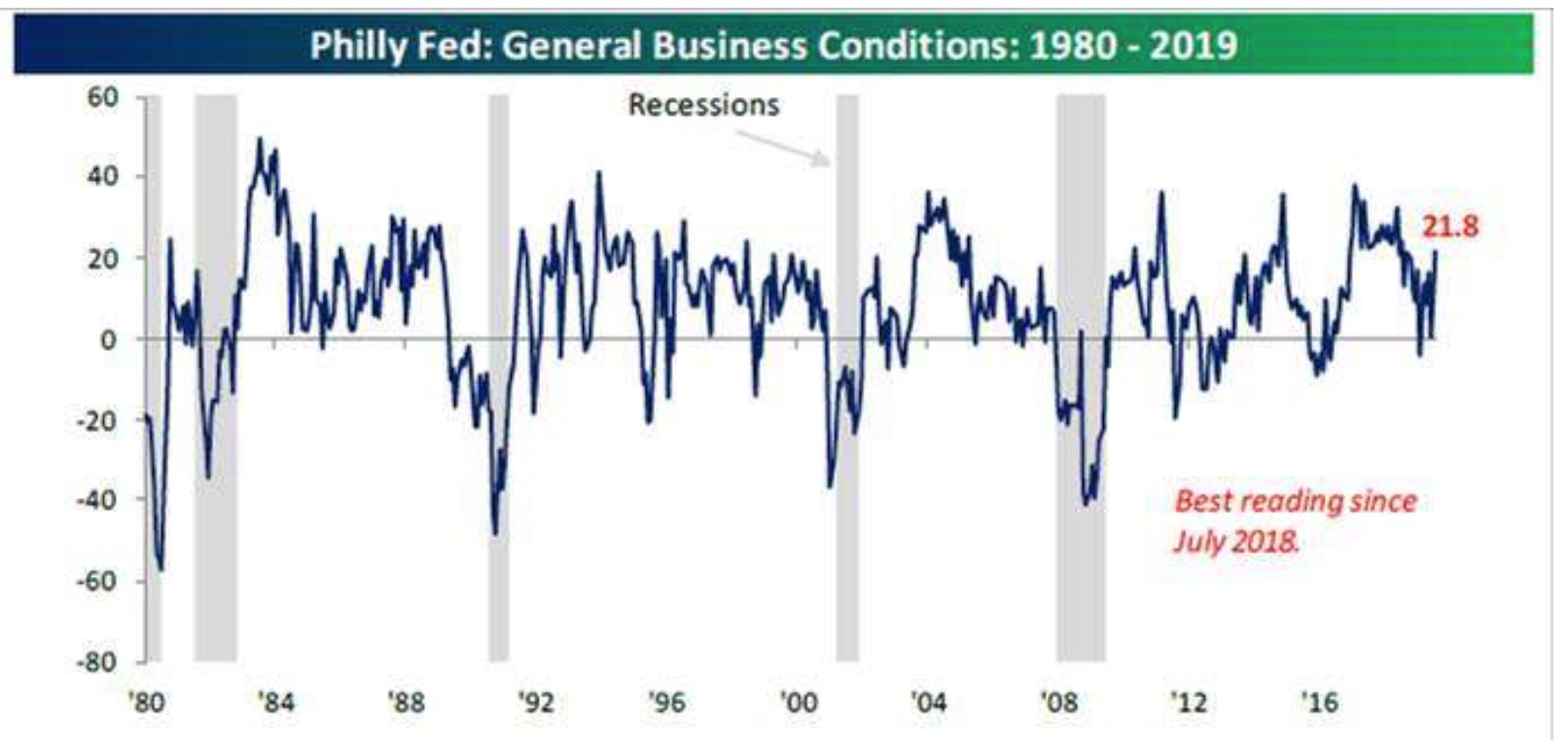

Last week there were mixed economic messages, but of note is that the Philly Fed: General Business Conditions Report surged to its highest reading since July 2018 (chart 1). This is consistent with our view that the economy will reaccelerate. Yet, the highlight of the week was the Muller testimony. The astute Bill King had this to say about said testimony:

First: Mueller came across as hesitant, uncertain and ill-prepared. He seemed unfamiliar with his own report, which led to some gross inconsistencies in his testimony. Couple this with his unusual request to have his deputy counsel along for backup and suddenly there was a very real perception that Mueller was not fully in command and control of the special counsel effort. This was amplified by his efforts to heavily redact himself . . .

Second: Mueller was given a mandate to conduct a counterintelligence investigation based on that which the FBI started. He instead decided on his own, according to his testimony, to conduct a criminal investigation. He did this even though the memo authorizing the special counsel provided no justification for a criminal investigation of the Trump campaign or the president. In other words, he started a criminal investigation for which there was no predication. We don’t do that in this country — or, at least, we didn’t until now . . .

This week the focus will be on the FOMC meeting and if the Fed will cut interest rates. I have said for over a month according to the data sets I look at there is no real reason to cut interest rates. That said, it appears, however, there will be a cut because the Fed is now not just looking at employment and inflation. They seem to also be focused on China trade, Iran, the dysfunctional U.S. government and other moving parts. Clearly this is not your father’s Fed.

Speaking to the equity markets, our pal Leon Tuey writes:

What a market! Last week, the following hit record highs: VTI, $WLSH, $DJUSFN, SPXEW, SPX, $NAUD (Cumulative), the A-D Lines for NDX, MID, & SPX. Also, note the bullish breakouts by: $DJW, XLF, $XBD (see GS), $NYA, & $MID. Yet, investors are leery and fearful, (see chart 2). The market will continue to climb the "wall of worry". Should the market correct, buy the dips!

As for the alleged collapse in earnings, of the companies that have reported 70% of them have beaten earnings estimates, while 56.5% have bettered revenue estimates (McDonald’s reports its biggest increase in sales in seven years). Hereto, this is consistent with our view that participants have lowered earnings expectations way too far. We continue the believe earnings will surprise on the upside and the negative nabobs will be forced to “pay up” for stocks as the secular bull market extends. In our presentation, and subsequent panel discussion, on Steve Forbes’ Cruise for Investors, one particularly savvy portfolio manager stated their favorite group was medical devices. While that group is not our favorite, it is certainly high on our list (chart 3).

The call for this week: We are still out of the country writing this missive from Amsterdam. Accordingly, over the past few weeks on Steve Forbes’ “Cruise for Investors” we have not paid as much attention to the various markets as we usually do. It has, however, been amusing to watch Wall Street’s strategists scramble to raise their respective year end price targets for the S&P 500 (SPX/3025.86) now that the SPX is 85 to 185 points above their previous targets. While we do not like to set such price target often stating the SPX will be higher, or lower, at year’s end, we have in past missives stated that if the earnings estimate for this year is correct (~$168) our work suggests 19x that number is the correct price earnings multiple yielding a year end price target of roughly 3200. We have used that target price of 3200 pretty much all this year and have not have to raise said target price, at least not yet. While it is true the SPX has run into another potential overhead resistance zone (chart 4), as Leon Tuey notes, “Buy the dips.”

As a reminder, our firm, Capital Wealth Planning’s CEO (Kevin Simpson) and I are doing a system wide conference call on August 1, 2019 at 4:15 p.m. You can register for the call here:

https://zoom.us/meeting/register/ca54d622af7f42d07c24e00bf0acd2b8

Chart 1

Source: Bespoke Investment Group

Chart 2

Why the Fed could be setting stocks up for a painful drop

MORE FROM CNBC

Recession threat is rising as earnings roll over, market bear David Rosenberg warns

Source: CNBC

Chart 3

Source: Bespoke Investment Group

Source: Bespoke Investment Group

Chart 4

Source Bespoke Investment Group

Investing/trading involves substantial risk. The author and Saut Strategy do not guarantee or otherwise promise as to any results that may be obtained from using this report. Past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence, including carefully reviewing any prospectus and other public filings of the issuer. These commentaries, analyses, opinions, and recommendations represent the personal and subjective views of the author, and are subject to change at any time without notice. The information provided in this report is obtained from sources which the author believes to be reliable.

Copyright © Saut Strategy