by Matt Brill, Invesco Canada

As yields across the globe plummet, many investors are now actually paying someone to take their money. Currently, there are more than US$12 trillion of bonds with negative yields outstanding which equal 24% of the global bond market.1 In Europe, the search for positive yield is especially challenging. Over half (51%) of the European bond market now yields a negative rate.1 Germany recently issued €5 billion of bunds at a price of €101.5, but these will only return €100 in two years with zero coupons paid.2 And according to Reuters, Austria is also rumoured to be planning to issue a 100-year bond at roughly 1% to feed yield-hungry investors.

The U.S. is currently the largest contributor of global fixed income yield

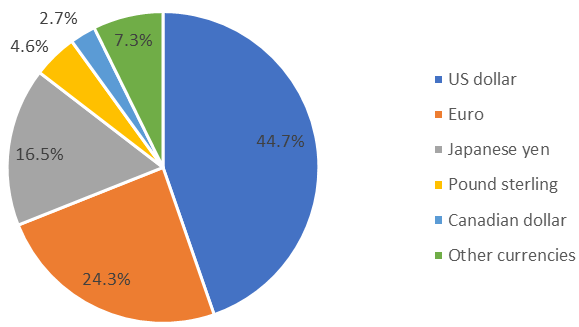

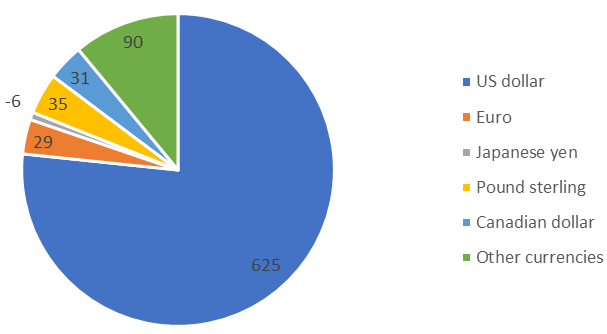

While Europe and Japan account for 40.8% of the global bond market by market value, they generate only 2.8% of the income (figures 1 and 2).1 So where can yield-starved European and Asian investors find positive yields? Emerging markets like South Korea, China, Thailand and Indonesia have been positive yielding and account for 6.1% of global income generated from bonds.1 Developed but smaller debt markets such as the U.K. and Canada account for 8.1% of global income. The biggest source of yield is the United States, which contributes 77.9% of the globe’s fixed income yield on only 44.7% of the debt.1

Figure 1

Bloomberg Barclays Global Aggregate Index – Market value by currency

Source: Bloomberg L.P., data as of June 28, 2019.

Figure 2

Bloomberg Barclays Global Aggregate Index – Yield generated by currency ($ billions)

Source: Bloomberg L.P., data as of June 28, 2019.

As the European Central Bank considers rate cuts and additional bond purchases, Europe’s negative yield problem may only get worse. Potential interest rate cuts by the central banks of England, Australia, and Canada could compound the problem. To top it off, fixed income traders expect (per the CME FedWatch Tool) the U.S. Federal Reserve to cut interest rates by 25 to 50 basis points at its July meeting.

Summary

At Invesco Fixed Income, our view is the global search for yield will continue to lead fixed income investors to the U.S. We see high-quality U.S. corporate bonds as “the only game in town,” and believe these issues should continue to benefit from ongoing downward pressure on sovereign bond yields. This “quality trade” is likely to persist in the coming months, and as negative-yielding global bonds raise interest in the U.S. market, we expect investment grade corporates to test 2016 lows.3

This post was first published at the official blog of Invesco Canada