by Liz Ann Sonders, Brad Sorensen, Jeffrey Kleintop, Charles Schwab and Company

Key Points

- U.S. stock indexes reached new highs but we are concerned that the potential good news is already mostly reflected, while the potential bad news is being largely ignored.

- Earnings season started with reduced expectations, leading to the possibility of upside surprises. Meanwhile, the Fed seems likely to cut rates, but the impact may be diminished, while recent economic data shows reason for concern.

- Earnings, especially for financial companies, could differ between the United States and international regions due to diverging global central bank actions.

“Remember that not getting what you want is sometimes a wonderful stroke of luck.”

― Dalai Lama

New records

U.S. stock indexes recently moved to new record highs; however, they are only slightly above January 2018 levels. Investors have been buoyed by the belief that the Federal Reserve will start cutting rates later this month, while also receiving a tailwind from the perceived ratcheting down of trade tensions with China. Rather than climbing the proverbial “wall of worry” the recent move seems to be more of the riding the escalator of optimism. Investor sentiment has reached the extreme optimism zone—a contrarian indicator—according to the Ned Davis Research Crowd Sentiment Poll, suggesting some caution is warranted in the near term. We are also concerned that investors seem to be ignoring some budding risks. There is the potential that the Fed doesn’t deliver the number of cuts the market is currently expecting over the remainder of the year, with fed funds futures currently pricing in a greater than 50% chance of three cuts by the end of the year. We are also skeptical about the actual impact a rate cut may have. As Chairman Powell noted many times in his testimony before Congress, today’s economic “uncertainty” is due largely to trade; it is not a function of rates being too high. As such, we’re skeptical that lower rates are the elixir to what ails the economy—at least not enough to offset the trade-related uncertainty.

Are lower rates really going to help?

While the meeting between China and the United States at the recent G20 summit resulted in a temporary cooling of tensions, the meeting did nothing to reduce the currently imposed tariffs. Both sides have indicated there is still much hard work remaining to complete for a deal; while there was no deadline announced. It’s difficult to envision a reigniting of corporate animal spirits absent a trade deal, which suggests recent weakness in business capital spending is likely to persist. Adding to the trade-related uncertainty, the United States is also at loggerheads with the Eurozone and India; while passage of the USMCA remains bogged down.

Manufacturing recession?

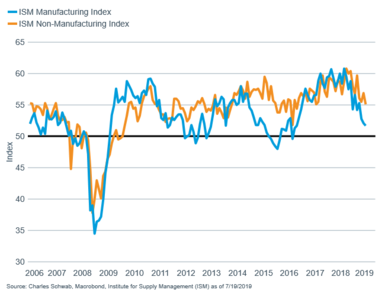

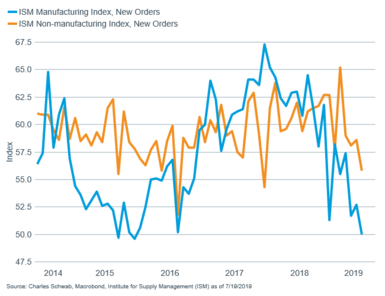

U.S. manufacturing has weakened this year, especially new orders; approaching levels typically associated with recessions. For now, relative strength in services is a positive offset, but if manufacturing continues to weaken—following weak global manufacturing trends, it would likely bleed into services. Both Institute of Supply Management (ISM) surveys have fallen, but the levels for the service side of the ledger remain quite a bit higher than the manufacturing side.

Both indexes have fallen, but manufacturing looks to be in worse shape

The forward-looking new order components tell a similar story

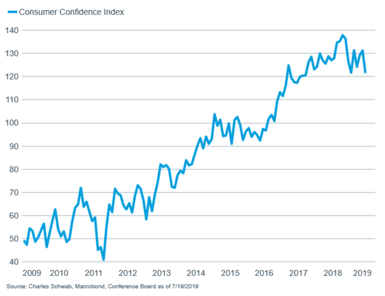

We’ve also seen trade uncertainty impact small business confidence and, for the first time, potentially consumer confidence.

Small business confidence has moved lower

And consumer concern seems to be rising

Lately the stock market seems to be viewing good news as bad as it could hurt the chance of a Fed rate cut. June’s labor report showed a rebound from May’s weakness with 224k jobs created—greeted by the selling of stocks by investors. Illustrating this trend more broadly, since early 2018, stocks and economic surprises have moved into negative correlation territory; in stark contrast to the nearly-perfect positive correlation of the first 16 months of the Fed’s rate tightening cycle.

Stock market now negatively correlated to economic surprises

For illustrative purposes only.

To those cheering negative economic news, be careful what you hope for. An economic decline to the point that the Fed has to cut multiple times would likely be recessionary and not a positive backdrop for stocks.

Earnings could provide a boost

Second quarter earnings season is underway and estimates coming into the quarter were relatively downbeat, with a slight negative year-over-year change anticipated according to Refinitiv. Now that companies have begun reporting, that estimate has moved back into slight positive territory. The weakness in consensus estimates is largely attributable to the 88 S&P 500 companies (77% of all companies issuing guidance) that have guided estimates down, according to FactSet. That is higher than the average 70% negative guidance heading into a typical quarter, again, per FactSet. Ironically, this could help to cushion a potential pullback, as it’s easier for companies to jump over a lowered bar; but we’ll be listening to forward-looking and trade-related commentary closely. Read more below on earnings both in the United States and internationally.

Fed decision coming

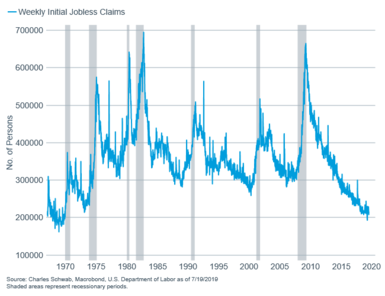

While earnings will gain much investor attention, eyes are also keenly focused on the two-day Federal Open Market Committee (FOMC) meeting that concludes on July 31st. The market is pricing in close to a 100% chance of at least a 25bps cut, with a roughly 43% chance for 50bps. Attention will be closely paid to forward-looking comments in the FOMC statement and subsequent press conference as to the chances for further cuts. We believe there is a chance of a disappointment for investors hoping for an aggressive easing program. The labor market still looks healthy, which is half of the Fed’s “dual mandate;” with unemployment claims historically-low.

Labor looks healthy

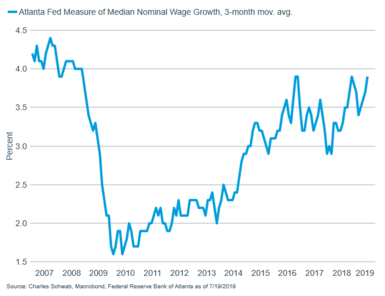

Inflation (or “stable prices”) is the other half of the Fed’s dual mandate; and there may be too much complacency about inflation remaining low. The recent Consumer Price Index (CPI) released by the Bureau of Labor Statistics (BLS) showed core inflation (ex-food and energy) surprised on the upside by rising 2.1% year-over-year; while wage gains are improving and businesses are starting to raise prices.

Wages are starting to rise

Businesses may have increasing pricing power

Earnings: similarities and differences

As mentioned, something may be able to pull attention away from the Fed, as four times a year we get to take a close look at the real impact of developments around the world on the most important driver of stock prices over the long-term: earnings. We can compare similarities and differences between U.S. and European earnings trends in order to assess the possible impact on stock markets in the second half of the year.

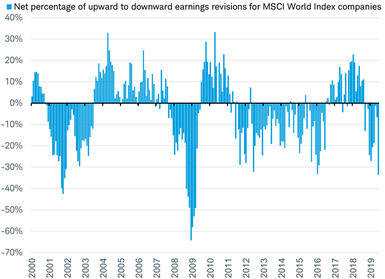

More earnings estimates are being revised lower for the global companies that make up the MSCI World Index; as you can see the chart below that looks at the percentage of upward versus downward revisions. Although it is common for analysts to be too optimistic in their initial forecasts, and usually have to lower their targets as time goes on, the latest revisions are the most negative since the financial crisis of 2008-09 and are weak across all major countries, including the United States and Europe.

Analysts are lowering earnings estimates for global companies

Source: Charles Schwab, Factset data as of 7/17/2019. For illustrative purposes only.

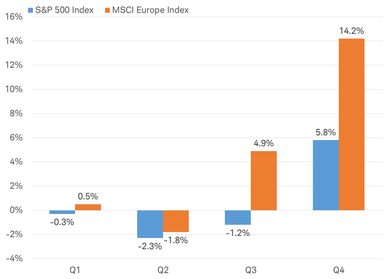

Another similarity between the United States and Europe is that they are both currently expected to have a modest decline in earnings from a year ago in the second quarter.

Consensus forecast for earnings per share change from a year ago by quarter of 2019

Source: Charles Schwab, Factset data as of 7/17/2019. The estimates of future earnings per share are hypothetical and are provided for illustrative purposes only. It is not intended to represent a specific investment product.

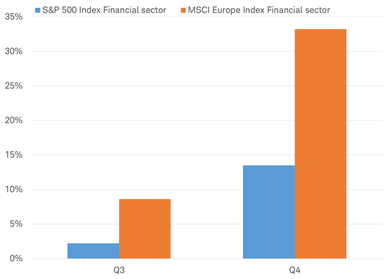

However, a big difference can be seen in earnings expectations for the second half of 2019; with analysts predicting a strong rebound for Europe compared to the United States. This divergence can largely be explained by the differing outlook between the estimates for the United States and Europe in just one sector: financials.

Big difference in expected earnings growth from a year ago for financial sector

Source: Charles Schwab, Factset data as of 7/17/2019. The estimates of future earnings per share are hypothetical and are provided for illustrative purposes only. It is not intended to represent a specific investment product.

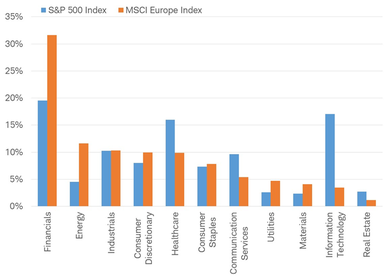

The divergence in growth rates for the financial sector is large. The overall impact is even greater since the financial sector is the largest contributor of earnings for both the U.S. and European stock markets, as you can see in the chart below. In fact, financial sector earnings account for more of the total than the smallest five (U.S.) or six (Europe) sectors combined.

Earnings contribution by sector: financials is the largest sector by earnings

Source: Charles Schwab, Factset data as of 7/17/2019. For illustrative purposes only. Past performance is no guarantee of future results.

The difference in expectations for the U.S. and European financial sectors may be due in part to the outlook for central bank policy. In the United States, rate cuts by the Fed are expected to act as a drag on the profitability of financials by lowering net interest income. But, in Europe, the European Central Bank (ECB) is expected to be focused more on quantitative easing (QE) than on rate cuts. Unlike the Fed, the ECB has not raised rates in recent years.

The stock markets’ optimism in the first half of the year over the potential for rate cuts in the second half of the year may fade if those cuts further undermine earnings growth, which is already weak. In the past, rate cuts took place near the peak in the earnings cycle for global companies—in part due to their impact on the financial sector. Since financial conditions are not currently acting as a drag on growth, as mentioned above central bank actions may do little to spur growth that could offset the drag on financial sector earnings. Stocks may struggle to sustain this year’s rise in valuations if earnings fail to rebound as analysts currently predict. For more insight on valuations for U.S. and international stocks, please see the recent article Valuations Hold A Surprising Message For Stock Market Investors.

So what?

Stocks recently hit new record highs but sentiment is elevated and the possibility of disappointments may be rising. Lower rates could be an offset to ongoing trade tensions, but lower rates are unlikely to mean a trade deal is more likely. We continue to suggest investors remain at their long-term strategic equity allocations, using discipline around diversification and rebalancing.

Copyright © Charles Schwab and Company