by AllianceBernstein Research

When macroeconomic growth slows, investors get edgy. But the economy isn’t the only thing that drives revenue and earnings growth for companies. Some industries are poised to expand at a rapid clip even if GDP growth is subdued or decelerating.

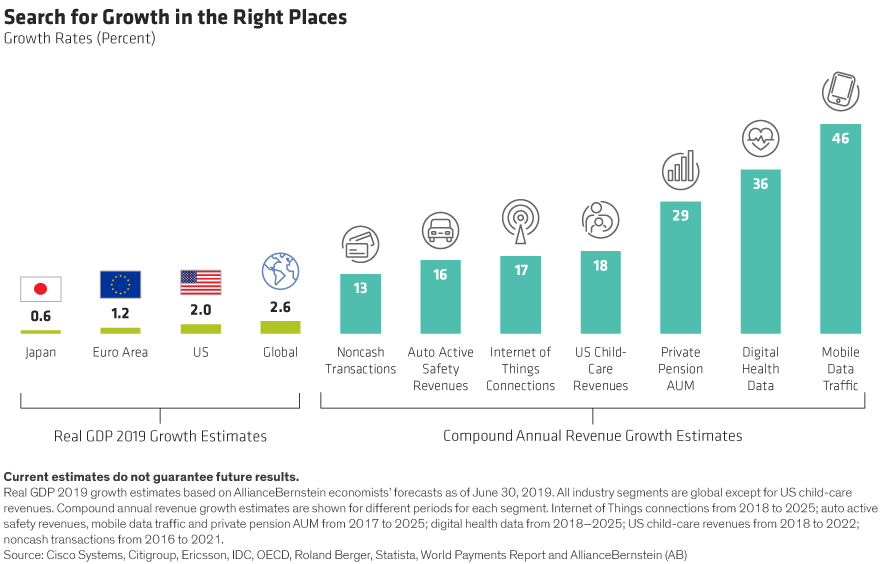

The global economy is growing, but not so fast. In the US, GDP growth is forecast to advance by 2.0% in 2019, followed by the euro area at 1.2% and Japan at 0.6% (Display). It’s hardly surprising that investors are concerned.

Some industries aren’t really tied to the economic cycle and are benefiting from technological innovation, changes to consumer preferences or long-term trends. Around the world, people are using less cash and increasingly shifting toward electronic payments. The number of devices connected to the internet is mushrooming. Digital health data and mobile data traffic are proliferating at annual rates of 36% and 46%, respectively.

Of course, even in a fast-growing industry, investors must always pay close attention to a company’s business model, sources of revenue and profit dynamics. Yet we believe that companies operating in these industries have a distinct advantage in a subdued macroeconomic environment. Growth is hard to come by today, but it can be very rewarding for investors who know where to find it.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein