by Invesco Canada, Invesco Canada

Invesco Global Bond Fund crossed its three-anniversary with strong returns, finishing in the top quartile of its peer group.1 The management team navigated choppy waters with a changing mix of assets to capture upside in good times while providing protection in more challenging periods. The use of corporate credit, mortgage back securities and emerging markets helped to generate returns in calm markets, while a significant allocation to global government bonds helped to provide ballast during times of volatility.

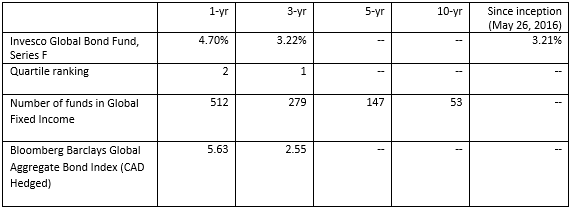

When Invesco Global Bond Fund was launched at the end of May 2016, the 10-year U.S. Treasury had a yield of 1.83% and not long after dropped to 1.37% only to rise to a high of 3.25% in the fall of 2018. Despite the changes in interest rates and the associated volatility, the Fund (Series F) delivered an annualized return of 3.21%† since inception, net of fees, compared its benchmark, the Bloomberg Barclays Global Aggregate (CAD) Hedged, return of 2.55%.2

While global government rates have been the driving factor for risk and returns, the Fund also has meaningful exposure to corporate credit, emerging markets and structured products. These holdings have not only boosted the yield of the portfolio, but have also diversified the Fund and led to better risk-adjusted returns. The benefits of this diversification are evident in our strong risk-adjusted returns compared to peers and our benchmark. Moreover, the up-market and down-market capture ratio since inception has been 99.9 and 68.9, respectively, which demonstrates our ability to add value as an active strategy.

With a duration position that has typically exceeded five years, the Fund has been an effective hedge against equity market volatility. For example, in December 2018, global equities as measured by the MSCI World, sold off almost 8% as investors fled to the safety of high-quality government bonds. Due to our duration positioning, the Global Bond Fund managed a positive return that month. This was also reinforced in May of this year as investors became increasingly concerned about the impact of the trade tensions between the U.S. and China and a slower global economy. As a result investors once again fled to the safety of high-quality bonds. Both months underscore the value of the Global Fund in portfolios that are dominated by equity market risk.

As we look towards the next three years, the portfolio management team will continue to use a similar approach by leveraging the $1 trillion-plus asset management platform at Invesco to get the best ideas from across the globe into the Fund. As we look forward, we see a landscape of slowing global growth, benign inflation and global central banks reducing interest rates. This is a very different environment than the global synchronized growth we witnessed the past few years.

We believe Invesco Global Bond Fund is positioned to thrive in such an environment, as its position in developed market governments will provide ballast in a slow-growth environment, along with income generation from its holdings in other high-quality fixed-income assets. We will continue to oscillate risk in the portfolio to take advantage of market opportunities and our aim is to help our investors achieve the income generation and capital preservation they need in a bond fund.

Performance

Table data as at May 31, 2019

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog