by Rick Rieder, Blackrock

Rick Rieder and Russ Brownback argue that while most investors are focusing primarily on trade-related supply chain disruptions today, they need to continue to situate this turmoil in the more fundamental changes at play in technology and demographic trends.

Myopia in life/death and in investing

The leading causes of death in the United States, by an overwhelming margin, are heart disease and cancer. Yet one would not be able to tell this based on the share of mass media air time these illnesses received. If we had to guess, we’d judge that this relative lack of attention was due to the longer time frame these illnesses often take to play out. In reality, the media spends an overwhelming majority of time reporting on terrorism and homicide – abrupt causes of death that dominate the air time even though they are (relatively) few and far between. We believe a similar attention-deficit dynamic exists in investing today, where the leading drivers of portfolio health (durable long-term returns) can often be the least covered by the media, because they take the longest time to play out. Still, as investors, it is our role to bridge that divide and focus on what we think are today’s structural drivers of tomorrow’s cash flows, and of forward returns, to help clients achieve the outcomes they seek.

In our view, chief among these drivers is a structural deficit of yielding assets. During the late-20th Century, a young and growing population that was devoid of a need for income-generating assets was, nonetheless, contributing impressively to robust growth and inflation, as it entered the workforce, in turn engendering elevated nominal interest rates. Today, however; that same cohort is an older and rapidly aging population that is tapering its economic contribution, which results in dwindling systemic growth and inflation that is ultimately forcing yields lower. Thus, at the same moment that the global population has become ever more reliant on retirement savings, and actually needs the very investment income it once helped generate, there is a large and growing deficit of precisely such income.

These acute demographic influences are being exacerbated by the global economy’s ubiquitous evolution away from a traditional manufacturing economy toward an ever-greater reliance on services – a transition that has immense implications for global investors and savers. Historically, corporations issued debt to finance the capital expenditures associated with hard assets that generate goods-centric operating cash flows. But, in today’s service-oriented, capital-light and asset-light world, there is a diminished need for debt financed cap-ex. Today’s leaner, and more competitive, economic environment, when combined with slowing demographics, forces companies to aggressively preserve margins by cutting costs and creating efficiencies, further inhibiting systemic nominal growth. The places where robust operating cash flows actually do still exist are more concentrated around specific sectors, like technology.

Fixed income markets change alongside the broader economy

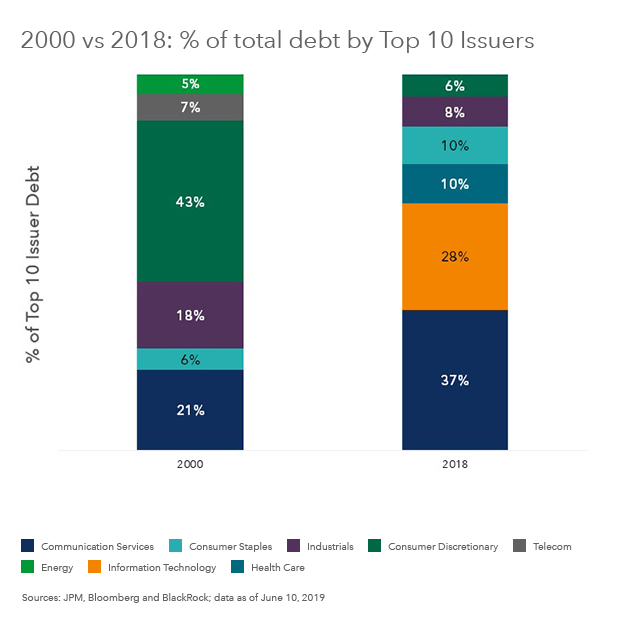

A broader and more Darwinian environment is facilitating a rapid obsolescence of traditional supply chains. The commensurate financing required to support them has dissipated demonstrably, as evidenced by the composition of corporate debt markets. Twenty years ago, the biggest issuers were predominantly industrials and banks, the latter of which had higher loan to deposit ratios and therefore needed incremental debt financing. Instead, today’s debt financing is more concentrated on synergistic mergers and acquisitions, and on financing stock buybacks, such that debt financing proceeds often don’t find their way back into growth-enhancing investment (see graph).

At the national level, this same goods-to-services phenomenon is increasingly penetrating emerging markets. In Brazil, education and healthcare now account for a larger share of GDP than does manufacturing; for the first time ever! In Russia, professional and business services share of GDP is more than three times larger than it was in 2000, and in China, imports of semiconductors have rapidly over-taken oil in recent years. That evolution is significantly diminishing the amplitude of the traditional goods-dominated business cycle, such that now overall EM country GDP growth volatility more closely resembles that of Germany than of Argentina.

Leaner, capital-light global supply chains are compounding the global shortage of income. It may seem paradoxical that there is a shortage of yielding assets in a world that is flush with policy-induced liquidity, but the reality is that existing liquidity alone is not sufficient to stimulate the requisite real-economy credit creation that might offset the deficit of yielding assets. Indeed, the contemporary liquidity pool needs complementary velocity to facilitate actual credit creation and broad money growth. That velocity, in turn, must come from the places where credible growth opportunities and operating leverage exist. But, for sustained economy-wide velocity acceleration to occur, demand for corporate investment must consistently surpass operating cash flow, an outcome that remains elusive in the current environment.

Moreover, notwithstanding these secular headwinds to organic velocity, global protectionism has suddenly become a cyclical constraint. Indeed, with the current and acute issues surrounding global trade, the forward path of globalization is suddenly being reshaped before our very eyes, in real-time. Simultaneously, there is massive economic value at stake associated with the global technology evolution over the next several decades, and there is a clear first-mover advantage in artificial intelligence, 5G, cloud computing, data storage and the Internet-of-Things, such that a winner-take-all outcome looks increasingly likely.

Trade wars and policy shifts lead (shorter-term) investment implications

The uncertainties associated with trade frictions look set to dampen global growth, and more importantly, place further downward pressure on already precariously low levels of inflation and inflation expectations. That may well force central banks to provide additional stimulus much sooner than trailing economic data might suggest. Meanwhile, as global interest rates fall and an easing cycle starts anew, the already limited availability of cash flow becomes increasingly limited, particularly in fixed income – and especially relative to the demand for income. The bid for high-quality carry is not going away anytime soon (only the income is), especially in light of tomorrow’s uncertainties. We like sectors with better-than-average volatility-adjusted carry (or a high carry/volatility ratio), and like regions with high real rates, such as can be found in EM.

Still, in a world that seems solely focused on trade wars and their commensurate supply chain disruptions, we spend far more time focusing on the other (more fundamental) source of supply chain disruption (technological advancement), as well as on the constrained supply of income. Today, while the future of global trade (and central banks’ responses to it) will certainly impact portfolios on a day-to-day basis, we believe the technology and demographic stories are the underappreciated ones that- for those who get them right- will drive portfolio health for a generation to come.

Rick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Global Fixed Income, is Head of the Global Allocation Investment Team, and is a regular contributor to The Blog. Russell Brownback, Managing Director, is Head of Global Macro positioning for Fixed Income, and he contributed to this post.

Investing involves risks, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Prepared by BlackRock Investments, LLC, member Finra

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners.