by Shawn Keegan, Fixed Income, AllianceBernstein

A growing number of investors want to play an active role in building a more sustainable future, rather than merely screening out the least sustainable industries from their portfolios. They want to make a greater impact than investing in green bonds alone allows. One efficient way for such investors to invest for good is to use the United Nation’s Sustainable Development Goals (SDGs) as a road map for buying traditional corporate bonds.

The SDGs are a set of 17 objectives the United Nations issued in 2015 in hopes of creating a more sustainable world by 2030. The goals (Display 1) cover a wide range of subjects, from clean water to gender equality. Some 193 countries have pledged to work toward achieving them.

The estimated cost of realizing the SDGs is about US$90 trillion, however—too high for the public sector to shoulder alone. Investors can help make the goals a reality by funding not only government and nonprofit efforts but ambitious attempts at self-transformation in the corporate world.

Following the SDG Road Map

Some of the 17 areas that the SDGs cover offer more investable opportunities than others. Fixed-income investors can use the 169 sub-targets within the SDGs to create a specific list of potential investments. Those targets include goals such as improving access to affordable medicine and vaccines and making clean water more widely available, and our analysis identified about 80 products and services that address the SDGs. From there, we identified 784 global issuers that offer those products and services.

Through this investment process, managers can open a window into the future: picture a bank in a poor emerging-market country that has pledged a significant chunk of microfinance loans to women entrepreneurs, a large developed-world bank that has poured money into green bonds and is lending to small- and medium-sized businesses, and a biopharmaceutical company that provides a significant portion of its medicines to the emerging world. All these corporate issuers already exist.

It’s worth emphasizing the difference between using the SDGs to zero in on issuers contributing to a sustainable future and the more common desire to invest in sustainable companies. The latter is essentially a form of risk management. Companies that perform well on environmental, social and governance (ESG) measures are less likely to find themselves embroiled in scandals that trigger enormous regulatory fines, legal costs or mass customer defections that threaten their business models. That’s why the best asset managers consider ESG issues in their fundamental research for every fixed-income investment. Integration is good practice, but it does not require investors to decide which companies have the potential to change the world for the better, as following the SDGs does.

Why Follow the SDG Road Map?

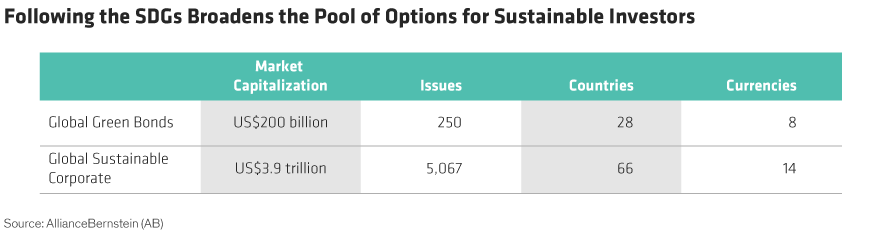

Funding corporations that are working toward fulfilling the SDGs has several advantages over more traditional approaches to sustainable fixed-income investing. While green bond issuance is growing fast, the market is still relatively small compared to the sustainable global corporate market (Display 2). Green bonds are also less liquid and can be more difficult to access in the secondary market than their traditional corporate counterparts.

On the other hand, merely screening out bonds in the most obviously problematic industries creates an investable universe that’s too large to be meaningful for investors who truly want to build a more sustainable future. Rejecting companies that produce weapons, alcohol and tobacco products, gambling establishments and services, and pornography leaves companies that cover a very wide spectrum of behavior.

The Myth of the Perfect Investment

If building a sustainable bond portfolio sounds tidy and straightforward, it isn’t. The auto industry illustrates the difficulty of finding perfectly sustainable private sector investments. But it also underscores the imperative of investing in issuers that are trying to make progress toward sustainability.

General Motors, Volkswagen and Ford Motor have all made significant commitments to building out their electric vehicle lines in the past several years. Electric vehicles are responsible for between 10% and 24% less greenhouse gas emissions than gasoline-powered cars over a 100,000-mile lifetime. That percentage could rise as renewable power continues to grab market share from coal-fired electrical utilities, thereby also playing a greater role in fueling electric cars.

Yet, General Motors and Ford Motor also rely heavily on sales of relatively fuel-inefficient trucks and SUVs. Ultimately, we think it’s worth supporting traditional car companies’ transition to electric vehicles, even if they don’t overhaul their entire vehicle lineups overnight. We believe fixed-income funding—a major source of funding for the auto industry and a more stable funding source than equity—is crucial to enabling this transition.

So why not just invest in Tesla Motors, which makes only electric vehicles? Here’s where nuance and fundamental research come into play. Tesla’s products are great for the environment, but the company has struggled with its manufacturing process and confronted some well-publicized governance issues of late. The company itself presents some ESG risks that many long-term investors would want to think carefully about, even though the company’s products certainly further the SDGs.

Holding Issuers Accountable

For most companies, sustainability is a work in progress. That progress is often uneven, and companies that are making great strides in one area can stumble into serious scandals in other parts of their operations.

That’s why sustainable investing does not stop with the initial investment decision. Asset managers must engage frequently with management about ESG issues to ensure that leadership teams do what they promise in developing products, services and practices that support the SDGs.

In engaging with companies, it’s helpful for asset managers to be able to rely not only on a lone fixed-income product, but on multiple partners. These can include industry organizations that engage and advocate for changes, as well as in-house resources, such as a responsible-investing platform that spans asset classes. A sustainable bond fund manager who can walk into a management meeting with a partner running a sustainable equities portfolio has more leverage than either manager on his or her own. (And if those managers share information and perspectives frequently outside meetings, so much the better for investors.) Asking companies to participate in building a greener, more just world isn’t an easy ask—the more voices that demand that world, the faster change can occur.

---------------------------------------------------------------------------------------------------------------------

1 Bill Schlesinger, “Life-Time Side-by-Side Comparison: Electric vs. Gasoline Automobiles” (June 25, 2018). https://blogs.nicholas.duke.edu/citizenscientist/life-time-side-by-side-comparison-electric-vs-gasoline-automobiles/ The figure includes emissions during both the manufacturing process and the owner’s operation of the car.

Shawn Keegan is a Senior Vice President and Credit Portfolio Manager at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

This post was first published at the AllianceBernstein blog

Copyright © AllianceBernstein