by Michael Hatcher, Head of Global Equities and Director of Research, Invesco Canada Equity team, Invesco Canada

According to Plato’s account of his mentor’s trial, Socrates stated “The unexamined life is not worth living.” I think this is a pretty good motto, so I spent the past nine months reviewing and evaluating my investment process to ensure that I haven’t picked up any bad investment habits.

My educational background is very science based, and I believe that affects my approach to investing. I’m a strong believer in sticking to “first principles” – those basic, foundational propositions that cannot be deduced from any other proposition or assumption.

People tend to look for rules, but there’s a reason that scientists work from First Principles and not First Rules. The big difference is that rules are typically developed for a specific situation. First Principles are relevant for all situations.

There are two principles in particular that have served us well: Try to avoid mistakes; and buy solid earnings at a discount.

Avoiding mistakes may sound obvious, but it is crucial to long-term returns. While the benefits of compounding returns are well known, investors must also understand the dark side of compounding –that recovery from a loss can be a tough, uphill slog. Remember, to recover from a 50% loss, you need a 100% gain.

Such investment mistakes can kill long-term returns, which is why I’m far more interested in identifying reliable, modest long-term compounding opportunities. The chief responsibility for the team is to accurately calculate the cash flows of each company we research. Every company we look at, we’re trying to make sure there’s a minimal amount of risk to the cash flows.

Our research into a company may identify a strong business, but it may not be a great investment if the market also recognizes the underlying strength. We don’t always have great insight into what the market will pay for a given company’s cashflows, but if we can identify a predictable cash flow, then we can wait for a valuation we like.

We’re looking for a substantial margin of safety, with a company’s stock trading at a steep discount – preferably around 30%.

It may seem unlikely that such a discount would be found on a strong business, but it occurs more often than you might expect.

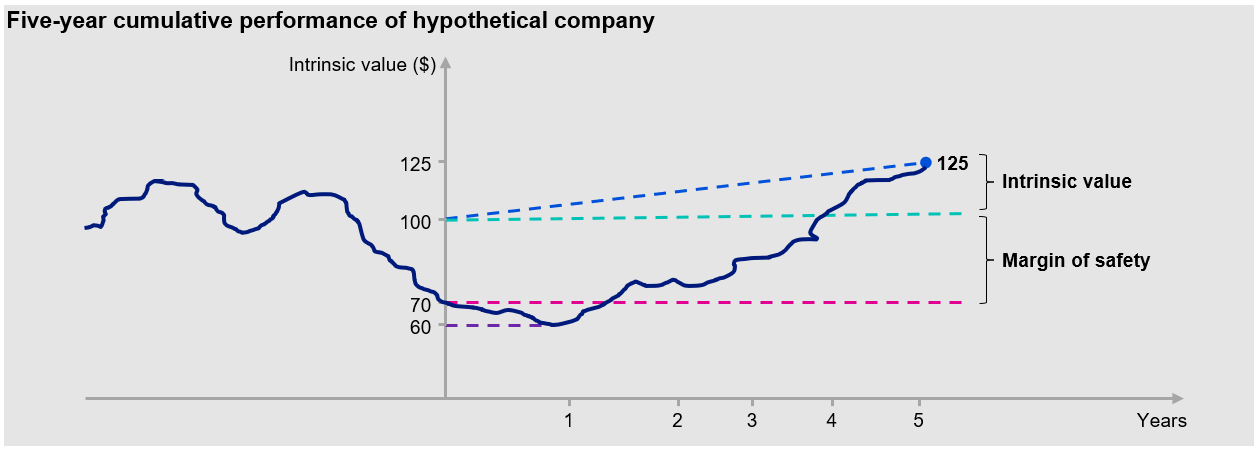

The following chart illustrates my thinking on how buying at a discount may limit risk.

In this hypothetical example, let’s say we research a quality company and determine its intrinsic value to be $100. At any point to the left of the vertical line, we’re not investors in this company, because the discount to intrinsic is not large enough.

Note: This example is for illustrative purpose and does not constitute any stock recommendations.

Let’s assume the company is able to compound its intrinsic value at about 5% per year. People seem to overlook these slow, steady compounders and assume that less-risky cash-flow generators are just defensive stocks that don’t offer good long-term returns.

After a few years of watching and learning about this company, some event has a negative impact on the share price, but we do not believe the event will have a material long-term impact on the company’s cash flow. If it drops down to $70, that’s where we start to take our position.

My experience tells me that we will never get this initial position “right” – there’s typically more downside momentum than we can predict. That’s fine, we might add to the position at $65 or $60, because we still believe the intrinsic value is $100.

If that company is growing its business value by about 5%, then over five years it’s intrinsic value will be over $125. If you are able to buy that at $70, that’s a 12% compound annual growth rate (CAGR), on a company that’s probably growing mid-single digits.

I do not believe that you will see a 12% compounding return over the next five years in a broad equity index. Over that time frame, I think a mid- to high-single-digit return should be seen as “great” for index investors.

Market drops may cause grief for indexers, but they are exactly what we are looking for – the opportunities to buy high-quality cashflows at a significant discount.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog