by Ben Powell, Blackrock

Ben shares key observations from a recent field trip to China amid rising U.S.-China rivalry and global trade tensions.

Rising U.S.-China competition and global trade tensions are increasingly weighing on global stocks and other risk assets. They are also raising questions on the sustainability of the global supply chain in which China is a key part. A group of our senior investors recently went on a trip to seek answers to those questions.

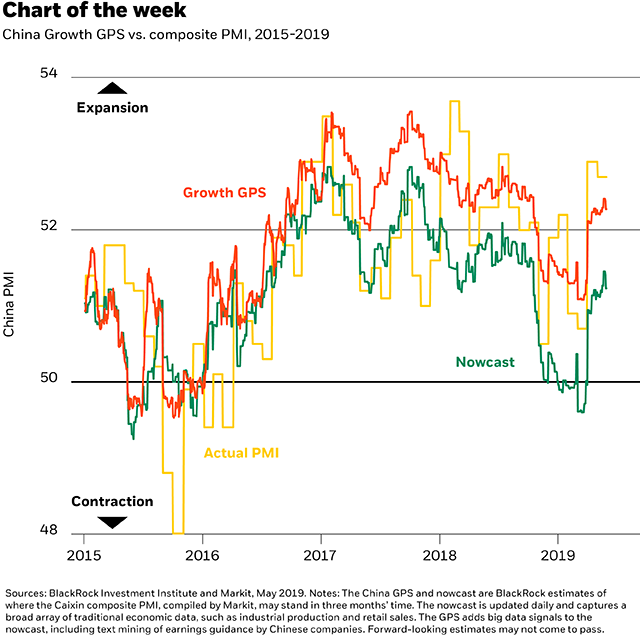

The intensifying U.S.-China strategic rivalry is clouding over China’s growth outlook. Selling of Chinese equities by foreign investors hit record highs in April and May, with the greatest outflow of foreign capital since the launch five years ago of the “stock connect” program that gave global investors access to Chinese shares through Hong Kong. For now, the Chinese economy appears to be holding steady, thanks to policy support. See the BlackRock growth GPS in the chart above, which provides a three-month look ahead on the Caixin composite PMI, a popular gauge of China’s economic activity. We see limited direct economic impact of a “no deal” scenario in the ongoing trade negotiations in which U.S. tariffs would be fully applied to all Chinese exports. China likely has the tools to cushion the impact. The more pressing concern is what the escalating tensions imply for the sustainability of global supply chains – and for both Chinese and global companies that rely on them.

The supply chain conundrum

China has evolved from the world’s factory of cheap consumer goods to an integral part of global supply chains for a wide range of products, including sophisticated tech products. The deeply intertwined nature of global supply chains and other mutual interests have contained full-blown escalation between the U.S. and China so far. Yet earnings downgrades across the entire tech supply chain in Asia, particularly in South Korea, Taiwan and Japan, underline investor worries about the long-term disruption brought by rapidly escalating tensions.

Some global companies with large supply chains in China are not going to wait for the next turn in U.S.-China trade negotiations. A sign of the migration already underway: Dramatic wage increases in neighboring, poorer Vietnam as manufacturing jobs relocate there. Yet labor costs are not the only factor when companies consider relocating production facilities. One example: A basic requirement for large-scale manufacturing is a reliable supply of electricity, and many of China’s emerging market rivals fall short in this regard. Adjusting supply chains is a costly affair that companies may have to grapple with for years ahead, in our view. In addition, U.S. firms supplying to Chinese customers face a potential loss of revenues. We also see China’s move toward greater self-reliance–from the tech sector to energy and food production–as likely to accelerate.

Bottom line

We see the direct impact from a fallout in U.S.-China trade talks as limited. And we expect Chinese policymakers to provide support in the case of a downturn, yet are mindful that many policy tools could have unintentional side effects on the economy and markets. Our research on the ground still pointed to confidence in the resilience of the Chinese economy, despite trade talks grinding to a halt. One reason: The credit impulse to the economy is turning positive–a sea change from last year’s clampdown on credit growth. Yet the heightening global trade conflict–including a U.S. threat of tariffs on Mexican goods–is a source of major macro uncertainty globally. This reinforces our call for portfolio resilience, including allocations to U.S. government bonds, which have historically played an important role in cushioning portfolios against bouts of volatility.

Ben Powell is the Chief Investment Strategist for APAC at the BlackRock Investment Institute. He is a contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June, 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0619U-865600