by Stephen Dover, Executive Vice President, Head of Equities, Franklin Templeton Investments

I’m often asked by investors about the advantages that an actively managed mutual fund offers over a passive fund. In light of the recent high-profile initial public offerings of Uber, Lyft and Pinterest, I would call attention to the fact that many actively managed mutual funds have access to companies that aren’t yet listed on a stock exchange.

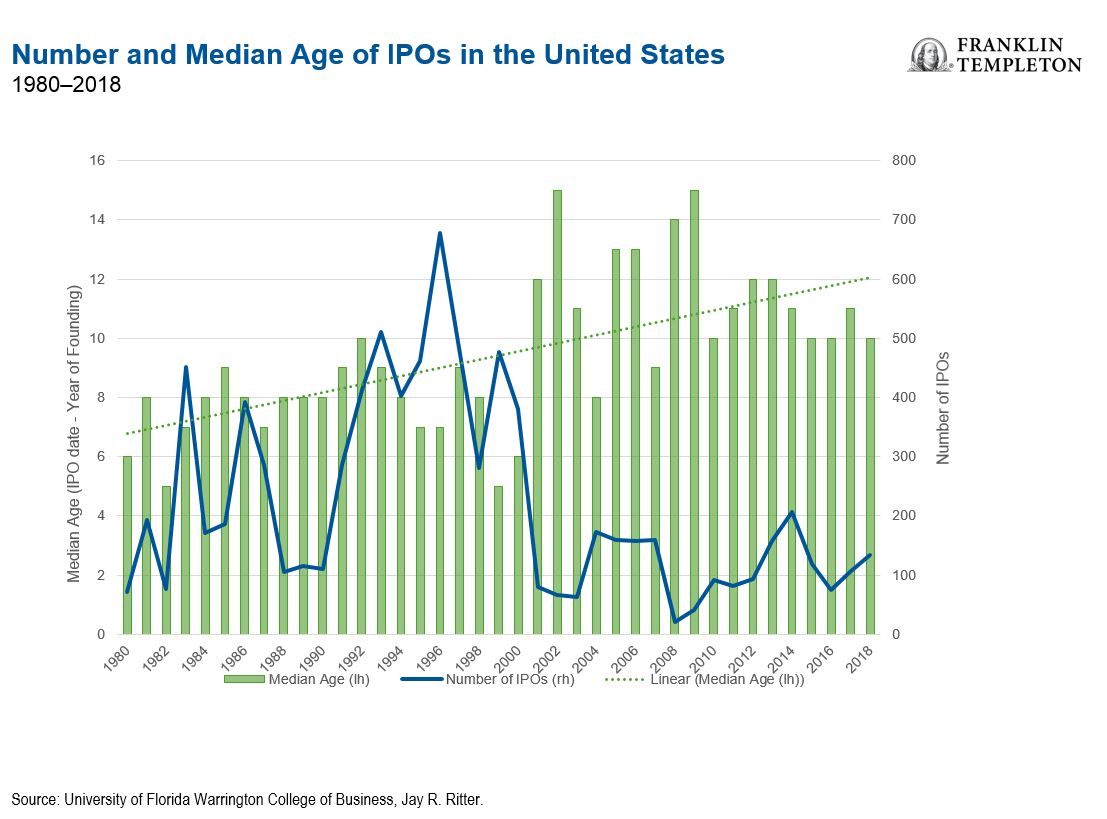

Many companies today are staying private for longer periods of time before deciding to go public—if they do so at all—and this “private-for-longer” trend has some significant implications for investors and the market.

All US companies start out as privately held—many as small family businesses. As a company starts to grow, often outside capital is needed to continue to expand and fuel the business. Staying private can make raising that capital (that is, finding outside investors) more difficult. However, that challenge isn’t as big as it used to be.

Today, many companies no longer feel the need to list on a public market like the New York Stock Exchange, NASDAQ or other global stock exchange to raise money via an initial public offering (IPO). “New economy” companies in particular are more easily able to obtain funding without going public. So, these companies are often staying private for longer.

Going public can allow a company to quickly raise lots of capital from a large number of shareholders. It also means a company has to answer to those shareholders and follow greater regulatory requirements, and it can cost a lot of money to list.

Many large companies today with valuations over US$1 billion (known as “unicorns”) are still private and do not have current plans to list. As of 2018, the median age of venture-capital-backed technology companies at time of IPO rose to 10.9 years, up from 7.9 years in 2006.1

These more mature-company IPOs can affect the dynamics of the public markets.

Since many companies hitting the public market today have been in operation quite a while prior to deciding to go public, it has often been the case that more of the appreciation in their value is happening prior to the launch of their IPO. In the past, it was certainly not unusual for companies to see big upswings in the price of their shares right after going public—particularly technology companies. (Remember the dot.com boom days of the 1990s?)

Many companies that have been going public more recently aren’t experiencing that same type of post-IPO appreciation—again technology or “new economy” companies in particular. So, we could see a new kind of boom-and-bust cycle that could be a risk for investors. We’ve dubbed the prolonged bullish cycle we’ve been in as a bit of an “unloved” bull market, and this dynamic of post-IPO letdown could be a reflection of that sentiment.

Why Go Public?

As mentioned, most companies go public to raise large amounts of capital. Certainly, there are still plenty of IPOs hitting the market—Lyft, Pinterest and Uber being recent examples. Other new-economy companies expected to go public this year include data-mining company Palantir Technologies, messaging platform Slack and home-rental company Airbnb.2

An additional reason to go public relates to employee incentive programs. Many new companies offer their employees a stake in the business as a benefit of working there. Going public would typically help their employees cash out their shares more easily. However, today there are online platforms like Forge Global, SharesPost and EquityZen that allow employees and other private shareholders to sell unlisted company shares, so it’s not as necessary to be listed publicly for this reason.

Many companies are raising capital more easily without the need to go public. Even if unlisted companies are unprofitable, there are often private investors willing to invest in them, because these companies may have new business models that are disrupting established industries. Of course, investors expect them to eventually be profitable.

Who are these private-company investors? They include the aforementioned venture capitalists as well as independent investors, but also may include mutual funds. With the latter, mainstream retail mutual fund investors are able to access these private opportunities and potentially benefit from valuation growth while they are still private. I’ll dive more into that a bit later, but in our view, this feature alone can make a strong case for considering actively managed strategies, versus investing in a passive index-based vehicle.

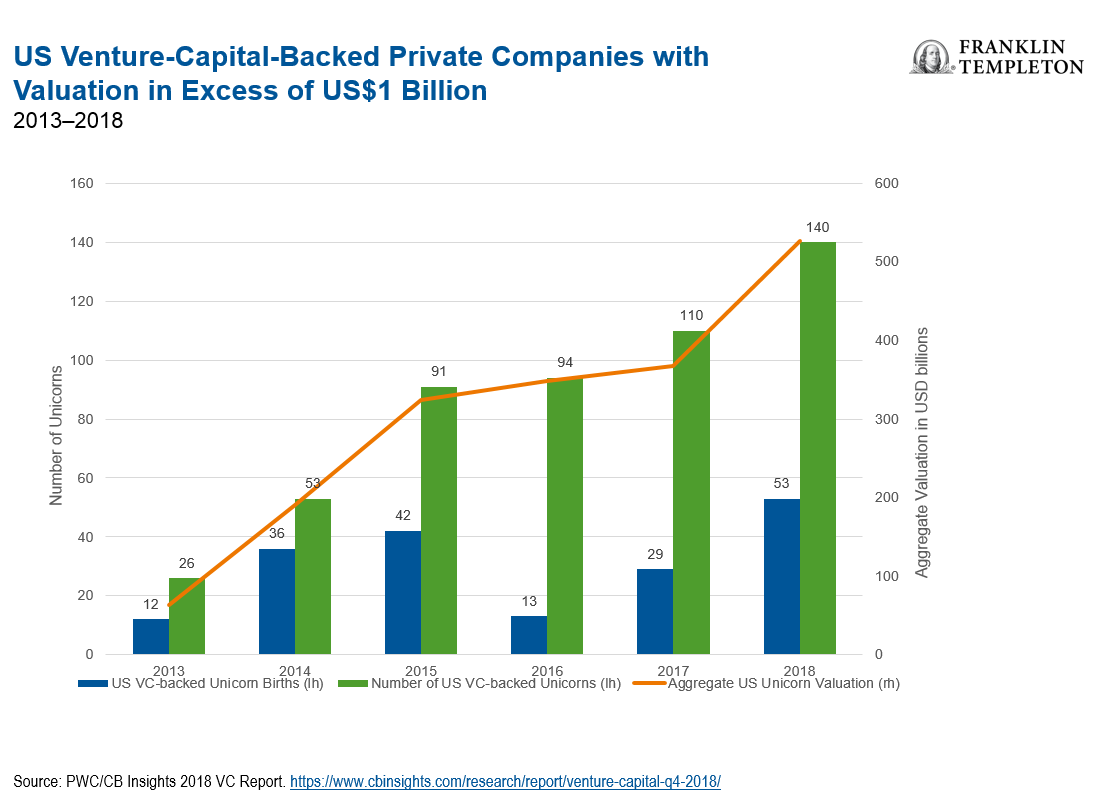

Over the past decade, a large amount of capital has been funnelled into startups, making securing funding relatively easy and allowing private companies to think big and grow fast. In 2018, venture capitalists and other non-traditional investors invested US$131 billion into private companies.3

As a result of this flood of capital, we’ve also seen an increase in unicorns. There are 145 unicorns in the US alone, worth an aggregate valuation of US$556 billion.4

Can the Market Absorb these Outsized IPOs?

There are expectations that many unicorns, and even a few “decacorns” (companies with a value greater than US$10 billion), will in fact go public in 2019. The total amount raised could reach US$80 billion in 2019, double the yearly average since 1999.5 Meanwhile, US equity markets had US$38 billion in outflows during the first quarter of 2019,6 so there is a possibility that these large IPOs may funnel too much equity supply into the market, weighing on the post-IPO performance of these stocks.

That said, considering IPOs have not been more than 1.5% of the market value of the S&P 500 Index in the past 15 years, they may not create a supply issue as long as their IPO timing isn’t too close together.7

This also begs the question: Is investing in IPOs a lucrative strategy? Maybe—or maybe not. Returns from US IPOs have been trending lower; US stocks that had an IPO in the first quarter of 2018 returned an average of 15% over the following one-year post-IPO period, less than half of the average of 34% and 39% returns in 2017 and 2016, respectively.8

The Active Access Advantage?

Many mutual funds have invested in private companies over the years and stand to potentially benefit as these private companies raise new rounds of funding at higher valuations. Mutual funds tend to have better access to information on these private companies, as they buy into capital raising rounds (which grants them access to company financials and management teams) instead of buying from the employees of these companies.

Mutual fund companies also have robust valuation processes that value these unlisted investments using formulas that incorporate recent funding round valuations, peer valuations, and trends and outlooks for these companies. This helps ensure that investors in mutual funds get an accurately valued portfolio, even for the unlisted holdings.

Pre-IPO companies like to have long-term investors, so they often offer shares to mutual fund companies, which tend to take long-term positions. This practice offers mutual fund investors the potential for early, pre-IPO access to growth companies, and allows the pre-IPO company to have a more stable investor base.

All things considered, we think gaining access to pre-IPO companies is an increasingly compelling argument for investing via actively managed strategies.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This commentary reflects the analysis and opinions of the author as of 24 May 2019, and may differ from the opinions of other portfolio managers, investment teams or platforms at Franklin Templeton. Because market and economic conditions are subject to rapid change, the analysis and opinions provided are valid only as of 24 May 2019, and may change without notice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The companies and case studies shown herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton Investments. The opinions are intended solely to provide insight into how securities are analysed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable, but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security. Past performance does not guarantee future results.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. Investments in fast-growing industries like the technology sector (which historically has been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments.

Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

______________________

1. Source: Pitchbook Private Market Playbook, first quarter 2019.

2. Source: The Wall Street Journal, “Magical thinking about unicorn IPOs,” 26 March 2019.

3. Source: Pitchbook Private Market Playbook, first quarter 2019.

4. Sources: Techcrunch, “Unicorns aren’t special anymore,” 16 November 2018; Pitchbook, 30 September 2018.

5. Source: Goldman Sachs, November 2019. There is no assurance that any estimate, forecast or projection will be realised.

6. Sources: Bank of America Merrill Lynch; Bloomberg, “Lyft Leads Pack of $50 Billion Planned IPOs as ‘Decacorns’ Gallop to Market,” 29 March 2019.

7. Sources: Renaissance Capital; Bloomberg, “Unicorns Everywhere Spread Fear of an End to the Bull Market,” 28 March 2019.

8. Source: Bloomberg, 16 April 2019. Average return for US IPOs over US $50 million issue size. Past performance is not an indicator or guarantee of future results.

Copyright © Franklin Templeton Investments