by Stephen H. Dover, CFA, Franklin Templeton Investments

The war of words between the Trump administration and China threatens to break out into a full-scale trade war. Franklin Templeton Head of Equities, Stephen Dover, considers the reaction of global investors and puts the current US stock market environment into perspective. And, he considers some other issues that are contributing to markets’ cautious sentiment.

Recriminations and retaliations have dramatically escalated the trade tensions between the United States and China in recent days, creating volatility in global equity markets.

The situation has been exacerbated because markets had earlier priced in a short-term resolution to trade tensions on the back of emollient words from both sides in recent weeks. The escalation in tension into a potential full-scale trade war between China and the United States clearly creates uncertainty, but when we talk directly to management of companies in China, we feel more positive about the situation longer term. While we’re optimistic that there’s scope for some short-term negotiated settlement to this latest skirmish, that should be positive for the markets, it seems clear to us that there are long-term geopolitical issues between the two countries that have no short-term fix. As a result, we believe investors need to take a longer-term view on China and trade issues.

Changes in Global Markets and Their Impact on Equities

Uncertainty over China, and its influence over the fortunes of the US and global economies, is just one of the issues casting a shadow over investor sentiment. But we believe there are several reasons to continue investing in equities as corporate and economic fundamentals are generally holding strong. We view market volatility as a buying opportunity because we take a long-term view as investors.

China’s Role in the Global Economy

China has become such a large component of the global economic growth, so we think it merits individual consideration. Notwithstanding the tough line that the Trump administration is taking on trade, we think the outlook for China may be more positive than markets are suggesting.

While many observers fear a slowdown in China’s rate of economic growth, it’s important to keep in mind just how big its economy is, and how many tools the government there has to stimulate it.

Already this year there have been signs that the trade tensions with the United States were helping to focus the minds of policymakers and corporate leaders in China, prompting tax cuts and other fiscal liberalisation measures.

China’s Increasingly Domestic Economy

The Chinese economy appears to be in a much more balanced place today than just a few years ago. It is more domestically oriented, which, in our view, makes it more stable and less vulnerable to external shocks.

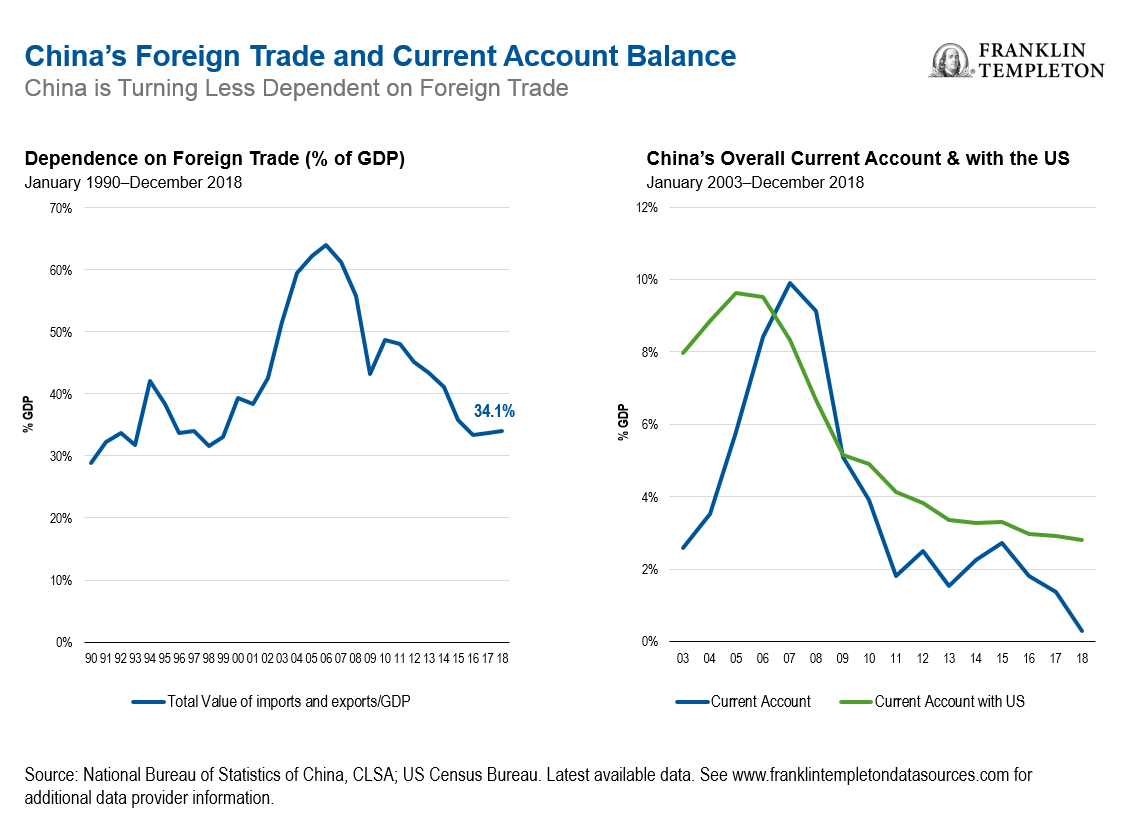

It’s important to keep in mind that China has largely insulated itself from a dependence on foreign trade. Only 34.1% of its gross domestic product (GDP) today comes from foreign trade, compared with around 50% to 60% a few years ago.1 That percentage is roughly equivalent to a country like the United Kingdom.

Significantly, China’s trade balance with the United States has substantially narrowed. On a current account basis, China is no longer a major net exporter to the United States. It remains a significant net exporter of goods, but also imports a lot of services from the United States. So really, the trade balance for the United States isn’t that significant for China.

China’s Innovation Shines Through

China has shown a formidable ability to innovate, spurred in part by the government’s research and development (R&D) push. China has actually overtaken developed markets such as the United States, Japan and Germany in terms of the number of patent applications filed in recent years.2

Across various industries, China has become the innovator to watch. For instance, rapid improvements in lithium-ion battery production have helped turn the country into the world’s largest electric vehicle market by both production and sales. In China’s pharmaceutical industry, government policies favouring the development of novel drugs over generics have encouraged local companies to scale up R&D expenditures. This could sow the seed for a pipeline of groundbreaking treatments from Chinese drug makers. These are just a couple of examples that highlight China’s pursuit of its own economic destiny independent of US and European manufacturers.

Uncertainty Prompts a Search for Alternatives to Chinese Suppliers

The fact that talks between US and Chinese trade representatives haven’t broken down completely despite the escalation in tensions (at least as at this publication date), gives us some hope that a compromise could be reached over these latest tariffs.

However, the entrenched attitudes on both sides will make it tougher to find agreements on the wider geopolitical differences. We expect further flare-ups in the future.

The uncertainty created by this situation can make it hard for businesses to make capital investment decisions; we think these trade negotiations will affect sourcing decisions for businesses for years to come. In our view, businesses looking to reduce this uncertainty will likely seek out local suppliers.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

The comments, opinions and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

What Are the Risks?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The technology industry can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants as well as general economic conditions. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile.

______________________________

1. Sources: National Bureau of China, CLSA. Latest available data as at February 2018.

2. Sources: World Bank, World Intellectual Property Organization (WIPO), WIPO Patent Report: Statistics on Worldwide Patent Activity as at January 2019. The International Bureau of WIPO assumes no responsibility with respect to the transformation of these data.

Copyright © Franklin Templeton Investments