by Larry Adam, Chief Investment Strategist, Raymond James

Despite the ongoing ratcheting up of tariffs between the U.S. and China, we remain in a negotiating window before those tariffs actually take effect. Assuming the approximate three-week transit time between goods leaving China (via ships) and arriving in the U.S., and China’s stated June 1 implementation of tariffs on $60 billion worth of U.S. imports, the clock is ticking as these increases become unavoidable around June 1. Outside of the long-run structural benefits of establishing a fair trade agreement between the two largest economies in the world, there are two other short-term dynamics that could accelerate the progress of an eventual deal: the stock market and the economy.

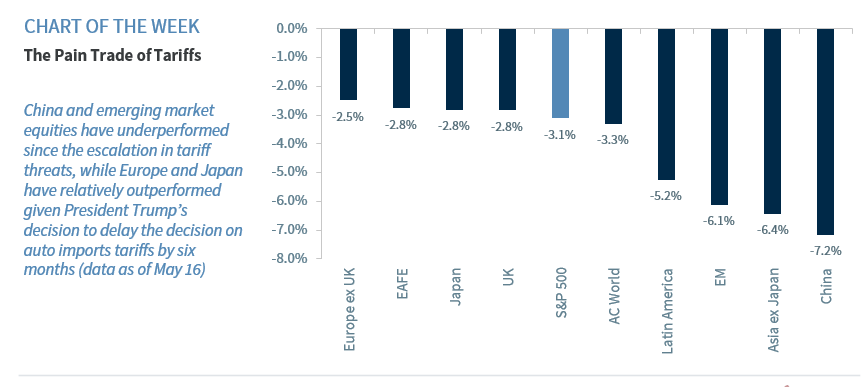

- Stock Market Signals. After the initial trade squabble that sent the S&P 500 down almost 20% during the fourth quarter last year, the equity market recovered those losses and rallied back to record highs. The new tension over the “breaking” of an apparent deal last week has thus far sent equity markets down a manageable 4%. However, our political analyst Ed Mills believes the urgency to finalize a deal will not be felt by negotiators until we see declines closing in on 20% again. China has been more impacted by the trade war, as Chinese equities are down ~7% since President Trump’s tariff threat and remain ~20% off their last record high (on a USD basis) set in 2007. As a result, the equity market is not necessarily forcing the hand of negotiators now.

- Economic Elasticity. Another potential driving force behind a deal is the vulnerability of each country’s economy to a slowdown. While tariffs, to date, have had little direct impact on economic growth, any softness in either country could be exacerbated by increasing trade tensions that not only serve as a tax on consumers but could also weigh on business and consumer sentiment. Even before these new tariffs take effect, recent economic data suggests a mild slowing in both economies.

- Chinese economic data moved lower this week as Chinese retail sales (+7.2% year-over-year (YoY) vs. +8.6% YoY expectations) and industrial production (+5.4% vs. +6.5% YoY) both came in weaker than expected. More specifically, Chinese retail sales are now rising at the slowest pace since 2003 and industrial production is rising at the slowest pace since 2002. While China still has the capacity to stimulate its economy further, it is set to incur its largest budget deficit.

- U.S. data overall has remained robust with little sign of recession; however, there are some small cracks forming. April retail sales (-0.2% month-over-month (MoM) vs. +0.2% MoM expectations) were weaker than expected and point to tighter consumer spending. The manufacturing sector saw weakness as April industrial production (-0.5% MoM vs. 0.1% MoM expectations) posted the largest MoM decline since May 2018 and is rising at the slowest YoY pace (0.9%) since February 2017. Capacity utilization also declined to the lowest level since February 2018. Following these weak economic figures, the Atlanta Fed GDPNow forecast for 2Q19 declined to 1.1% (from 1.6%), which is half the pace of growth during the first quarter. Growth concerns are also being reflected in the financial markets, as the Fed Funds futures market now reflects a 78% and 38% probability of one or two cuts, respectively, by the end of 2019.

Bottom Line: Our base case remains that some form of a deal will ultimately be signed as the “no deal” negative consequences to the equity market and economy are too dire, given that both are important to President Trump’s re-election bid. However, the ebb and flow between “deal” and “no deal” are likely to keep markets on edge. As we wrote in our publication Tariff Tug-of War (May 13), levels of the market are important. Given that our earnings estimates ($166 in 2019 earnings) and economic forecasts (very low probability of recession) remain unaltered as of now by this trade friction, we remain confident in our year-end target of 2946. As a result, at levels near 2950, the risk/reward is less attractive. However, at 2800 (5% upside) and 2700 (~10% upside) or below, the S&P 500 is more attractively valued and presents better buying opportunities.

Economy

- This week, retail sales and industrial production both disappointed in April. At face value, this data is consistent with a lackluster-to-moderate pace of near-term economic growth. In contrast, the University of Michigan consumer sentiment index rose to a 15-year high, led by rising expectations (thought to be a driver of big-ticket purchases), but the survey may have failed to fully capture the potential negative psychological impact of the trade war.

- Focus of the Week: While the market has been pricing in a greater chance of a rate cut, we haven’t gotten that signal from the Fed yet. Investors will be sifting through the minutes of the April 31-May 1 monetary policy meeting (to be released Wednesday afternoon) for any clues regarding what would prompt an ease. Durable goods orders (Friday) should reflect a drop in aircraft orders, with a lackluster trend otherwise. Fed Chair Powell speaks Monday evening on “Assessing Risks to our Financial System.”

U.S. Equity

- At this stage, the most likely scenario is that both the U.S. and China are leaving room for negotiation despite re- escalation (i.e., 25% tariffs go into effect but are reversed within weeks as both sides come to an agreement). Under this scenario, the S&P 500 is likely to find support near the 200 DMA (2776) or 2665 breakout level in downside moves, and eventually stabilize and rally to a new high (on a trade agreement). This would put the S&P 500 P/E in the range of 16.3-17.0x on down moves. Our 12-month 2964 target equates to an upside of ~6.0-10.5% on a price return basis.

- S&P 500 companies with over 50% of their revenues coming from the U.S. grew sales and earnings by an average of 5.6% and 8.6% respectively in Q1 (and had an average price bump of 0.2% following earnings). This compares favorably to S&P 500 companies with less than 50% of revenues coming from the U.S., which showed 2.1% sales growth and 3.6% earnings growth on average (with an average price reaction of -1.3%).

- Focus of the Week: U.S. and China are leaving room for negotiation despite re-escalation, and investor focus is on the late June G-20 meeting in Japan where Presidents Trump and Xi are set to meet. In the end, we believe cooler heads will prevail. Headline and equity market volatility are likely to increase in the coming weeks, and we expect range- bound trading with investors more guarded until the execution of a deal. Therefore, we would exercise patience with new purchases as favored sectors and stocks are likely to provide opportunities to accumulate during weak periods.

Fixed Income

- Escalation in trade rhetoric (U.S./China) and weak economic data releases (e.g., retail sales and industrial production) brought increased concerns regarding the health of the global economy, which sent sovereign yields around the globe sharply lower this week. As a result, the 10-Year Treasury yield fell to a year-to-date (YTD) low (2.38%).

- Heightened trade-induced fears of slowing economic growth drove the U.S. Treasury yield curve (10-Year/3-Month) to temporarily invert for the second time this year. While these inversions (10-Year/3-Month) cannot be ignored as a potential harbinger of a recession, our preference is to follow the 10-Year/2-Year yield curve spread, which remains in positive territory at 21 basis points and is not flashing a recessionary signal.

- Focus of the Week: U.S./China trade talks will overshadow other geopolitical news such as Italy’s reemerging impudence against the European Union’s debt/GDP targets. There is little economic data to drive rates next week.

International

- While uncertainty regarding U.S./China trade negotiations has driven negative headlines, there were a few positive trade developments in other regions this week. First, the Trump administration elected to delay the decision (originally due May 18) on whether to impose tariffs on imported autos and auto parts by six months, which is a positive step for Europe and Japan. Second, progress is being made on the U.S.-Canada-Mexico Agreement (USMCA), with U.S. officials in talks to exempt those countries from steel and aluminum tariffs.

- Talk about a Bank of England interest rate hike before the end of the year has been building, although any such eventuality would only come after overt progress in the Brexit discussions. UK inflation data is released on May 23.

- Focus of the Week: The results of the European Parliamentary elections following the start of voting on May 23 will provide insight into the thoughts of the electorate of the European Union, who have been buffeted by the impact of low economic growth rates and rising concerns about inequality. Expect populist parties to make gains, but not take majority control of the European Parliament.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James