by Scott Thiel, Blackrock

Volatility across markets had been generally low – until last week. Scott offers some thoughts on what it means for investors.

Market volatility is low until it isn’t, or so the saying goes. We’ve witnessed a volatility spike over the past week, as fading prospects for a U.S.-China trade pact shattered the calm after a prolonged period of low volatility in 2019. We are still cautiously pro-risk, but see the recent episode as a reminder of the potential for volatility to flare up – especially in the late phase of the economic cycle.

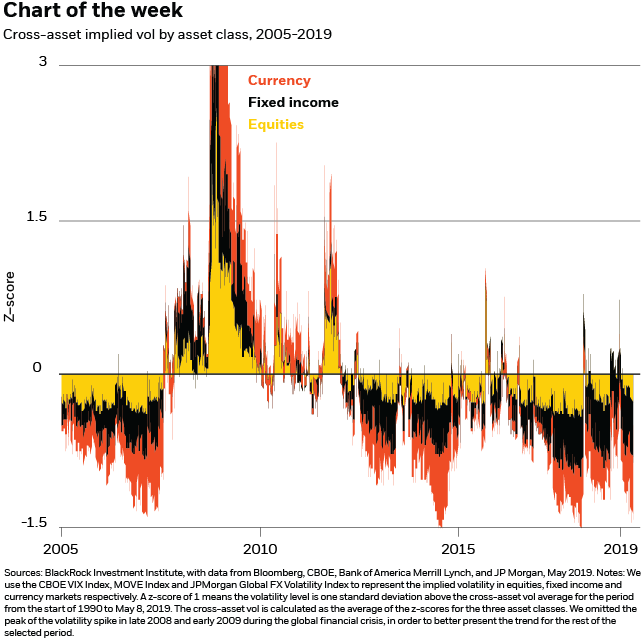

The market outlook had become more benign this year, following a selloff in the last quarter of 2018. Cross-asset implied volatility – a gauge of volatility across the equity, fixed income and foreign exchange markets – recently dropped to near record-low levels. See the chart above. Volatility in the currency markets had been particularly low, dragging down the average level across different markets. The backdrop behind low vol: a potential prolonged holding pattern by key central banks – most notably the Federal Reserve – coupled with a slowing but still growing global economy. Yet earlier last week market volatility spiked, after U.S. President Donald Trump’s tariff threat on China upended the expectation for an imminent trade agreement. The VIX Index, a gauge of the U.S. stock market volatility, jumped to the highest level since late January.

Reasons for caution

Last week’s market moves serve as a reminder that unusually low levels of market volatility likely do not accurately reflect the risks in this late-cycle period. Geopolitical risk is a key example. The market’s attention to global trade tensions – as reflected in chatter about the risk in analyst reports, traditional and social media – had dropped sharply from the peaks in mid-2018, our BlackRock geopolitical risk indicator (BGRI) shows. This was pointing to greater potential for market volatility should the risk flare up, as it has over the past week. We could still see a U.S.-China trade deal that includes a Chinese pledge to purchase more U.S. goods, among other items, yet implementation and enforcement will be challenging, in our view.

We still favor risk assets, given the ongoing global economic expansion and the prospect for central banks to stay accommodative. Yet macroeconomic volatility is increasing in this late-cycle period, reflected in the rising dispersion of analysts’ GDP forecasts. Our research suggests periods of rising macro volatility have historically featured greater market volatility. To be sure, we see major central banks on hold in the months ahead, providing a stable policy backdrop. But U.S. growth is slowing and economic data could become noisier in the months ahead after a sharp inventory buildup in the first quarter. Another potential source of volatility: In China, we see signs of a growth recovery, but the scale and longevity of the government’s stimulus package may soon be called into question.

Bottom line

Recent spikes in market volatility remind us a balanced approach is key to investing in the late-cycle period. We still see a narrow path ahead for risk assets to move higher – but there are risks that could knock markets off track. U.S. government bonds have historically played an important role in cushioning portfolios against such bouts of volatility. In equities, we favor the U.S. and emerging markets, with a focus on quality companies that can sustain earnings growth even in a slowing economy.

Scott Thiel is BlackRock’s chief fixed income strategist, and a member of the BlackRock Investment Institute. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of May 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0519U-840444