A Reminder to Be Diligent

by Commonwealth Financial Network

Traditional IRAs were created by the Employee Retirement Income Security Act of 1974. Originally designed as a vehicle for contributions, IRAs have seen most of their recent growth from rollovers from employer-sponsored retirement plans. In fact, capturing retirement plan rollovers can be an effective way to grow your assets under management. But you need to be diligent and ensure that clients are aware of all options available to them, which include leaving assets in the plan.

Traditional IRAs were created by the Employee Retirement Income Security Act of 1974. Originally designed as a vehicle for contributions, IRAs have seen most of their recent growth from rollovers from employer-sponsored retirement plans. In fact, capturing retirement plan rollovers can be an effective way to grow your assets under management. But you need to be diligent and ensure that clients are aware of all options available to them, which include leaving assets in the plan.

A December 2018 Investment Company Institute (ICI) study clearly demonstrates the significance of IRAs and the common use of IRA rollovers in the construction of a personalized retirement plan asset strategy.

- One-third of U.S. households owned IRAs in 2018.

- IRAs held $9.3 trillion in assets as of June 30, 2018, representing 33 percent of total U.S. retirement market assets, up from 21 percent two decades ago.

- Among all IRA-owning households, more than eight in ten also had employer-sponsored retirement plans, such as defined contribution and defined benefit plans.

- Nearly 60 percent of traditional IRA-owning households, or 19 million U.S. households, indicated that their traditional IRAs contained rollovers from employer-sponsored retirement plans.

- Among the households with rollovers in their traditional IRAs, 84 percent indicated they had rolled over the entire retirement account balance in their most recent rollover.

The ICI study also provides some insight on why investors chose to roll over their assets and whom they consulted to help them make the best choice for their financial situation. It is within this data we can see that advisors and financial services firms are often critical players in the rollover decision.

For example, financial advisors were by far and away the top information source across all age ranges for plan participants considering rolling over their assets.

| Top 3 Sources Consulted for Information on Rollover Decision

Percentage of traditional IRA-owning households with rollovers by age, 2018 |

|||||

|

|

All |

Younger than 50 |

50–59 |

60–69 |

70 or older |

|

Professional Financial Advisor |

48 |

38 |

45 |

58 |

56 |

|

Financial Services Firm |

19 |

22 |

22 |

15 |

17 |

|

Employer |

12 |

12 |

15 |

11 |

9 |

Source: ICI, “The Role of IRAs in US Households’ Saving for Retirement, 2018”

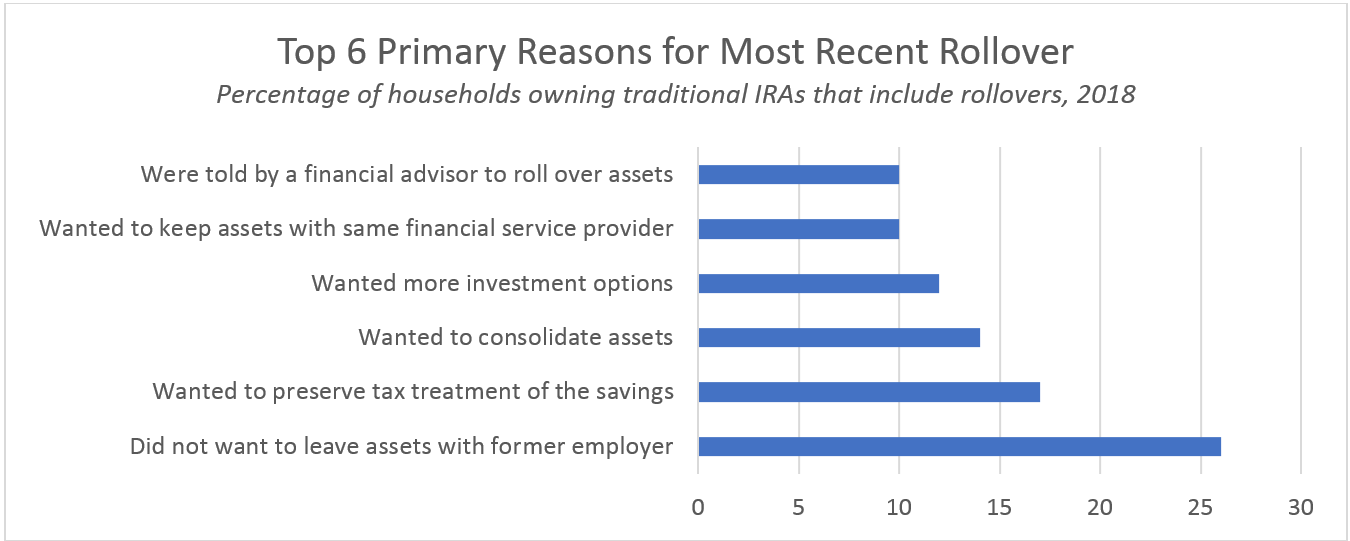

Further, two of the top six primary reasons participants executed the rollover decision were because of advice received from a financial advisor or the desire to keep assets with a particular service provider.

Source: ICI, “The Role of IRAs in US Households’ Saving for Retirement, 2018”

Source: ICI, “The Role of IRAs in US Households’ Saving for Retirement, 2018”

Due to the advisor’s influence in capturing retirement plan rollovers, FINRA and the SEC have maintained review of such matters as a top examination item for several years. For this reason, it is important that you remember to carefully document the diligence of your work and client conversations to demonstrate that you’ve covered all options.

It seems simple. When participants change jobs or retire, they may choose to leave their money in their employer plan or roll the assets to an IRA at a time of their choosing. But the devil is in the details. Be sure to discuss the pros and cons of each option. For example, take care to educate clients on the potential benefits of leaving money in an employer-sponsored plan, such as:

- Access to lower-cost mutual fund share classes, which may be unavailable outside the plan

- The availability of a plan loan, if permitted by the plan

- Access to investment planning tools and other educational materials from the plan sponsor

- The potential for penalty-free withdrawals, if terminating employment after age 55

- Broader protection from creditors and legal judgments

- The ability to postpone required minimum distributions beyond age 70½ under certain circumstances, if still employed

In cases that involve company stock, review the ability to preserve net unrealized appreciation. The maximum federal capital gains tax rate is currently 20 percent, far lower than the top income tax rate of 37 percent, so your clients’ potential tax savings may be substantial. Additionally, employer stock should be evaluated for asset concentration within the overall retirement portfolio to determine whether it may make sense to diversify.

Cost is another factor to consider. Employer-sponsored retirement plans and IRAs typically have investment-related expenses, as well as plan or account fees. An IRA’s investment-related expenses may include sales loads, commissions, investment advisory fees, and fund expenses. Retirement plan or account fees may include allocated administrative fees, fees for specific participant services, and trustee or custodial fees. The overall estimated annual expenses of the proposed account must be reasonable for the amount and type of service provided. Offering more investment flexibility, personalized financial planning, and higher client service standards can warrant a higher market value, but that value should be both reasonable and comparable with others in your market offering similar services.

As a top source for information regarding the benefits and considerations surrounding retirement plan rollovers, advisors should be prepared to discuss specifics with existing and prospective clients. By positioning yourself as a key resource, individuals may very well turn to you when it’s time to decide what to do with their retirement assets.

Are retirement plan rollovers a significant source of new assets for your firm? Are you careful to document your conversations to ensure compliance with regulations? Please comment below.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network