by Russ Koesterich, CFA, Blackrock

Can cyclical stocks continue to trounce defensives? Russ discusses.

Cyclicals rule. After getting trounced in Q4, year-to-date more cyclically oriented stocks and sectors have trounced “defensive”, less-cyclically exposed names. The trend has been even more pronounced during the past month. For example, in April financials have outperformed healthcare by 1200 basis points (bps, or 12% points)!

While healthcare’s under-performance has been in large part driven by growing concerns that, depending on the outcome of the 2020 election, U.S. healthcare policy could undergo a seismic shift, divergent sector performance has not been confined to financials and healthcare. Month-to-date the technology and consumer discretionary sectors are both up more than 4%, while utilities stocks are down on the month and consumer staple names are up just about 1%.

Can this continue?

Two factors suggest that it can, although probably at a slower pace: defensive sectors are still not that cheap and economic expectations may already reflect enough pessimism.

Starting with valuations, both the S&P 500 utilities and consumer staples sectors are currently trading at a 2-3% premium to the broader market. Although the premium may be justified for staples, as these companies tend to have structurally higher profitability, it looks out of place for the slower growing utility sector. Since the financial crisis U.S. utility stocks have tended to trade at about a 10% discount to the market.

Another way to look at relative value is versus interest rates. Since the financial crisis both sectors have often traded more in line with interest rates than the equity market. This is because many investors think of them as “bond market proxies,” i.e. less volatile stocks you own primarily for the dividend. After taking into account the recent backup in rates, both sectors look too expensive relative to the broader market.

To be fair, both sectors have been more expensive and could probably support premium valuations if economic expectations continue to fall. The challenge for defensive names is it looks like expectations may have already fallen too much.

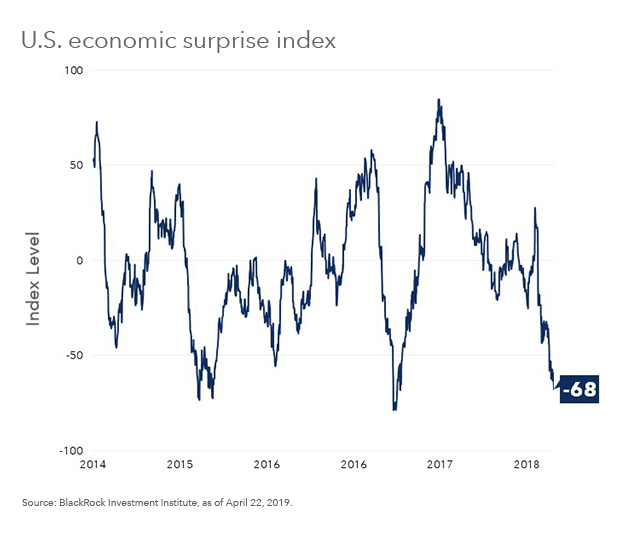

Some interesting work by my colleague Kevin Bynum illustrates the point. Looking at previous periods when economic surprises became unusually negative, defined here as periods when the Citi U.S. Economic Surprise Index dipped below -50, these periods tend not to last very long (see Chart 1). This suggests that the recent drop in the U.S. Economic Surprise Index may be fleeting, particularly given the recent easing in financial conditions.

Should the U.S. Surprise Index start to recover from its recent low of -67, this may support further cyclical out-performance. Historically, once the Surprise Index climbed back above -50, cyclical sectors outperformed defensive ones by an average of about 5% during the following six months.

The takeaway

After strong relative performance in Q4, it is not obvious that defensive stocks are particularly cheap. At the same time, assuming any stabilization in growth, particularly relative to expectations, cyclicals can continue to run.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRMH0419U-830975-1/1