by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

The Northern Trust Economics team shares its outlook for U.S. economic growth, inflation, unemployment and interest rates.

Market participants have expressed pessimism thus far this year. The equity market sell-off in December rattled investors, while economic data showed mixed trends early in the year. The most recent data prints, however, lead us to believe initially weak signals were passing aberrations, not the start of a downward trend. Signs of slower growth are not cause for panic. The economy remains sound, and the Fed has made it clear that it will take no action to impede the expansion.

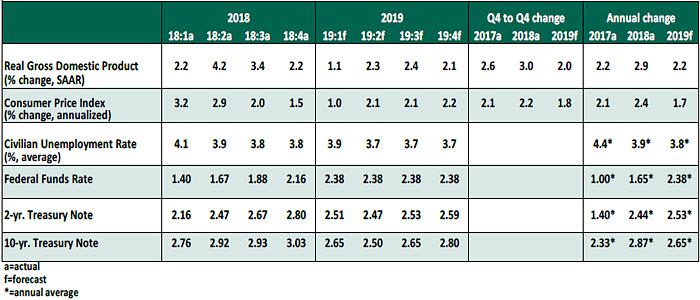

Key Economic Indicators

Influences on the Forecast

- At the March meeting of the Federal Open Market Committee, no rate changes were undertaken. The quarterly Summary of Economic Projections reflected the consensus expectation of slower growth and lower inflation in the years ahead.

- A soft growth outlook from the Federal Reserve coupled with weak production data from Europe took the wind out of investors’ sails, leading to an inversion in the spread between 3-month and 10-year US Treasury yields. Past inversions, when prolonged, have been reliable indicators of recession in the year ahead. We are encouraged that the inversion was short-lived, but the current set of yields reflects a market out of equilibrium.

- In light of the distorted yield curve and unanimously cautious rate projections from the Fed governors, we no longer anticipate any rate actions during the remainder of 2019. Should growth continue as projected, one additional hike in 2020 will be warranted to bring the Fed Funds rate closer to the center of its neutral range.

- The Fed said it will wind down its balance sheet runoff through September 2019, ending it sooner and at a higher terminal level than expected.

-

- After an anomalously slow month of job creation in February, employment grew by 196,000 jobs in March. The three-month average pace of job growth remains a healthy 180,000, and the unemployment rate of 3.8% is historically low. Initial weekly jobless claims are approaching 50-year-record lows, reflecting continued strength in the labor market.

-

- The growth rate of real gross domestic product (GDP) for fourth quarter 2018 was revised down to 2.2% from 2.6%. Revisions were minor and generally expected, with known weakness in consumer spending and residential investment. Despite this change, the full-year growth rate for 2018 remained at 3%, putting a wrapper on a strong year.

-

- Attention has turned to the outlook for first-quarter GDP growth. The quarter is likely to show a slow growth rate, largely due to seasonal and transient factors. A harsh winter in northern regions, followed by flooding in the country’s center, weighed on consumption and output. Early signs of weakness in monthly data series, including retail sales and personal consumption, are already showing recovery toward the end of the first quarter. The most recent indicators of inventory accumulation reflect business optimism, and the Institute for Supply Management’s Purchasing Managers Index (PMI) showed renewed expansion in the manufacturing sector.

-

- Inflation was subdued in the first quarter. The year-over-year increase in the consumer price index fell to 1.5% in February. Personal consumption expenditure (PCE) indices remain behind schedule due to the government shutdown, but core PCE showed only 1.8% year-over-year growth in January. “Headline” inflation is poised for recovery: the rise in gasoline prices over the past six weeks sets the stage for a year of more expensive energy, while trade tensions and floods in agricultural regions stand to elevate the price of food in the near term.

-

- Trade negotiations with China continue at the highest levels, with the outlines of a deal taking shape. The deadline of March 1 passed without a tariff increase. Open questions remain as to the potential reduction of U.S. tariffs and the mechanisms to ensure compliance with the agreement. While the rumored trade deal is unlikely to resolve all tensions with China, it would serve to reduce downside risks to the outlook. Meanwhile, renewed attention to border crossings has elevated tensions between the U.S. and Mexico, but extreme threats such as total border closure are unlikely to move forward.

northerntrust.com

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2019 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.