by Craig Basinger, Derek Benedet, Chris Kerlow, Alexander Tjiang, RichardsonGMP

The marketing spin on why you should invest in Emerging Markets (EM) is compelling. These countries are growing faster than developed economies, a trend that will likely continue for decades. In younger populations like these, the working class continues to expand. They earn more, spend more and drive their respective economies. Contrast that with aging populations in the developed markets. If you’re looking for growth, EM is where it is easier to find.

We do not disagree with the long-term demographic / growth argument supporting EM. This equity category should always be on the radar of a well diversified and balanced portfolio. However, we do not believe it should have a permanent allocation and, at this point in time, the allocation should be underweight or even no weight.

First, what is in EM?

To start, there’s even disagreement on the nomenclature, as some call this sub-category of equities ‘Developing Markets’. We will rely on the MSCI Emerging Markets Index classifications: EM are markets of countries that are earlier on their development path based on socio- economic factors.

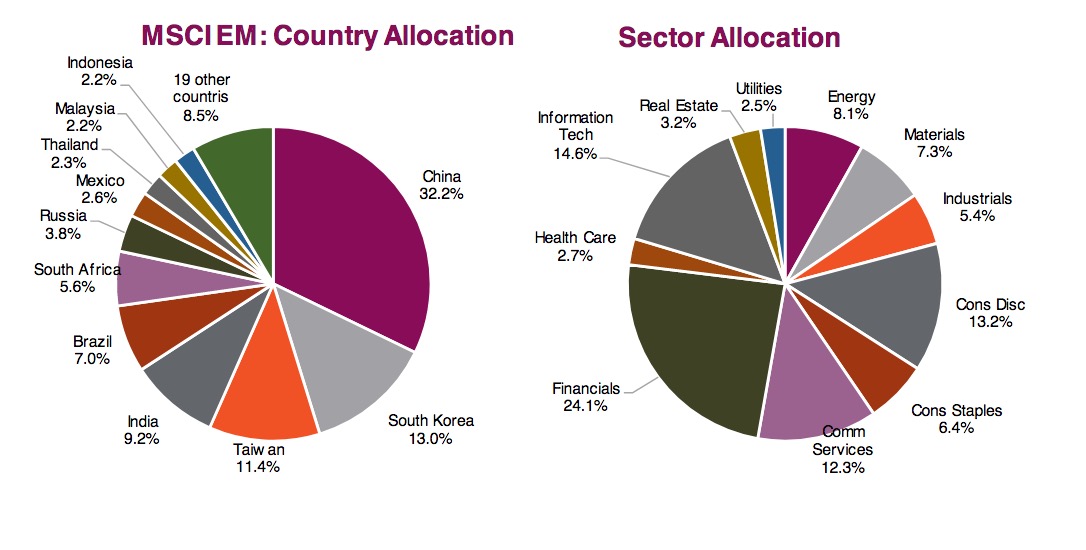

The two charts below provide some context on which countries are included and how the MSCI Emerging Market is currently weighted along with sector weights. The ETF EEM tracks this index.

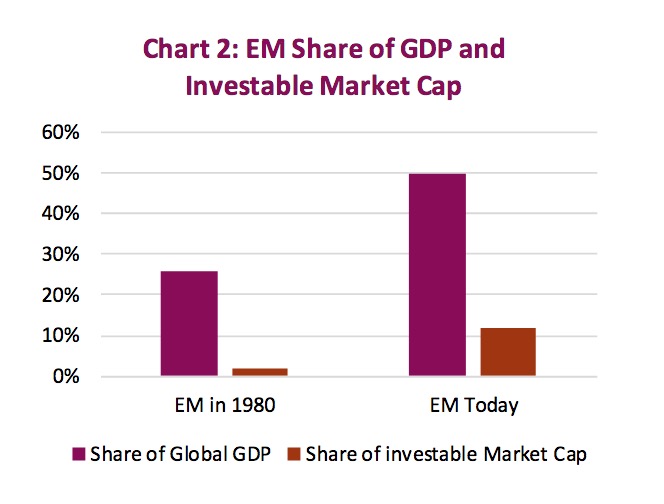

In 1980, Emerging Market economies accounted for about 25% of the global economy. As these economies grew faster than developed economies, this weighting has increased to almost 50%. This weighting is based on purchasing power parity GDP, the percentage is lower based on current market exchange rates at about 35%. Regardless of the measurement approach, EM has grown to be a material component of the global economy. Despite this sizeable weighting, the EM equity weighting among investible assets remains relatively low at about 12%. This will likely increase over time as EM markets grow, which is the long-term opportunity. (Chart 2)

One factor that slows this trend is some EMs become Developed Markets (DM) over time. Nonetheless, with such a discrepancy between economic size and market size, this will likely narrow over time and support exposure to EM.

So why not now?

One of the simplest reasons is the stage of the market cycle. This global economic expansion has been going for about ten years now and while we don’t know when it will end, a bear market is likely in the cards in the next few years. Emerging markets do not react well when global economic growth slows: their markets tend to be much more sensitive. We would much prefer to be market or overweight EM earlier in a market cycle, not in the later innings.

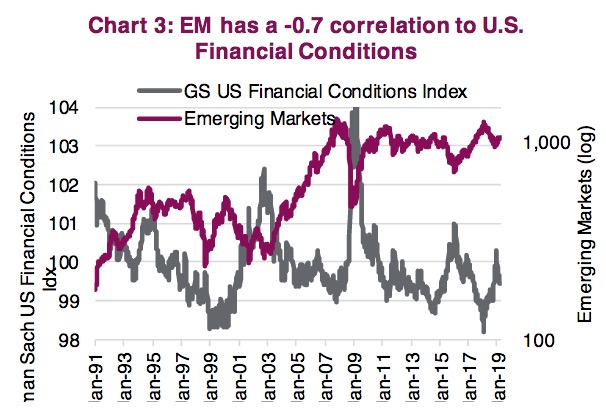

Financial conditions are tightening. For many years, we have had easing financial conditions globally and that has helped EM. While the trend has some bumps in it, the current trend appears to be for tightening financial conditions. This carries a strong negative correlation to the price performance of EM. (Chart 3)

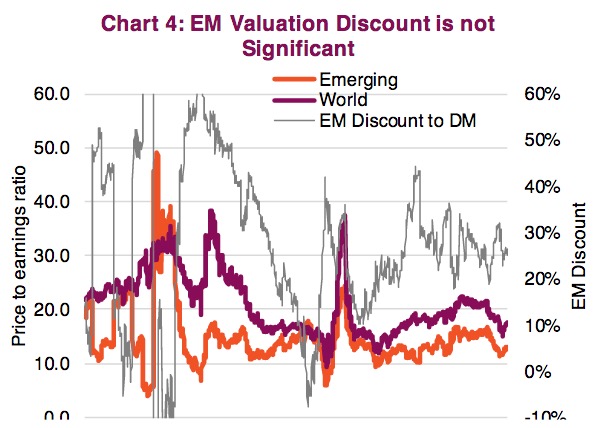

There is not a significant valuation discount in EM from either a price-to- earnings or price-to-book measurement. (Chart 4) The discount is currently about 25% based on relative PE ratios, which is pretty close to the long-term average. EM has been done very well vs DM when entering the trade at a higher discount.

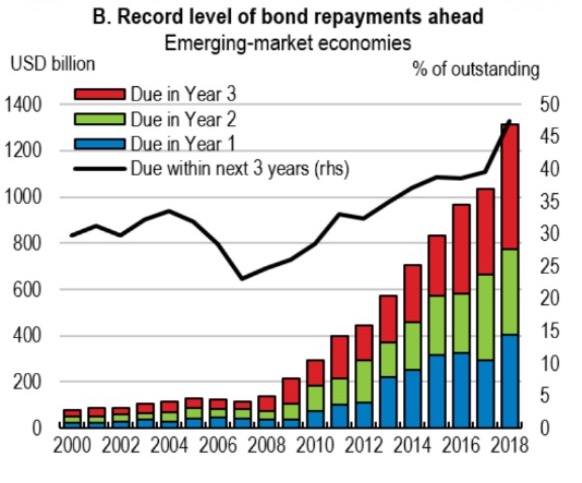

Debt is a rising concern at the corporate level in many emerging markets. The final chart on this page is from the recent OECD Economic Outlook and highlights how much debt repayment is due in the next few years among EM. Years of low global interest rates and easy monetary policy (QE) have contributed to a ballooning of EM debt. This isn’t an issue today, but if yields rise or the bond market becomes less enthusiastic about refinancing this debt or the global economy slows … this will become an issue fast.

Conclusion

We believe EM should be a long-term component in investor portfolios, but we simply don’t believe it needs to have a material allocation today. One factor that would have us reconsidering this view is if China really increased stimulus, but at this time that does not appear to be the most likely scenario.

*****

This publication is intended to provide general information and is not to be construed as an offer or solicitation for the sale or purchase of any securities. Past performance of securities is no guarantee of future results. While effort has been made to compile this publication from sources believed to be reliable at the time of publishing, no representation or warranty, express or implied, is made as to this publication’s accuracy or completeness. The opinions, estimates and projections in this publication may change at any time based on market and other conditions, and are provided in good faith but without legal responsibility. This publication does not have regard to the circumstances or needs of any specific person who may read it and should not be considered specific financial or tax advice. Before acting on any of the information in this publication, please consult your financial advisor. Richardson GMP Limited is not liable for any errors or omissions contained in this publication, or for any loss or damage arising from any use or reliance on it. Richardson GMP Limited may as agent buy and sell securities mentioned in this publication, including options, futures or other derivative instruments based on them.

Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

©Copyright 2019. All rights reserved.