by Richard Turnill, Blackrock

Risk assets have had a strong start to the year. How should investors play it from here? Richard explains.

Risk appetite has rebounded in 2019. Equities and other risk assets have performed well, just as various gauges show improving sentiment across markets. We remain modestly and selectively overweight equities – and moderately pro-risk in general – but would caution against expectations for the early-2019 rally to roar on.

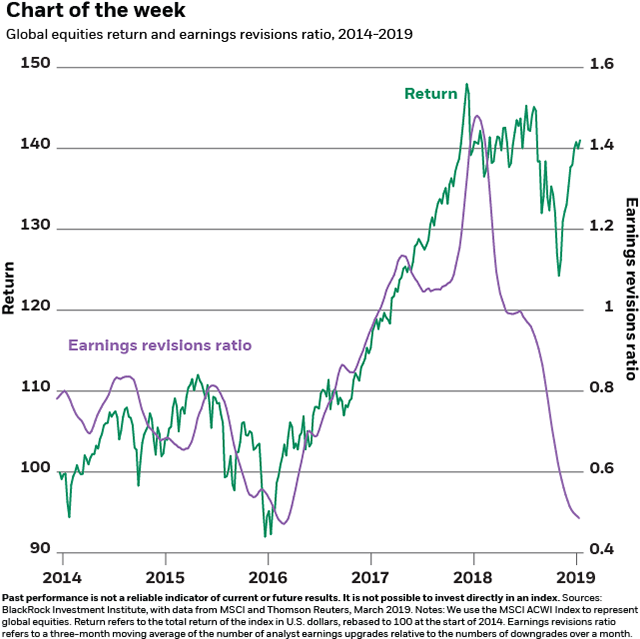

Our base case for 2019 is that the global economy and corporate earnings will slow, but still grow, as we approach a late-cycle stage. We see the near-term risk of recession as low, yet uncertainty over the duration of the cycle is high. The recent global stock market rally has come despite this weakening economic and earnings environment. Downgrades in analysts’ earnings expectations have increasingly outnumbered upgrades since mid-2018. See the chart above. We see potential for further downgrades to dampen stock returns – even though risk assets have historically tended to do well in late cycle. The rally so far this year can be seen as partly a snap-back from exaggerated worries of economic slowdown in the last quarter of 2018. The market’s assessment of the growth outlook is now more reasonable, in our view. A sign of calmer nerves in markets: The VIX Index of stock market volatility has fallen by more than half from its December peak.

Drivers of the risk rally

A perceived decline in geopolitical risk, in particular around U.S.-China trade relations, has helped provide a better backdrop for risk assets in early 2019. Our indicator of market concern relating to U.S.-China competition has fallen from last summer’s peak, and the market’s attention to our global trade tensions trade risk has nudged down as well. The immediate risk around U.S.-China trade tensions has declined, but we believe the longer-term strategic confrontation between the U.S. and China over technology will be a persistent feature of markets. This suggests investors may be becoming complacent about these risks and highlights the potential that any negative surprises have to roil markets. And there are other geopolitical risks that could emerge in 2019. We are particularly wary about the potential for a breakdown in U.S.-European Union trade negotiations, for instance.

Also contributing to the risk-on sentiment: a perception that global monetary policy has taken on a more dovish tilt. Markets now see the Federal Reserve on pause for the entirety of 2019 and have further pushed back expectations for an interest rate rise in the euro-zone after the European Central Bank said rates were unlikely to rise until at least 2020. We expect no change in the fed funds rate in the first half – with some potential for the Fed to raise rates late in 2019 if growth stabilizes above trend and signs of inflationary pressure gradually build. Markets may be under-appreciating this possibility, in our view. Markets also expect to see growth stabilizing in both China and Europe – and could be prone to setbacks should a recovery fall short of expectations.

What are the investing implications?

Valuations of most assets do not appear stretched, yet we would be wary of extrapolating the strong start to the year to the remainder of 2019. The path of least resistance for risk assets may be higher in the short term, but we advocate more carefully balancing risk and reward in portfolios. This implies a barbell approach to building portfolio resilience via substantial allocations to government bonds, flanked by selective risk-taking in areas such as U.S. and emerging market equities.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of March 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0319U-785187-1/1