The strong economy and market pressure may drive companies to pay down debt

by by Paul English, CFA®, Head of US Investment Grade Research,

and Matt Brill, CFA®, Senior Portfolio Manager, Invesco Fixed Income

Recent market stress surrounding trade policy, the US government shutdown, Brexit and recession fears has increased focus on the US investment grade credit market and its sharp rise in leverage in the post-crisis period. Invesco Fixed Income believes these concerns are best analyzed through the lens of the BBB-rated portion of the US investment grade bond market. Some investors worry that this segment is a ticking time bomb set to upend the US fixed income market. Credit spreads on BBB-rated bonds have widened 50 to 100 basis points in the past year.1 With a focus on BBBs, we tackle some important questions for investors: Is the recent sell-off in BBBs a sign of worse things to come, or has the market over-reacted? Are there stabilizing trends on the horizon?

Upward trend in leverage may reverse in 2019

Debt levels among US corporations have grown in the post-financial crisis period in response to a lack of organic growth, low interest rates, modest credit spreads and tax policy that restricted the use of overseas retained earnings. As such, companies have used incremental debt primarily to buy back stock, fund mergers and acquisitions, and increase shareholder dividends. This shareholder-friendly activity has, however, come at the expense of company credit profiles and has exposed the market to potential credit transition risks, in our view.

Going forward, we believe there are several reasons to expect a reversal in this leveraging trend, including a return to organic growth, higher interest rates, wider credit spreads and repatriation of foreign profits. As such, we expect to see less opportunistic funding as acquisition break-even points are higher and companies have increased access to internal capital. Companies are also experiencing increased investor scrutiny over elevated leverage profiles and are beginning to address their balance sheets more proactively. We expect CEOs to highlight their debt reduction efforts in much greater detail during future earnings calls. We also note that large companies have begun linking deleveraging success to CEO compensation. We believe these are very positive trends for investors in corporate credit.

Fed has credit growth in its sights

In addition, we believe issuers and investors have taken note of comments from the US Federal Reserve (the Fed) in its November 2018 Financial Stability Report, which highlighted concerns over the pace of credit growth, leverage and underwriting practices in the leveraged loan market.

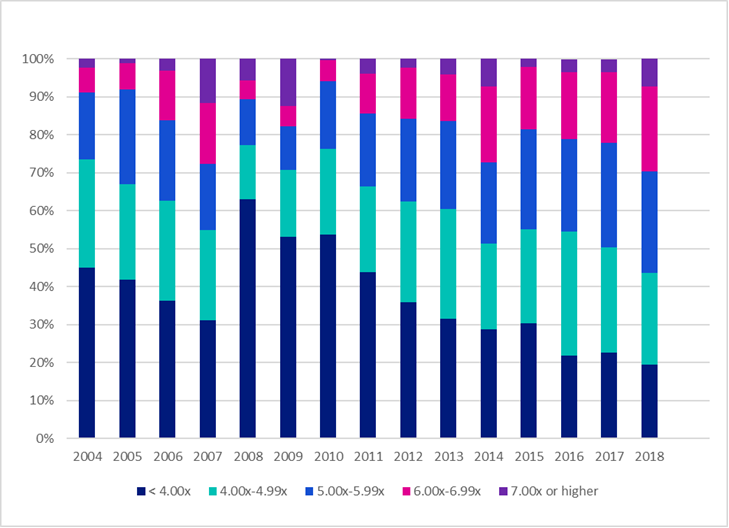

Figure 1: Leveraged loan quality

Source: S&P Global Market Intelligence, Dec. 31, 2004 – Dec. 31, 2018. Includes issuers with earnings before interest, taxes and depreciation (EBITDA) of more than USD50 million. In the graph series, “<4.00x” means “debt is less than 4.00 times EBITDA.”

The Financial Stability Report also highlighted that the distribution of ratings among investment grade corporate bonds has deteriorated, with a near-record number of bonds rated at the lowest investment grade. As of the second quarter of 2018, 35% of corporate bonds outstanding were at this level, amounting to approximately $2.25 trillion.2 The Fed noted that during an economic downturn, widespread downgrades of these bonds to speculative-grade ratings could force some investors to sell them rapidly, pressuring liquidity and prices in this segment of the corporate bond market.

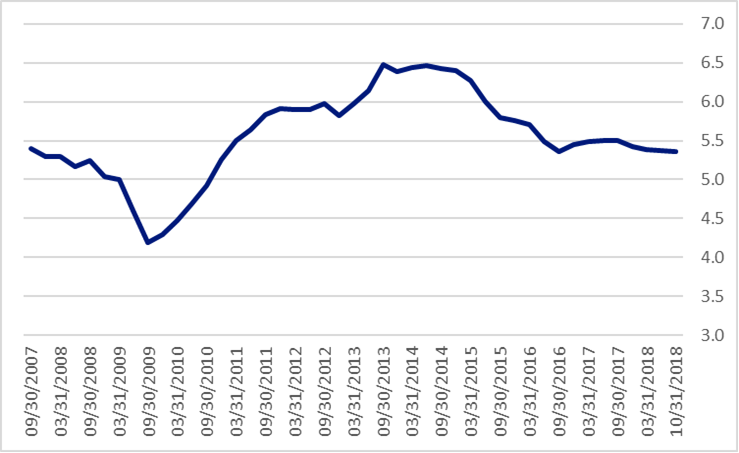

Ultimately, The Fed noted that despite elevated leverage, low interest rates have kept debt service costs at the low end of their historical range, allowing corporate credit performance to remain favorable. In addition, we estimate that current market spreads cover reasonable estimates of investment grade defaults by multiple times.

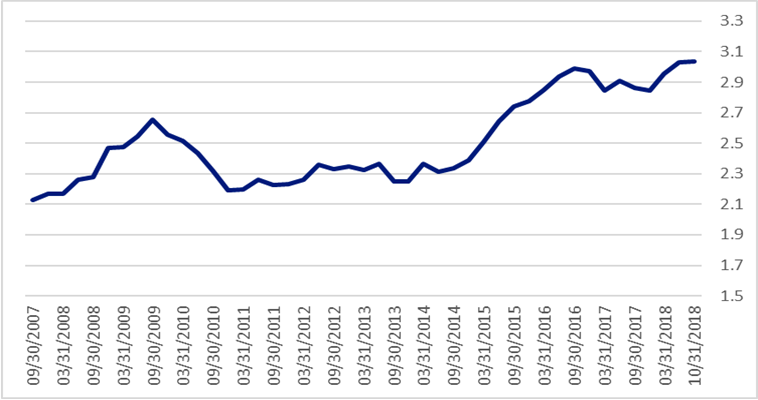

Figure 2: Net debt compared to EBITDA (BBB issuers)

Source: Bank of America, ICE BAML US Corporate Index, data from Sept. 30, 2007 to Oct. 31, 2018. The ratio on the right axis is total net debt divided by earnings before interest, taxes, depreciations and amortization (EBITDA).

Figure 3: Interest Coverage – BBB

Source: Bank of America, ICE BAML US Corporate Index, data from Sept. 30, 2007 to Oct. 31, 2108. Interest coverage ratio is earnings before interest, taxes, depreciation and amortization (EBITDA) divided by interest expense.

US investment grade outlook

We at Invesco Fixed Income believe that risks in BBB-rated credit will likely remain idiosyncratic, as most large bond issuers generate substantial free cash flow to service debt. Furthermore, we do not believe recent global macroeconomic issues (such as trade disputes) will cause a recession.

We have seen this leverage cycle playbook before with the energy crisis of 2015 and 2016. Some companies substantially cut dividends to conserve cash to pay down debt. Others stopped share buybacks, reduced capital expenditures or even went so far as to raise equity to pay down debt. Once companies started to address their balance sheet concerns, their stock prices typically began to stabilize and eventually turned higher. We believe this process could play out again with the majority of BBB-rated issuers. We think the message to CEOs is clear — the time to start fixing balance sheets is now.

BBB outlook

In our view, the largest BBB-rated companies have the cash flow to support their debt and debt service obligations and are beginning to acknowledge market concern about leverage. We believe issuers will begin to pay down debt while the economy is still strong. The recent spotlight on BBBs and punishment of over-levered companies by the equity market is likely to be a major catalyst for balance sheet cleanup. In addition, 2019 earnings growth, which we forecast in the high-single digit range, will likely remain a supportive factor for credit quality. We suspect the recognition of this dynamic could result in corporate deleveraging and outperformance of BBB-rated credits in 2019.

1 Source: Bloomberg Barclays US Credit Index, data from Jan. 24, 2018, to Jan. 24, 2019.

2 Source: US Federal Reserve, Financial Stability Report, November 2018.

Important information

Blog header image: Marc Sendra Martorell/Unsplash.com

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

An investment grade bond is generally recognized as such if its credit rating is BBB- or higher (Standard & Poor’s) or Baa3 or higher (Moody’s). These bonds are judged by the rating agencies as likely to meet the associated payment obligations.

Financial leverage refers to the use of debt to acquire additional assets.

A basis point is one hundredth of a percentage point.

Credit spread is the difference in yield between bonds of similar maturity but with different credit quality.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures.

Paul English, CFA®, Head of US Investment Grade Research, Invesco Fixed Income

Paul J. English is Head of US Investment Grade Research for Invesco Fixed Income. His primary responsibilities include the management and coordination of the investment grade research function, credit strategy, resource requirements and standards of practice. In addition, his coverage responsibilities are focused on the analysis of financial institutions.

Mr. English joined Invesco in 1998. Previously, he was a manager of financial planning with Macy’s (Federated Department Stores). He also served as a finance manager responsible for financial forecasting and analysis at Midland Enterprises in Cincinnati.

Mr. English earned a BS degree in business administration from Xavier University. He holds the Chartered Financial Analyst® (CFA) designation and is a member of the CFA Society of Atlanta.

Matt Brill, CFA®, Senior Portfolio Manager, Invesco Fixed Income

Matt Brill is a Senior Portfolio Manager for Invesco Fixed Income. He is responsible for implementing investment grade credit strategies across the fixed income platform.

Prior to joining Invesco in 2013, Mr. Brill was a portfolio manager and vice president at ING Investment Management, where he specialized in investment grade credit and commercial mortgage-backed securities. Prior to that he was a portfolio analyst at Wells Real Estate Funds. He entered the industry in 2002.

Mr. Brill earned a BA degree in economics at Washington and Lee University. He is a Chartered Financial Analyst® (CFA) charterholder.