by Blaine Rollins, CFA, 361 Capital

Sure, maybe the Fed now has our back. And maybe the trade war with China will be ending. But the reported economic data is still a mess and Washington politics continue to lead all the headlines. While it is tempting to want to push more investment chips into the middle of the table, valuations are no longer cheap for U.S. equities.

It would be most helpful to see the next set of economic numbers behind that fog before we put more capital at risk. The credit markets have returned to October levels – a great sign for higher risk appetites. Now, all the market needs is a clean trade deal and a bounce in the economy and then maybe it will, once again, challenge historic highs.

To receive this weekly briefing directly to your inbox, subscribe now.

New day, same leading market news story…

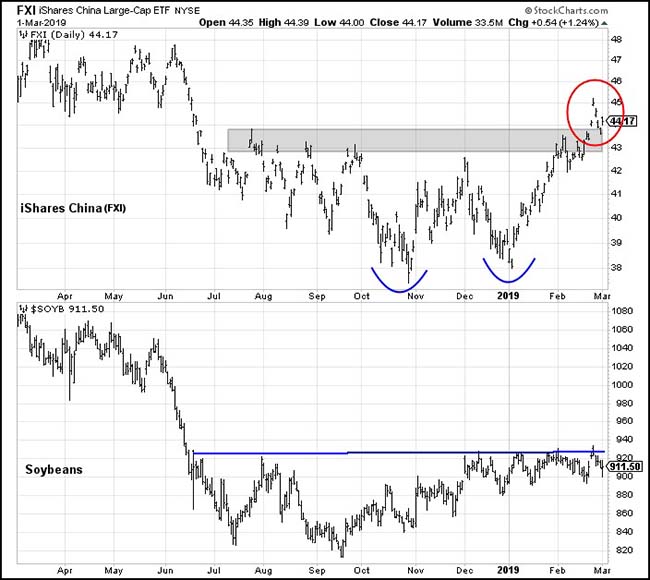

A trade deal looks to be good news for the Chinese stock market…

But many of us are still scratching our heads over the lack of a positive response in Soybean prices

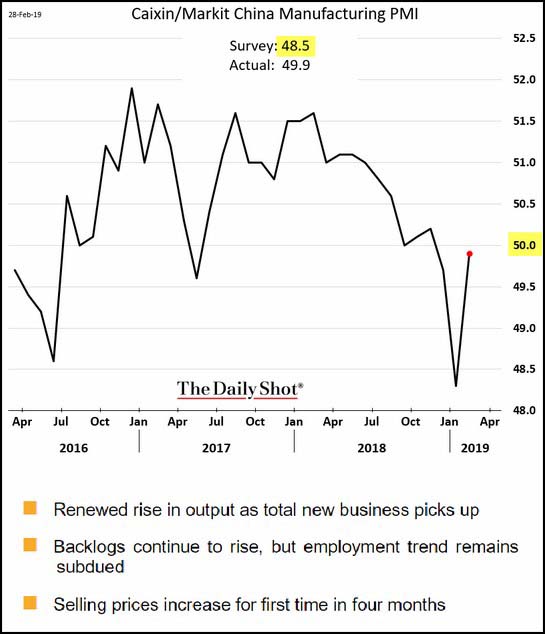

Or maybe the China bounce is also because the outlook for data has turned higher?

Bloomberg has a few ideas for why Chinese stocks have outperformed the rest of the world…

Multiple factors have helped drive the rebound in Chinese stocks this year. Optimism increased about the U.S.-China trade situation, while the People’s Bank of China moved to cushion the country’s economy and Beijing’s new chief securities regulator made a call to “revere the market.” And then there was the widely-anticipated announcement last week that MSCI Inc. would boost the weighting of mainland-listed shares in its indexes.

Ray Dalio moved his pre-election recession forecast from >50% to now 35%…

Your monthly reminder to “Don’t fight the Fed”.

…while the Fed probably doesn’t have enough firepower to offset a deep recession, the big sag that we expect is probably manageable. More specifically, the Fed now has 250bps of easing (which will be more impactful than typical because of the longer durations of assets this cycle), plus the ability to turn QE back on, which we estimate is roughly equivalent to the 4% to 5% of easing typically required to get out of recessions.

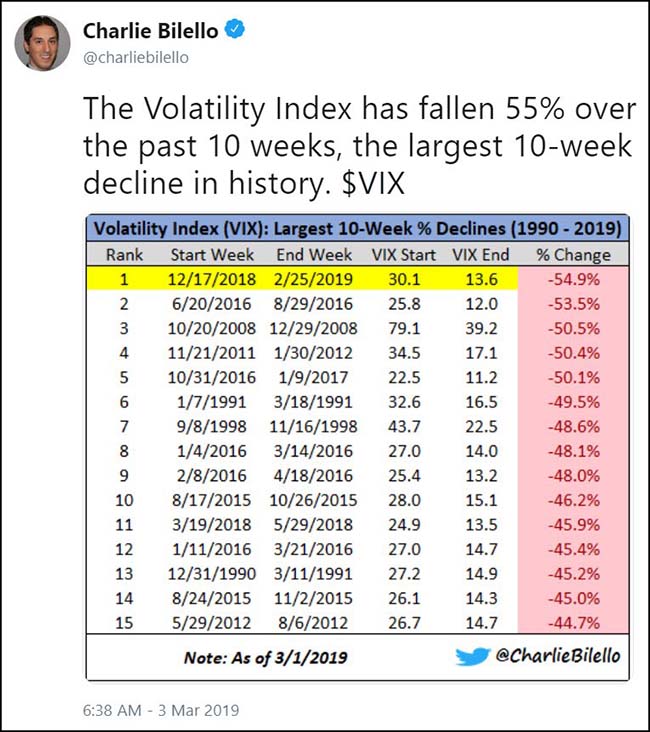

And thanks to the Fed, the recent 10 week plunge in the Volatility Index now gets a first place trophy…

Meanwhile, the Credit Markets continue to confirm the recent market’s strength…

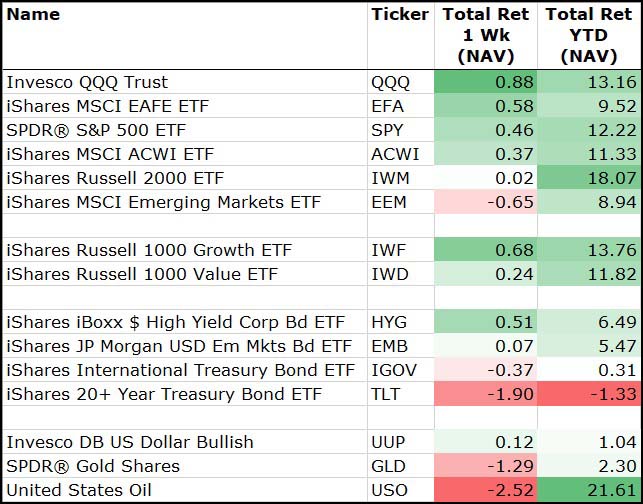

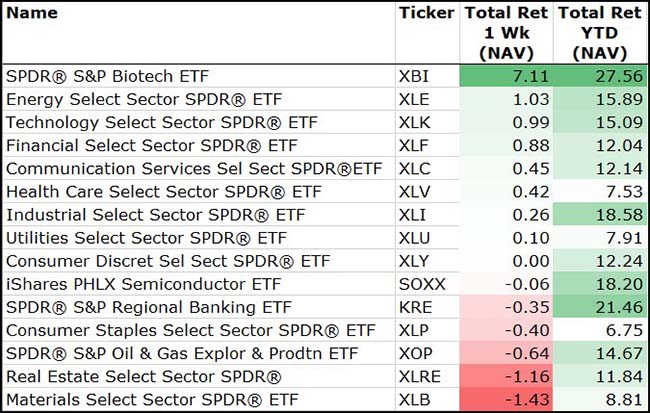

The week’s major asset returns show another appetite for risk…

More risk buying among the sectors as biotech soars due to M&A and positive drug data…

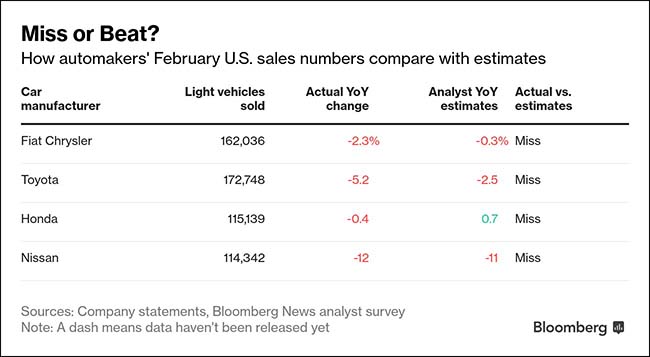

The U.S. auto sales slowdown is accelerating…

It’s been a cruel winter for auto sales, as slowing deliveries of even once-hot sport utility vehicles signal the rapid onset of a widely expected downturn in U.S. new-car demand.

Even Jeep, Fiat Chrysler Automobiles NV’s star SUV brand, suffered a second consecutive monthly decline, driving the carmaker to its first total sales retreat in a year. At Ford Motor Co., sales fell 4.4 percent, worse than analysts projected, due in part to a drop-off in sales of its top seller, the F-Series, according to a person familiar with the results.

Those companies joined Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. in trailing analysts’ estimates for February in a Bloomberg News survey. The annualized industry sales rate slowed to 16.6 million, the worst reading in 18 months, according to researcher Autodata Corp., also missing expectations.

Food poisoning from all sides for the major packaged goods companies…

#1 Parent’s don’t buy as many packaged foods anymore.

#2 If they do buy a packaged food, it is a healthier, niche SKU not made by a major manufacturer.

#3 They learn about the better options from the Internet, not TV/cable advertising.

#4 When they look at the choices on Amazon, they often buy there.

#5 Private label sales are surging because the quality is equally good and the manufacturers are desperate for volume.

#6 Finally, kids are done eating everything out of a bag or a box.

Shoppers, especially younger ones, learn about products online from friends, bloggers, YouTube celebrities, and so on. The shift to online shopping has opened infinite shelf space for niche products. Barriers to entry for food upstarts are low.“

Reviews on Amazon.com and other online stores level the playing field,” says Kelly Flynn, a portfolio manager at Winslow Capital Management. “Companies no longer have to invest in brands over decades. You can read online reviews and see thousands of people who gave a product five stars.”

Customer tastes have splintered. Some want gluten-free. Others, low-carb for so-called keto diets. Many want simpler ingredient lists and virtuous treatment of workers and animals. Those who can afford it look for artisan foods, not megabrands.

According to Credit Suisse analyst Robert Moskow, an early bear on packaged food in general and Kraft Heinz in particular, the combined market share of the top 20 packaged-food companies fell to 42.4% last year from 46.8% in 2011. Much of the lost share has gone to niche and entrepreneurial brands. Moskow recently calculated that among the 20 best selling foods and beverages on Amazon.com, more than 70% were created by start-ups. These include a brand of coconut oil called Viva Naturals, which is riding the keto craze, and a snack called RXBar, whose maker was bought by Kellogg in 2017.

(Barrons)

To receive this weekly briefing directly to your inbox, subscribe now.

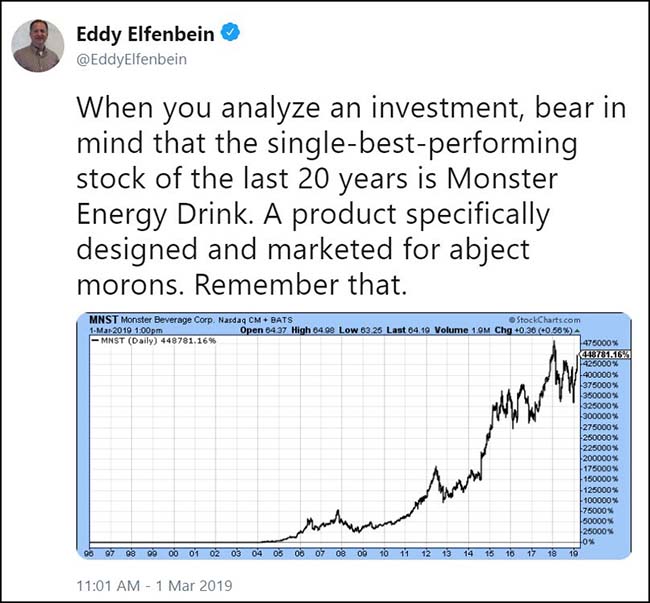

That said, the best stock return over the last 20 years was a packaged food company…

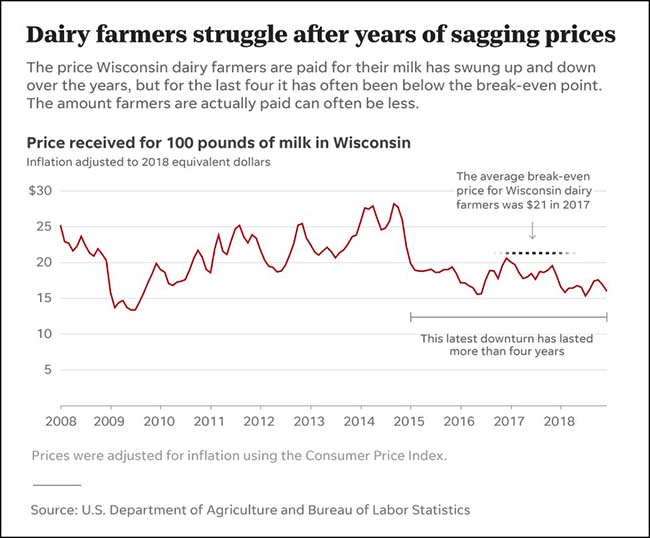

The final straw for Wisconsin dairy farmers…

But in late 2014, farm milk prices started to plummet. The downturn, fueled by overproduction and failing export markets, has lasted more than four years and has wiped out dairy farms from Maine to California.The price farmers receive for their milk has fallen nearly 40 percent.

“This downward cycle has been brutal,” said Kevin Schoessow, a University of Wisconsin-Extension agent in Washburn County.

Wisconsin lost almost 700 dairy farms in 2018, an unprecedented rate of nearly two a day. Most were small operations unable to survive farm milk prices that, adjusted for inflation, were among the lowest in a half-century.

As of Feb. 1, Wisconsin had 8,046 dairy herds, down 40 percent from 10 years earlier, according to state Department of Agriculture data.

The retiree who is thinking like a Millennial…

A Texas man is planning to spend his retirement years at Holiday Inns nationwide instead of moving into a nursing home, in an effort to cut costs, ABC affiliate WSET reported.Terry Robinson of Spring, Texas, listed his reasons for spending his golden years as a customer of the hotel chain in a viral post on Facebook earlier this month.

While the average cost of a nursing home can amount to $188.00 per day, Robinson wrote in the post that reservations at the Holiday Inn cost $59.23 per night with a “combined long term stay discount and senior discount.”

“Breakfast is included and some have happy hours in the afternoon,” Robinson wrote. “That leaves $128.77 a day for lunch and dinner in any restaurant we want, or room service, laundry, gratuities and special TV movies. Plus, they provide a spa, swimming pool, a workout room, a lounge and washer-dryer, etc.”

“Most have free toothpaste and razors, and all have free shampoo and soap,” he went on to write, adding that “$5 worth of tips a day and you’ll have the entire staff scrambling to help you.”

“They treat you like a customer, not a patient,” he said.

(TheHill)

Advances in technology have leveled the playing field for everyone…

Technology abilities do not differentiate by gender, race, language, location, age or physical ability.

Finally, although hockey season is in full swing…

When he is not suited up in between the posts, or cheering for the Colorado Avalanche, Aditya Bhave reads through a ton of material to find you highly intelligent weekly reads. Go sign up…

Copyright © 361 Capital