by Elga Bartsch, PhD, Blackrock

We expect the European Central Bank to keep rates on hold this year. Elga explains why.

We believe the European economy requires ongoing monetary policy support. Why? There was a marked slowdown in economic activity last year and inflation remains subdued. Hence tighter financial conditions would pose a risk to the region’s growth, as we write in our Macro & market perspectives Slowing – but still growing.

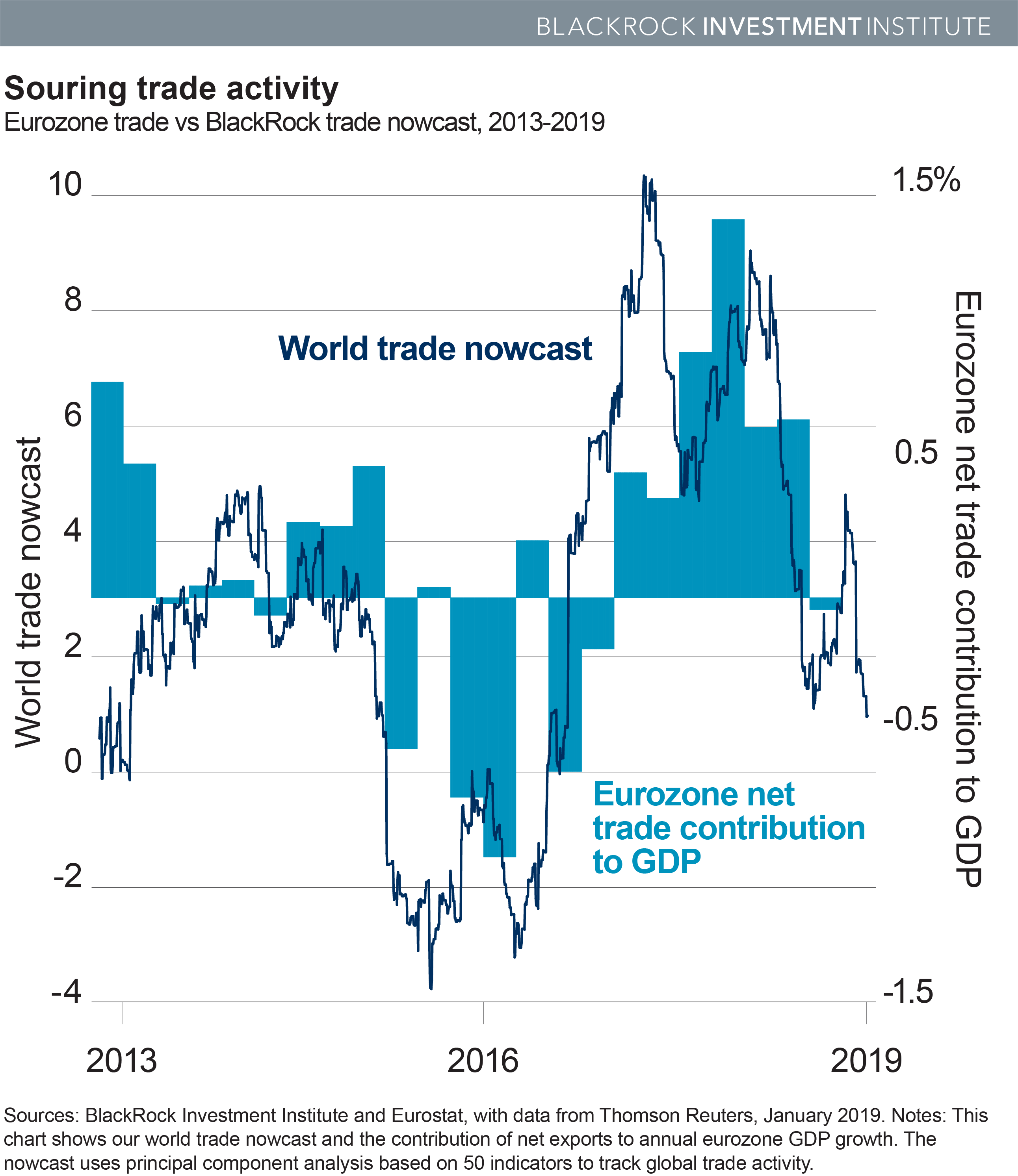

The euro-zone economy is more open than that of the U.S., and it felt last year’s deceleration in global trade growth more severely. See the Souring trade activity chart below. Several one-off factors also weighed on activity, including new global car emission standards and weather-related transport bottlenecks, wider intra-euro-zone government bond spreads after the Italian election, and recent public unrest in France.

Tighter financial conditions could push euro-zone gross domestic product (GDP) growth marginally below trend if they persist, we estimate. Data already suggest that Germany, Europe’s largest economy, stagnated in the second half of 2018. Euro-zone growth slowed to a standstill in late 2018.

The recession risk

We see the risk of a broad recession in the region as remote given the European Central Bank’s (ECB) already extra-easy policy, fresh fiscal stimulus and the lifting of the adverse one-off factors mentioned above. Yet markets might be rattled by the lack of policy levers to counter a new downturn. The main worry is probably less an actual recession than the fragmented political and financial landscape in which it would play out.

European countries such as France and Italy are embarking on new fiscal easing. Unfortunately, they already face fiscal sustainability issues due to either persistent deficits or elevated debt levels. Sustainability concerns could undermine the effectiveness of fiscal easing, especially against a backdrop of wider sovereign spreads and higher political tensions within the euro-zone.

For the euro-zone as a whole, however, the debt trajectory is still headed sideways, if not down slightly. In addition, we have argued that equilibrium interest rates–the rate estimated to be consistent with maximum employment and stable inflation in the long run–will stay structurally low for some time to come. Low equilibrium interest rates allow fiscal policy to become an increasingly important policy tool. Government funding costs are likely to stay well below nominal GDP growth, creating fresh fiscal space.

Our base case

Against this backdrop, our base case is that the ECB will keep interest rates where they are this year–at record low levels. We see the ECB waiting on a first rate rise until 2020 and focusing this year on the reinvestment of fixed income assets after wrapping up quantitative easing in December. We expect the ECB will likely offer another long-term refinancing operation to keep liquidity flowing to banks and the economy.

Beyond the first quarter, the ECB faces extra uncertainty this year: a new leader will take the reins from President Mario Draghi in November. It will be key for policymakers to firmly anchor market expectations of the ECB’s policy stance during this transition, in our view.

Elga Bartsch, Head of Economic and Markets Research for the BlackRock Investment Institute, is a regular contributor to The Blog.