by Gershon Distenfeld, Director, High Yield, AllianceBernstein

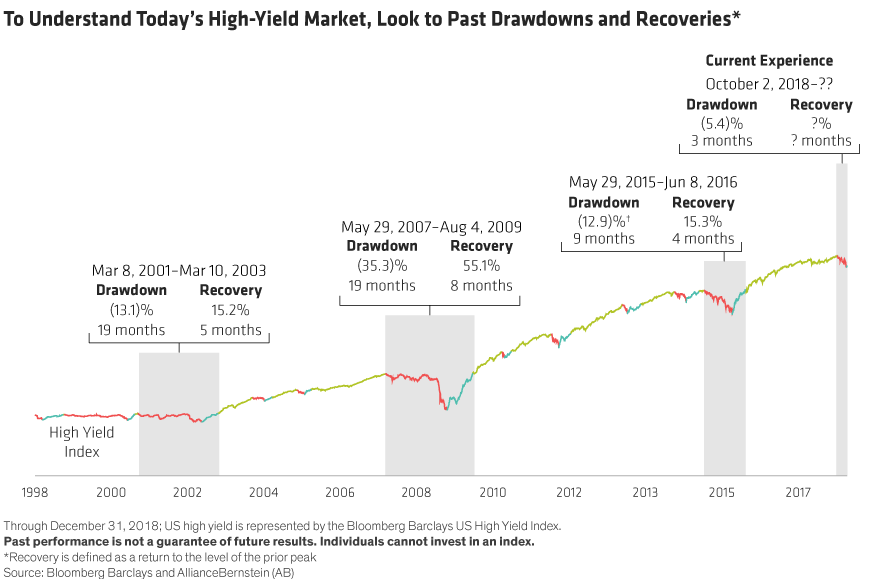

The US high-yield market has suffered ten peak-to-trough losses greater than 5% in the last 20 years. On average, investors recovered their losses in only four months—and sometimes as few as two. Following the longest and largest drawdown of –35%, which lasted 19 months, investors who stayed in the high-yield market earned back 55% in just eight months.

And that’s not all: The price of the high-yield market has historically continued to rise following recovery. While we anticipate more bumps in the high-yield road in 2019, high-income investors currently on the sidelines might want to weigh the opportunity cost of staying out altogether.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein