by Craig Basinger, Chris Kerlow, Derek Benedet, Alexander Tjiang, RichardsonGMP

Last week we ventured away from our normal market / economics topics and discussed the value of advice with a few of the various forms its takes. This week, the pendulum is swinging back the other way.

You may have heard the term “The trend is your friend” before. It really denotes that even with short term volatility, there can be a larger or longer trend in the direction of a markets or individual stock price. This trend, while never a straight line, often prevails. Our analysis of the current earnings season appears to support the importance of the overall trend whether a company reacts positively or negatively to quarterly earnings results.

Okay, we should share that we spend a considerable amount of analytical resources looking at how companies react to earnings. This is because earnings overreaction is one of the strategies we employ in the Purpose Behavioural Opportunities Fund. A fund that is designed to attempt to profit from the emotional mistakes of other market participants. In some cases, this mistake is how investors can often overreact to earnings.

Investor overreaction

If you believe a company’s value is based on its discounted estimated cash flow over the next 10 or 20 years, why would one quarter’s results matter so much? A company can miss the mark by just a couple pennies in earnings and the market may cut 5 or even 10% off the value of the entire enterprise. Or, in the case of Electronic Arts a few days ago, the company actually matched analysts forecasts and the share price was shaved down by 15% (well … more than just a shave).

This reaction clearly does not reconcile with a miss of a penny or two in any discounted cash flow model. Is this potential overreaction caused by investors’ short-term focus? Maybe, but we believe there are a number of contributing factors.

Behavioural biases – Earnings releases contain a considerable amount of information, released suddenly and often triggers emotional responses.

Recency bias: our tendency to focus on recent events and jump to the conclusion this trend will continue.

Availability heuristic: this is a mental shortcut we use that causes us to draw an inference from past events that remain vivid in our memories. An earnings miss may have us recalling the failure of other companies.

Disappointment for aspects that didn’t measure up or some euphoria on data that was better than expected. With emotions elevated, behavioural biases often get the upper hand and can influence our decision making process. Recency bias causes us (investors) to place a disproportionately large weighting on recently available information. The ‘availability heuristic’ causes us to focus more on memories that are vivid, which can certainly occur if a share price is down 20% after earnings. Essentially, these contribute to a much more short-term view and can elicit a knee jerk reaction.

Alternatively, from a more philosophical perspective, what is the current share price? Essentially, the price of any stock is the level at which the marginal buyer and seller are willing to meet to trade. So a stock price is set by a very small subset of existing shareholders or total number of market participants (potential buyers). Sprinkle high frequency traders into this marginal buyer / seller subset, and it doesn’t take much to cause a share price to move more than it should.

Say a company misses earnings and the share price drops. The majority of investors reading the earnings or listening to the conference call are those that own the company. Bad news happens and some start selling. New buyers are likely slower to join the fray. Finally seeing the share price drop and considering this as a potential entry point, more buyers materialize. Easy to see how this could cause overreactions.

Say a company misses earnings and the share price drops. The majority of investors reading the earnings or listening to the conference call are those that own the company. Bad news happens and some start selling. New buyers are likely slower to join the fray. Finally seeing the share price drop and considering this as a potential entry point, more buyers materialize. Easy to see how this could cause overreactions.

Not that one company is an example, but Electronic Arts was pushed down from $90 to below $80 on Wednesday. At the moment it is trading at $95.

The trend is key

After analyzing the size, beta, historical volatility, and pre-existing trend of the company, there appears to be a good indicator of how the share price will perform following a sudden price adjustment. We can’t help it, but it seems the trend is your friend in this case. Companies in an established uptrend, as measured by the slope of their 50-day moving average, show strong positive absolute and relative performance following a big downward surprise. Conversely, companies in an established downtrend that enjoy a positive surprise tend to give some of those gains back on a relative basis.

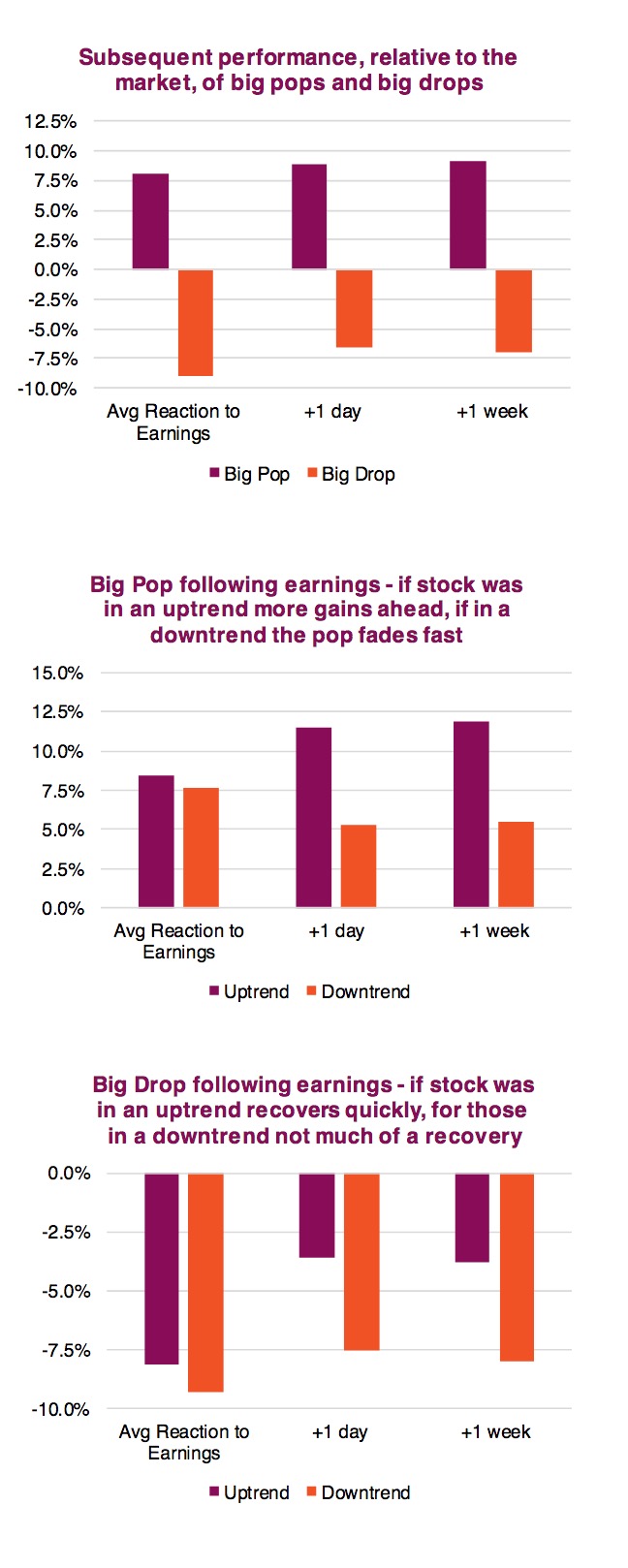

Just look at the current earnings season. In this analysis, we included companies that suffered a -5% or larger drop and companies that enjoyed a +5% or greater pop. The top chart shows the average reaction to the earnings results and the subsequent performance a day and week later (relative to the market). While minor, seems those that popped following earnings keep gaining a little and companies that dropped materially following earnings recover a little.

The biggest factor appears to be whether the company was in a pre-existing uptrend or downtrend. The 2nd chart is only looking at companies that had a big positive pop following earnings. If the company is in uptrend, on average there are more gains to come. If in a downtrend, that positive pop is trimmed by a 1/3 in the first week. The 3rd chart is looking at companies that suffered a big price drop following earnings. Here if the company was in an uptrend, the pain of the drop is cut in half within the first week (on average). If in a downtrend, not so much.

The market appears to have a tough time adjusting to big changes in a stock’s share price. At the very least, it needs more time to absorb the data that caused the initial move. Of greater interest from a trading perspective, it seems that big price drops often see a good degree of price recovery for companies that were in an established uptrend. Conversely, companies in a downtrend that see a sudden positive price change, appear to give some of those gains back.

In other words: don’t fight the original trend.

*****

This publication is intended to provide general information and is not to be construed as an offer or solicitation for the sale or purchase of any securities. Past performance of securities is no guarantee of future results. While effort has been made to compile this publication from sources believed to be reliable at the time of publishing, no representation or warranty, express or implied, is made as to this publication’s accuracy or completeness. The opinions, estimates and projections in this publication may change at any time based on market and other conditions, and are provided in good faith but without legal responsibility. This publication does not have regard to the circumstances or needs of any specific person who may read it and should not be considered specific financial or tax advice. Before acting on any of the information in this publication, please consult your financial advisor. Richardson GMP Limited is not liable for any errors or omissions contained in this publication, or for any loss or damage arising from any use or reliance on it. Richardson GMP Limited may as agent buy and sell securities mentioned in this publication, including options, futures or other derivative instruments based on them.

Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

RichardsonGMP © Copyright 2019. All rights reserved.